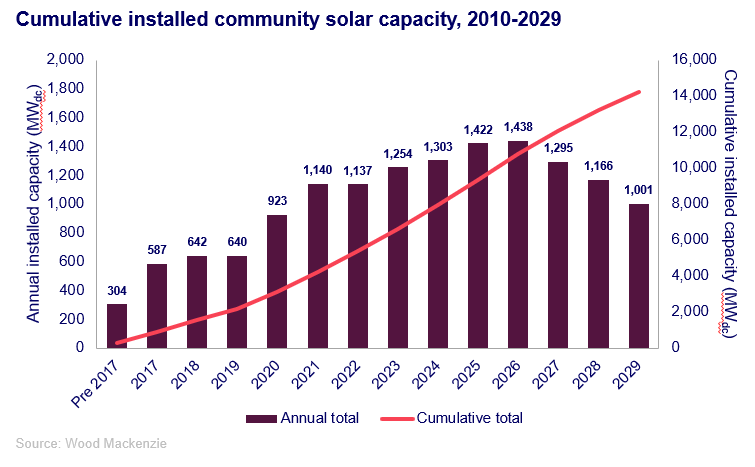

7.3 gigawatts direct current (GWdc) of total new community solar installations are expected to come online in existing state markets by 2029 in the US, according to the latest report released by Wood Mackenzie in collaboration with the Coalition for Community Solar Access (CCSA). Cumulative national community solar installations will break 14 GWdc by 2029.

Program pipelines remain strong in mature state markets, which is supporting near-term growth. However, mature markets cannot sustain annual growth in the long-term as they continue to saturate. Wood Mackenzie forecasts the national community solar market to grow at an average rate of 5% annually through 2026 and then contract by 11% on average through 2029. Expanded program capacity and the establishment of new state markets have the potential to add further uplift beyond 2026.

'The US community solar market has tripled in size since 2020, but growth is beginning to slow in existing state markets. Additionally, the May 2024 decision on California community solar resulted in a significant 14% reduction to Wood Mackenzie’s five-year national outlook. Without a major market entrant like California, long-term community solar growth will largely depend on the enactment of legislation to enable new state markets,' said Caitlin Connolly, senior research analyst at Wood Mackenzie, and lead author of the report.

Under a bull case forecast scenario, Wood Mackenzie’s five-year outlook increases by 21% in existing markets compared to the base case, while there is a 20% decrease under a bear case. Importantly, alternative scenarios do not account for the establishment of new state markets, such as Ohio, Pennsylvania, Michigan, and Wisconsin – all of which have significant interest and pre-development project pipelines.

Wood Mackenzie estimates that the enactment of proposed legislation in Ohio, Pennsylvania, Michigan, and Wisconsin and four additional potential state markets would result in an at least 17% uplift from the base case. When considering a bull case forecast scenario for existing markets and the successful passage of legislation in all potential markets, the cumulative national outlook reaches 17.1 GWdc by 2029.

Community solar developers also continue to navigate federal incentives. Connelly said: 'The fruits of the Inflation Reduction Act are numerous but difficult to count on. Community solar stakeholders are navigating a steep learning curve while trying to secure tax credit adders. In addition, awards from the $7 billion ‘Solar for All’ fund were announced in April 2024. Final implementation plans are not confirmed but developers hope to utilize federal funds to expand into new state markets even in the absence of official state programs.'

According to the report, 3.6 GWdc of community solar will serve low-to-moderate income (LMI) subscribers by 2029. As of Q1 2024, Wood Mackenzie estimates that 829 MWdc of community solar directly serves LMI subscribers. The share of community solar capacity serving LMI subscribers grew from 2% in H2 2022 to 12% in H1 2024. Given the availability of the LMI tax credit adder, Solar for All funding, and evolution of state-level LMI requirements, the share of community solar dedicated to LMI subscribers will grow to nearly 25% by 2025.

'One of community solar’s defining and unique benefits is its ability to deliver meaningful bill savings to small businesses and working families who need it most,' said Jeff Cramer, CEO of CCSA. 'Not only is the community solar industry delivering on that promise, but it’s doing so on pace with our goal to provide 4 GWdc of dedicated capacity to low-income residents by 2030. We’re also excited to see how Solar for All will positively impact our vision even faster than we had hoped.'

The top three subscriber management companies manage 56% of the total community solar subscribers and 71% of LMI subscribers. LMI subscribers remain the most costly to acquire with costs averaging $113 per kilowatt, 27% higher than the average cost to require non-LMI residential subscribers. Developers can save on costs by outsourcing subscriber acquisition and management to third-party companies, stated the report.

Source: Wood Mackenzie