HIGHLIGHTS

- Formal signing ceremony in Angola attended by Managing Director Andrew Knox, following parliamentary ratification of the Risk Service Contract (RSC) for Block 6/24

- Red Sky holds a 35% participating interest in Block 6/24, offshore Angola, in the high-potential Kwanza Basin

- The RSC was initially signed on 31 December 2024 with Sonangol E&P (operator, 50%), ACREP (15%), and Red Sky (35%) following direct negotiations with the Angolan National Agency for Oil, Gas and Biofuels (ANPG)

- Block 6/24 spans 4,930 km² in the Kwanza Basin, with existing seismic coverage and a material discovery at Cegonha

- Independent assessment confirms Net 2C Contingent Resources of 5.1 MMbbl and Net 2U Prospective Resources of 11.0 MMbbl, with pre-salt potential beneath Ibis as at 31 March 2025

- Oil discovered at Cegonha is heavy crude (18° API), confirmed as commercially viable using established global production methods

- Agreement paves the way for JVOA finalisation, and preparation of a work programme and budget

- Strengthens Red Sky’s long-term growth strategy and international diversification

Red Sky Energy has advised that Managing Director Andrew Knox attended a formal signing ceremony in Angola to complete the Risk Service Contract (RSC) for Block 6/24, following recent parliamentary ratification.

This marks a key milestone in Red Sky’s expansion into Angola and underscores the Company’s commitment to building long-term partnerships in one of Africa’s most prospective offshore basins.

The RSC was initially executed on 31 December 2024 between Red Sky Energy (35%), Sonangol E&P (operator, 50%), and ACREP (15%), following direct negotiations with the Angolan National Agency for Oil, Gas, and Biofuels (ANPG).

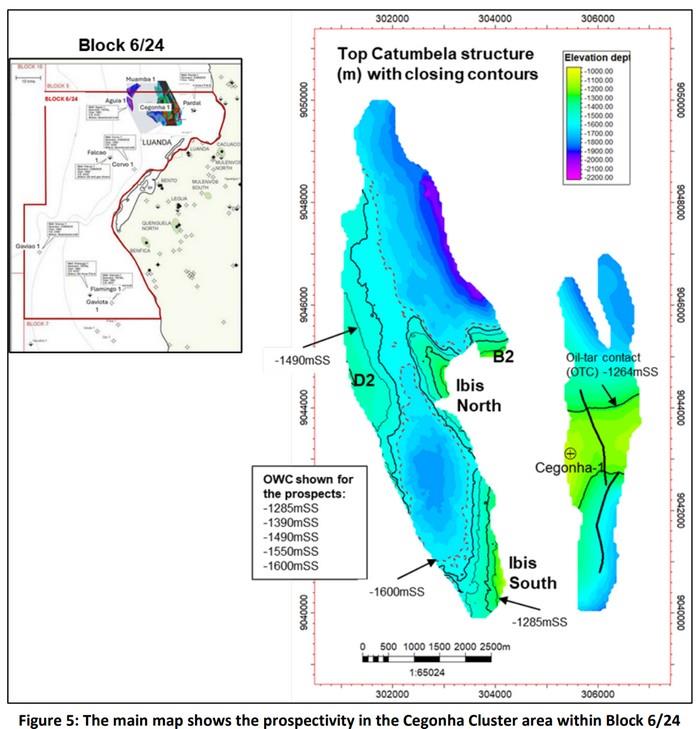

Block 6/24, located just 12 kilometres offshore in Angola’s Kwanza Basin, includes the Cegonha oil field, which has been independently assessed by PetroAus and carries a Net 2C Contingent Resource of 5.1 million barrels (MMbbl). Three additional prospects - IBIS, D2, and B2 - contribute a further 11.0 MMbbl in Net 2U Prospective Resources to Red Sky’s portfolio. Early seismic studies have also revealed potential pre-salt structures under the Ibis prospect. (Refer to Appendix for a Resources Summary.)

Managing Director Andrew Knox commented:

'The parliamentary ratification and formal agreement with the Angolan Government represent a key strategic achievement for Red Sky.

Block 6/24 is an exceptional asset — anchored by a material oil discovery, surrounded by highpotential prospects, and offering exposure to emerging pre-salt opportunities.

This milestone accelerates our ability to commence technical work with our partners Sonangol and ACREP and pursue early production potential. It also diversifies our portfolio across geographies and resource types, supporting long-term value creation for shareholders.

We are excited to take the next step in unlocking value from one of West Africa’s most prospective offshore basins.'

Next Steps

The formal agreement signing allows the joint venture to move into the execution phase, including:

- Finalisation of the Joint Venture Operating Agreement (JVOA)

- Commencement of Geological and Geophysical (G&G) studies

- Preparation for seismic reprocessing and potential drilling Background: Block 6/24 Ownership and Location

Background: Block 6/24 Ownership and Location

Sonangol E&P is the operator of the Block, with a 50% participating interest. Red Sky Energy holds a 35% participating interest, and ACREP has a 15% interest. Block 6/24 is located 12 kilometres offshore, in water depths ranging from 70 to 80 metres. Seismic data covering the block has shown significant oil discovery potential. Figure 5: The main map shows the prospectivity in the Cegonha Cluster area within Block 6/24

Source: Red Sky Energy