Vista Energy announced April 16 that its subsidiary Vista Energy Argentina has acquired 100% of the capital stock of Petronas E&P Argentina S.A. ('PEPASA'), which holds a 50% working interest in La Amarga Chica unconventional concession ('LACh'), located in Vaca Muerta, Argentina, from Petronas Carigali Canada and Petronas Carigali International E&P. The purchase price is comprised of US$ 900 million in cash, US$ 300 million in deferred cash payments and 7,297,507 American Depositary Shares representing Vista’s series A shares ('ADSs') paid to the Sellers and subject to lock-up restrictions that will expire (i) with respect to 50% of the ADSs on October 15, 2025, and (ii) with respect to the remaining 50% of the ADSs on April 15, 2026. The deferred cash payments will be paid 50% on April 15, 2029, and 50% on April 15, 2030, without accruing interest.

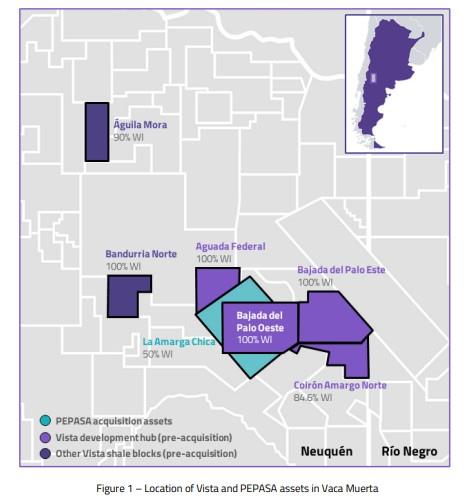

LACh spans across 46,594 acres in the black oil window of Vaca Muerta. As of December 31, 2024, it had 247 wells on production. In addition, as of December 31, 2023, LACh had 280 million barrels of oil equivalent ('MMboe') of P1 reserves according to the Argentine Secretary of Energy (at 100% working interest). During the fourth quarter of 2024, LACh produced 79,543 barrels of oil equivalent per day ('boe/d') at 100% working interest, of which 71,471 barrels per day ('bbl/d') were oil, according to the Argentine Secretary of Energy. Vista estimates LACh could potentially hold 400 new well locations to be drilled in its inventory (at 100% working interest). The remaining 50% of LACh is held by YPF, which is the operator of the concession.

Miguel Galuccio, Vista’s Chairman and CEO, commented, 'With this acquisition we gain significant scale in Vaca Muerta with a premium block that has growing production and low operating costs, enabling the acceleration of our long-term plan and strengthening our free-cashflow profile. The acquisition both increases our profitability and enhances our portfolio of ready-to-drill locations in the core area of Vaca Muerta. Importantly, in the current global macro and oil price environment we are consolidating a highmargin, low-breakeven asset, with strong synergies with our ongoing operation, reflecting our constructive long-term view on crude oil demand and supply dynamics. I firmly believe this represents a unique opportunity to create long-term value for our shareholders.'

Transaction highlights

- Highly accretive acquisition for our shareholders, comparing implied EV/EBITDA, EV/flowing barrels, EV/P1 reserves and price-to-earnings (P/E) metrics to Vista metrics;

- Low-cost, high-margin, high-return, cashflow-generating asset, as LACh’s lifting cost, Adjusted EBITDA margin and Return on Average Capital Employed are in line with Vista’s operating and financial metrics for the year 2024, whilst supporting our path to positive free-cashflow generation;

- Increased scale, as Vista consolidates through PEPASA an oil and gas production volume that is approximately 47% of its Q4-24 production, leading to a pro forma total production of 125,048 boe/d for Q4-24;

- Portfolio enhancement, with an estimated inventory of 200 ready-to-drill wells at Vista’s 50% working interest in the core of Vaca Muerta, and geographically located next to Vista’s development hub;

- Operating synergies based on the proximity of LACh to Vista’s development hub, which could translate into potential savings related to sharing surface facilities, optimizing well placement close to the limits between LACh and Vista’s development hub, streamlining new well design and sharing general services;

- Significant oil midstream capacity is consolidated through the acquisition, as PEPASA has approximately 57,000 bbl/d transportation capacity and 48,000 bbl/d export dispatch capacity in several key midstream projects.

In order to carry out the Transaction, own funds and funds from the Transaction financing were used, consisting of a credit agreement between Vista Argentina as borrower and Banco Santander, S.A. as lender, for a total amount of US$ 300 million. This credit agreement has a term of four years.

Source: Vista Energy