Dorado Phase 1 liquids development continues positive progress towards FEED re-entry later this year and FID in 2025

- The assessment of key optimisation opportunities is being finalised, which are expected to improve project economics and significantly lower upfront CAPEX

- The Joint Venture is assessing several idle FPSOs that could be re-purposed for the project

- FEED re-entry is expected to occur later this year with FID expected in 2025

- Carnarvon anticipates that overall CAPEX prior to first oil will be below previous guidance of ~US$2 billion (gross)

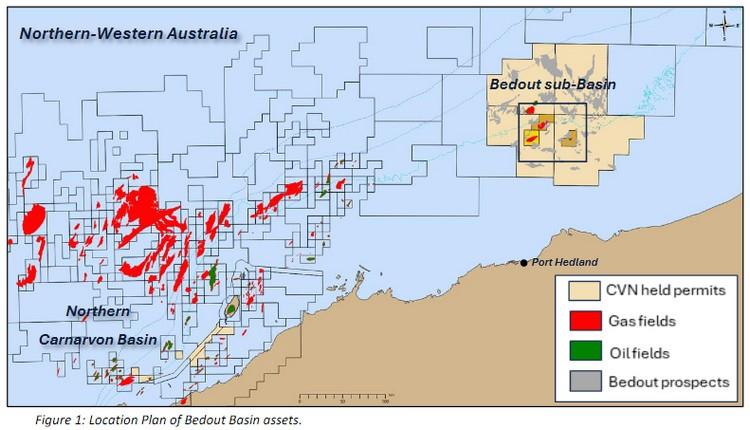

Carnarvon Energy has provided an update on its world class Dorado Phase 1 liquids development, offshore Western Australia.

The Joint Venture that covers Dorado (Joint Venture) is between Santos Limited (80%, Operator), Carnarvon (10%) and OPIC Australia Pty Ltd (its ultimate holding company is CPC Corporation, Taiwan) (10%).

The Joint Venture continues to make positive progress towards finalising the material economic improvement opportunities for the Dorado project, which Carnarvon previously outlined in its announcement on 29 April 2024.

These include an opportunity to optimise the production rate, allowing the Joint Venture to reduce the sizing of the Floating Production Offtake and Storage (FPSO) vessel, Wellhead Platform (WHP) and other facilities, and phase the timing of wells.

Reducing the facility capacity is expected to reduce the overall Capital Expenditure (CAPEX) for the Phase 1 liquids development. Phasing the development wells and reducing the number of wells required prior to first oil allows the joint venture to further reduce the up-front CAPEX prior to first oil. Any remaining wells would be drilled during production allowing them to be funded through project cash flows. These opportunities are expected to considerably improve the project’s economics and reduce the time to first oil.

The Joint Venture is also assessing FPSO vessel redeployment options along with other donor hulls for FPSO conversion. Dependent on the suitability and availability of these units, there could be further cost savings and opportunities to reduce the time to first oil for the Project above those already outlined.

The Joint Venture is taking the requisite time to fully evaluate these potential opportunities. Given the impact on engineering design and cost of utilising this potentially lower cost option, FEED re-entry is planned for later this year once the Joint Venture secures the best option vessel or hull.

Importantly, any design changes would be within the scope of the approved Offshore Project Proposal (OPP). This allows the Operator to leverage the previously completed FEED work for the optimised development FEED re-entry later this year, with FID expected in 2025.

Along with the engineering and design work to allow the Dorado Phase 1 liquids development to progress to FID, work is ongoing for the requisite Environment Plans (“EPs”) that are necessary to progress the project. The EPs for Drilling and Completion, and WHP and subsea systems installation are in progress, with the external consultation work expected to be visible in the coming quarter. The Joint Venture has already secured a Production License and Offshore Project Proposal, ensuring that all primary project approvals will be secured following the approval of the relevant EPs.

Based on the project optimisations, Carnarvon estimates that the overall CAPEX prior to first oil will be below the previous guidance of ~US$2 billion (refer to STO ASX announcement on 16 February 2022). Carnarvon expects that the Company, with its strong balance sheet, the US$90m development cost carry and optionality for a prospective debt facility, will be fully funded for its share of development costs.

Carnarvon CEO, Philip Huizenga, commented:

'I am pleased with the progress the Dorado project has made and am excited by the re-shaping of the project, which is expected to reduce the total capital outlay by Carnarvon.

While the FID timing is slightly later than previously envisaged, the Joint Venture is taking the requisite time to assess the optimisation and FPSO redeployment opportunities, and to materially progress EP approvals prior to FID. These are important activities which require additional time and are expected to unlock considerable value for shareholders.

Carnarvon’s estimates for up-front capital expenditure savings are expected to be material to the Company. With the Company’s A$176m (~US$115m) cash balance (31 March 2024), US$90m development funding cost carry and optionality for a prospective debt facility, Carnarvon expects to be fully funded for its share of development costs to first oil under the optimised project.'

Source: Carnarvon Energy