Carnarvon Energy has provided an update on the Company’s activities and financial position as at 31 March 2025.

Quarter Highlights

- Robust Balance Sheet maintained with A$186 million cash, no debt, and US$90 million Dorado development free carry

- Capital management initiatives commenced, including an On-Market Buyback for up to 10% of the Company’s issued capital,

- In addition, the Company has commenced a process to enable the potential return of up to $0.07 per share (A$125 million) to shareholders.

Carnarvon’s CEO, Philip Huizenga, commented: 'It was disappointing to announce at the beginning of the quarter the decision not to acquire the identified FPSO and delay commencement of FEED on the Dorado project.

'I am aware that we still need to provide our shareholders with a revised timeline for the Dorado development. We are working with the Joint Venture partners on this and investigating alternative options to accelerate the project. Dorado, which has been recognised as the third largest oilfield in the greater North-West Shelf, is just too big and valuable to remain undeveloped for an extended period of time.

We’re also continuing to work on several options to realise value for shareholders, including our process on a potential corporate or asset transaction and a long-awaited return to drilling. The Company will consider all opportunities that provide value and certainty to Carnarvon shareholders.

With the delay to the Dorado development, the Carnarvon Board recognises that the current funds earmarked for the execution phase may be idle in the upcoming period, which leads to the potential for a capital return later this year. We have commenced the process of a class ruling from the Australian Taxation Office (ATO) to confirm that any capital returns are not treated as a dividend for taxation purposes.

A decision on the capital return, and the exact quantum, is expected once that ruling has been received, which is expected to take around six months. Unless a superior, value accretive alternative is presented by that time, the Board will seek shareholder approval for a capital return.

Even with a capital return to shareholders, Carnarvon will remain well-funded for our near-term plans of the exploration of up to three wells in the Bedout Sub-basin and to take the Dorado project into a final investment decision. Future Dorado development costs can be funded by a combination of the existing US$90m capital cost carry and debt.

Although not recognised in our current share price, the Bedout Sub-basin, offshore Western Australia, has incredible latent value headlined by the approximately 200 million barrels (2C, gross) 1 of high-quality hydrocarbons in both Dorado and Pavo, and outstanding exploration upside.

We are also working hard on getting back to exploration drilling. At least one well is planned for next year in the Bedout Sub-basin and preparation work on this is well underway. With a significant number of prospects and leads mapped using modern 3D seismic data, and an incredible success rate of close to 70% for exploration wells, we look forward to outlining more detailed plans in the near-term.'

Project Development Dorado WA-64-L (Carnarvon 10%, Santos 80%, operator)

The Dorado oil and gas field sits 150km off the coast of Western Australia, in approximately 90 metres water depth. The largest undeveloped oil field in Australia, plans were advanced for Dorado to be developed via a staged development, with an initial liquids extraction (Phase 1) followed by gas export (Phase 2). The Phase 1 liquids development concept, which was optimised in 2024, was centred around a single well-head platform (WHP), supporting up to 12 wells being tied back to a Floating Production Storage and Offloading (FPSO) vessel.

During the quarter, the Operator decided not to proceed with the acquisition of an identified FPSO vessel and deferred the commencement of Front-End Engineering and Design (FEED) studies that had been anticipated for this year2 . The

Company is working with the Joint Venture partners to update the timeline for the Dorado development and is investigating alternative options to accelerate the project. Despite the delays to the Dorado development, the Joint Venture recognises immense value in the discovered resources at Dorado, Pavo and Roc, and the world class exploration prospectivity in the surrounding Bedout Sub-basin. Carnarvon looks forward to providing an update on the development timeline in due course.

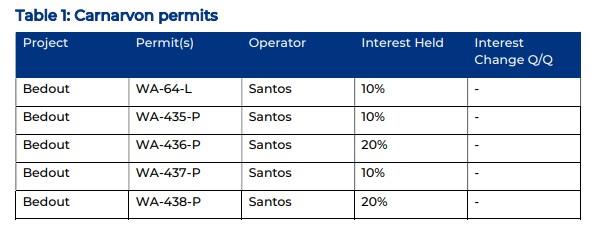

Bedout Exploration WA-435,6,7&8-P (Carnarvon 10-20%, Santos is the operator)

The Bedout Sub-basin, offshore Western Australia, is one of Australia’s most exciting exploration regions. The Joint Venture’s exploration strategy could potentially unlock substantial additional resources, with unrisked prospective resource estimates of 9 Tcf of gas and 1.6 billion barrels of liquids (Pmean*, gross)3 .

At the start of the quarter, the regulatory authority offered the Joint Venture a renewal of the four Exploration Permits, WA-435-P, WA-436-P, WA-437-P and WA-438-P. Per regulations, the renewal required the relinquishment of 50% of the Permit, excluding the WA-64-L Production License (Dorado) and defined Location Declarations (Roc and Pavo). The JV retains an area encompassing over 11,000 km² in which 95% of the identified prospectivity has been preserved, with 79% of the exploration permits now covered by modern, high-quality 3D seismic data.

Carnarvon is looking forward to working with the Joint Venture to return to drilling. The Operator has stated a desire to further evaluate the Bedout Sub-basin resources through exploration, and the JV is targeting drilling in 2026, subject to Environmental Plan approvals and rig availability.

The Joint Venture has yet to finalise where the drilling will occur, with the proposed Environmental Plan covering several locations across all four Permits.

The prospectivity outlined has the potential to unlock sufficient gas resources to underpin a future gas export development project. Corporate The Company recognises significant value in the Bedout Basin assets, including the Dorado and Pavo discovered oil fields. Despite the delays to FEED entry and therefore FID, Carnarvon continues to explore alternative transactions to accelerate value realisation.

Source: Carnarvon Energy