Central Petroleum has entered into a conditional sale and purchase agreement to sell its interests in the three Northern Territory sub-salt exploration permits - EP82, EP112 and EP125 - to Georgina Energy in consideration for a 25% equity interest in Georgina.

Prior to completion of the transaction, Georgina must undertake an equity raise of at least GBP £7 million (circa AUD $14 million) in order to fully fund its acquired share of the Mt. Kitty appraisal well which is expected to be drilled by June 2027.

The transaction would result in Central holding a 25% interest in Georgina post equity raise (i.e. Central will not need to contribute to the Georgina equity raise to end up with a 25% interest in Georgina).

On completion of the transaction, Central’s intention would be to distribute the Georgina shares to Central’s shareholders (subject to regulatory requirements).

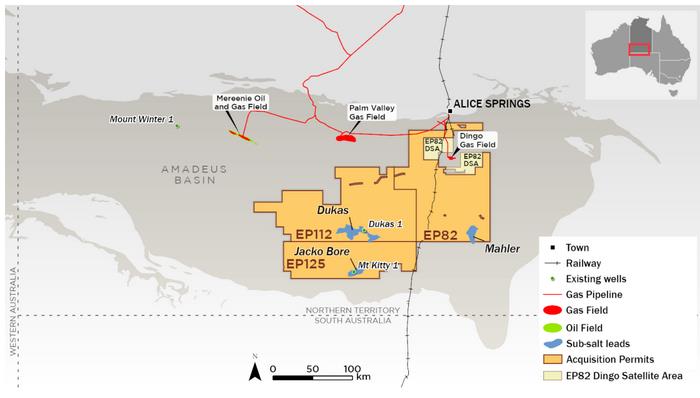

The transaction would significantly enhance Georgina as a pure-play helium explorer, with a focus on five helium, hydrogen and hydrocarbon prospects in highly prospective areas of central Australia, comprising of Central’s three sale permits, EP82 (Mahler/Magee), EP112 (Dukas) and EP125 (Mt Kitty/Jacko Bore) and Georgina’s two other permits, Mt Winter (EPA155, Amadeus Basin, Northern Territory) and Hussar (EP513, Officer Basin, Western Australia). Mt Kitty is a discovery with world class levels of helium (9%) and hydrogen (11.5%) and will be the first of these targets to be drilled.

Highlights

• Central to sell its interests in three Northern Territory exploration permits, EP82 (60% interest) (excluding several sub-blocks adjacent to the Dingo production licence, ‘DSA sub-blocks’), EP112 (45% interest) and EP125 (30% interest) to Georgina.

• As a key condition to the sale, Georgina must demonstrate that it has no less than GBP £7 million in equity cash available immediately prior to completion and prioritise drilling the Mt Kitty / Jacko Bore prospect by the permit commitment date (anticipated to be June 2027 per the current renewal application).

• On completion, Central will receive ordinary shares in Georgina such that it holds shares and rights equating to 25% of Georgina’s fully-diluted share capital as at completion (e.g. post any equity raise or issue of dilutive securities prior to completion).

• Central would be entitled to appoint a director to the Georgina board while it holds at least 15% of Georgina’s issued capital.

• Central intends to distribute the Georgina shares received at completion to its shareholders on a pro-rata basis (subject to regulatory requirements).

Central’s Managing Director and CEO, Leon Devaney said 'This conditional sale would give Central shareholders an interest in a significant helium explorer, with an extensive portfolio of operated and non-operated prospects across helium-rich Central Australia.

As a key condition to completion of the sale, Georgina must be sufficiently equity capitalised to undertake an appraisal drilling program at the Mt Kitty prospect in partnership with Santos, with the well expected in the first half of 2027. Mt Kitty, a noteworthy sub-salt gas discovery with world-class concentrations of helium (9%) and hydrogen (11.5%) measured, would be prioritised for initial appraisal drilling, while additional helium and hydrogen prospects throughout the Amadeus and Officer Basins offer Georgina ongoing exploration opportunities and upside.

Importantly, the transaction would facilitate the restart of near-term sub-salt drilling in the Amadeus Basin, and provide Central’s shareholders with exposure to a focused, well capitalised, and substantial helium exploration company. Our intention is to ultimately distribute Georgina shares to Central shareholders next year in what we expect to be a tax effective structure.

The value for Central shareholders will ultimately depend on Georgina’s share price after completion. Using Georgina’s last closing share price of GBP £0.048 as an example, Central’s interest in Georgina would have a value of approximately AUD $8.8 million, or approximately AUD 1.2 cents per CTP share equivalent.'

Transaction details

Central has executed a conditional share sale and purchase agreement to sell three whollyowned subsidiaries that hold interests in certain Amadeus Basin exploration permits to Georgina Energy Plc, a helium focussed exploration company listed on the London Stock Exchange.

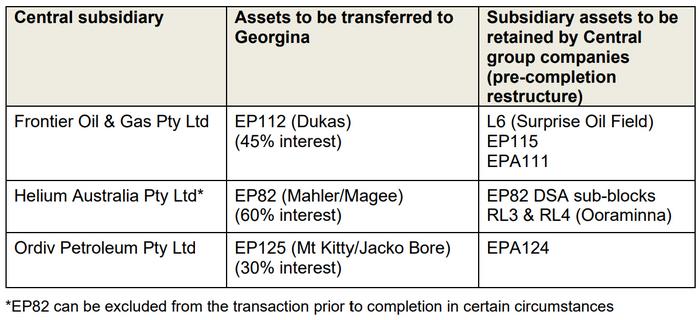

Certain assets held in the subsidiaries to be sold to Georgina that are not related to the subsalt prospects will be transferred to other Central group companies prior to completion (pre-completion restructure).

The three permits to be sold to Georgina are highly prospective for helium, hydrogen and hydrocarbons in sub-salt accumulations, with high concentrations of helium and hydrogen measured in previous exploration wells at Mt Kitty (9% helium and 11.5% hydrogen) and Magee (6.2% helium), and potentially large resources identified at Dukas.

Consideration

Subject to completion, Central would receive:

• Shares and convertible loan notes in Georgina such that it holds shares and rights to 25% of Georgina’s fully-diluted share capital as at completion, comprising:

- Shares in Georgina such that it holds 25% of Georgina’s share capital upon completion of the transaction. The 25% interest is calculated after any Georgina equity raise undertaken prior to completion; and

- Convertible loan notes, providing rights to additional Georgina shares equal to one-third of the number of any shares subsequently issued upon conversion of any of Georgina’s dilutionary securities existing at the completion date; and

• Reimbursement of Central’s expenditure on the three permits between 1 May 2025 and completion, with adjustment for joint venture working capital balances at the completion date.

Conditions precedent

The transaction is subject to a number of conditions being satisfied within four months (with a possible extension of up to two months), including:

• Georgina demonstrating that it has no less than GBP £7 million (circa AUD $14 million) in equity cash available immediately prior to completion.

• Georgina has issued a prospectus and obtained relevant shareholder approvals.

• Central completing the pre-completion restructure.

• Renewal or extension of the permits by the NT Government.

• Relevant approvals and consents to the necessary ownership transfers from the NT Government, joint venturers, financiers and other relevant stakeholders.

Proposed in-specie distribution to Central shareholders

Central intends to distribute to Central shareholders the shares in Georgina received by Central at completion, subject to regulatory requirements and shareholder approvals (as required). It is anticipated that Central may be in a position to distribute the shares by late 2026.

Subject to approval from the ATO (pre-approval cannot be obtained at this time), Central will seek to distribute the Georgina shares to shareholders as a “return of capital”, in preference to a distribution or dividend.

Strategic Considerations

Central will retain its portfolio of production assets in the Amadeus Basin, along with its other conventional oil and gas exploration prospects.

Georgina, listed on the London Stock Exchange (LON:GEX), is focussed on securing stable helium and hydrogen supplies in Australia. Georgina currently holds interests in two exploration permits in Central Australia, where it is planning to re-enter previous wells to drill down to deeper helium and hydrogen targets at:

• Mt Winter (EPA155, Amadeus Basin, Northern Territory); and

• Hussar (EP513, Officer Basin, Western Australia).

Subject to completion of the transaction, Georgina would become a pure-play helium company focussed on five helium, hydrogen and hydrocarbon targets within the highly prospective Amadeus and Officer Basins in Central Australia. Georgina would also be fully funded to drill its JV share of the Mt Kitty/Jacko Bore prospect by the permit commitment date (anticipated to be June 2027 per the current renewal application).

Source: Central Petroleum