HIGHLIGHTS

- Equus Energy commences trading on the Australian Securities Exchange (ASX), following its acquisition of the Equus Gas Project in WA and a A$15 million Public Offer, at $0.20 per share (before costs)

- Equus Energy now owns 100% of the Equus Gas Project, after receiving regulatory approval from the National Offshore Petroleum Titles Administrator

- Public Offer proceeds will enable the Company to advance its Equus Gas Project, one of the largest undeveloped gas resources on WA’s North West Shelf

- The Project contains an independently certified 2C contingent resource of 1,702 billion standard cubic feet (Bscf) of gas and 38 million US stock tank barrels (MMstb) of condensate(1)

- The Company is well funded with $~16m cash at hand and a conditional funding and gas sales agreement with Alcoa for staged funding up to US$30 million (~A$46m) to cover Project costs to a Final Investment Decision

- The agreement also provides Alcoa with exclusive rights to approximately 50 TJ/d of domestic gas over 10 years, which represents ~25% of Alcoa’s long-term WA gas needs

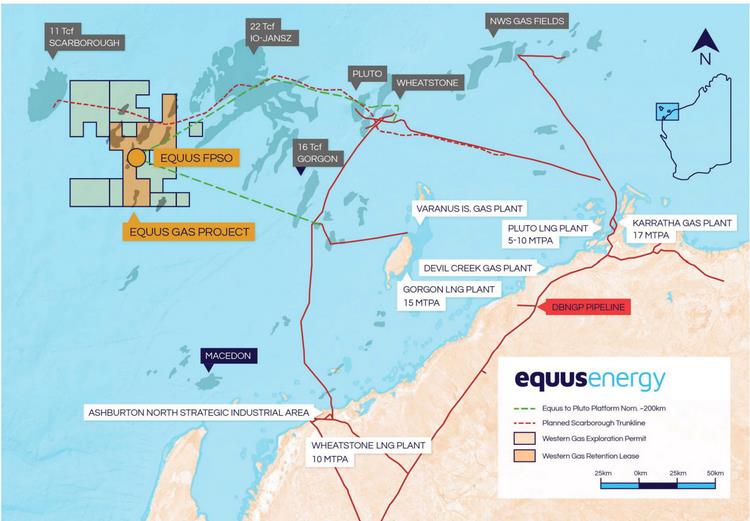

- Equus Energy is now focused on unlocking the strategic value of the Equus Project, that can supply a vital new gas source for WA's existing liquefied natural gas plants and domestic market

- Equus Energy will host an investor webinar on Friday, 19 December 2025 at 11:00am AEDT. Registration details are provided at the end of this announcement

Equus Energy has commenced trading on the Australian Securities Exchange today under the ticker EQU, following completion of a A$15 million Public Offer (before costs) and receipt of approval from the National Offshore Petroleum Titles Administrator (NOPTA) for its acquisition of the Equus Gas Project.

Public Offer funds will allow the Company to advance the Equus Gas Project (Equus or the Project), a large undeveloped gas resource on Western Australia’s North West Shelf (NWS). Equus has an independently certified resource of 1,702 billion cubic feet of gas and 38 million barrels of condensate2, located close to existing LNG and domestic gas infrastructure.

The Company has signed a funding and gas sales agreement (Alcoa Agreement) with Alcoa of Australia Limited (Alcoa), which provides conditional staged project funding of up to US$30 million and a conditional commitment for Equus to supply around 25% of Alcoa’s long-term WA gas requirements. The Alcoa Agreement also supports the next steps in project studies and project partnering.

NOPTA approval confirms Equus Energy as the 100% owner and operator of the Equus Gas Project. This approval was the final regulatory condition required to complete the acquisition of Western Gas and the Company’s Public Offer and ASX listing.

Equus Energy Managing Director Will Barker said:

'We’re grateful for the support from investors, both existing and new, that so strongly backed the Public Offer. Receiving NOPTA approval has been equally important, as it confirms Equus Energy as the approved owner and operator of the Equus Gas Project.

Together with our recently signed Alcoa Agreement that provides staged project funding of up to US$30m, the A$15m Public Offer provides the corporate funding to advance the Equus Gas Project and unlock the value of its large resource based, strategically located in the heart of WA’s gas and LNG industry.

The Company thanks investors for their support of the Public Offer and acknowledges the efforts of BW Equities Pty Ltd and Unified Capital Partners Pty Ltd as Joint Lead Managers, and Bridge Street Capital Partners and Canaccord Genuity as Co-Managers to the Public Offer.'

Source: Equus Energy