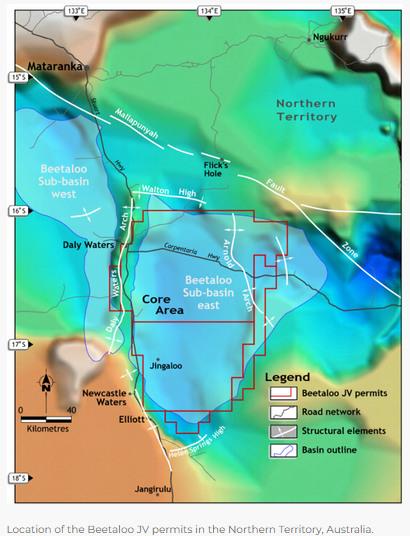

Falcon Oil & Gas has provided the following update on operations at the Amungee NW-2H ('A2H') in the Beetaloo Sub-Basin, Northern Territory, Australia with Falcon Oil & Gas Australia’s joint venture partner, Tamboran, collectively the joint venture.

Background

In December 2022 the A2H well was drilled to a total depth (TD) of 3,883 metres, including a 1,275-metre horizontal section within the Amungee Member B Shale, with a 25-stage stimulation programme completed across a 1,020 metre horizontal section in March 2023. Operations to install production tubing were completed in late-April 2023 and the well was subsequently re-opened in preparation for production flow testing. This is only the sixth well drilled and fracture stimulated in the Beetaloo Sub-basin to date.

Update on Flow Testing

- The A2H well achieved gas breakthrough, however, modelling and independent third-party analysis from a US laboratory identified a potential skin inhibiting the flow of gas from the stimulated shale. Despite this, the gas has flowed at an average rate of 0.97 mmcf/d over 50 days with circa 10% of the water used in the simulation programme recovered to date, well below other wells in the basin.

- The JV believe flows from the well are yet to establish an uninhibited 30-day initial production rate.

- The well is currently producing approximately 0.83 mmcf/d and water recovery is approximately 50 bbl/d with cumulative gas production and water recovery of 52.37 mmcf and 17,879 bbl, respectively.

- The hydrocarbon phases recovered are dry gas with 90.4% methane and 2.9% ethane.

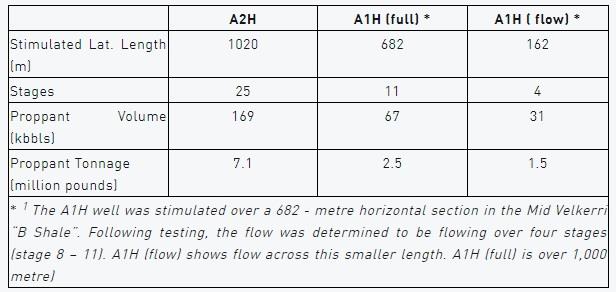

- The JV believes the results are not indicative of the underlying production potential of the Amungee Member B Shale as the Amungee NW-1H well (“A1H”) achieved flow rates of >5 mmcf/d over a normalised 1,000 metres from the same well pad in 2021. Comparative details are included in the table below:

Forward Work Programme

The JV partners will continue to focus on interpreting the results to date and completing the test and analysis work, to determine if there is clean-up work that can be carried out on the A2H well in Q3 2023.

The JV is also considering undertaking a two well drilling programme in the second half of this year which, once formally approved by the JV, will include drilling a well at Shenandoah South ('SS1H') in exploration permit 117, 60 kms south of A2H (from the same pad Kyalla 117 N2-1H ST2 was drilled) in Q3 2023 targeting deeper acreage in the JV exploration permits followed by drilling Amungee 3H (“A3H”), a well in close proximity to the existing two Amungee wells.

Further details will be announced to the market once the JV has formally approved the work program.

Philip O’Quigley, Falcon’s CEO, commented:

'Initial flow rates demonstrated from the A2H well to date do not reflect the true deliverability of the shale in the Amungee region. Being the sixth well drilled and stimulated within the Amungee member within the Beetaloo Sub-basin, we continue to learn from how the shale is stimulated and performs under varying conditions. Further analysis of all available data together with any clean-up work will hopefully yield more positive interpretation of the results obtained to date.

We look forward to being able to use all the learnings from this A2H well and other work conducted in the Beetaloo Sub-basin to date in order to allow the JV to design a modified drilling and completion programme for the proposed upcoming two-well drilling program which hopefully will deliver a successful outcome for our shareholders.

Falcon remains in a very strong financial position with circa US$16 million in cash and remains carried for costs at this time.'

Source: Falcon Oil & Gas