Horizon has advised that its acquisition of a 25% non-operated interest in the producing Mereenie oil and gas field has completed.

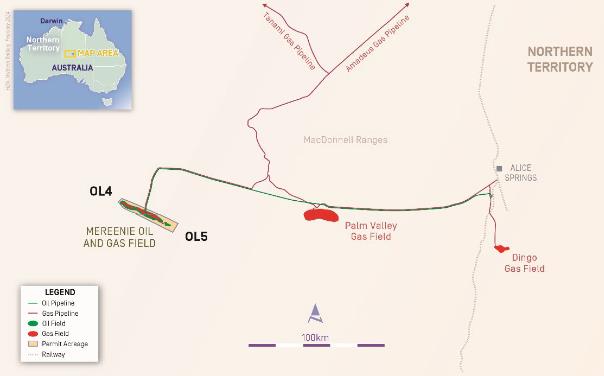

Horizon announced on 14 February 2024 that it had executed a sale and purchase agreement with Macquarie Mereenie to acquire a 25% non-operated participating interest in the OL4 and OL5 development licences, Northern Territory, Australia, which contain the producing Mereenie conventional oil and

gas field. The acquisition was executed together with New Zealand Oil and Gas ('NZOG'), an incumbent Mereenie joint venture partner, who acquired a further 25% participating interest in OL4 and OL5 from Macquarie on identical terms.

The effective date of the transaction is 1 April 2023, with revenues earned and costs incurred during the period from effective date to completion adjusted against the initial cash consideration of A$42.5 million (~US$27.6 million). Funding for the initial cash consideration is from a new A$42.5 million senior debt facility which was recently executed with Macquarie Bank as per Horizon’s announcement on 4 June 2024. Financial close and drawdown of the facility occurred earlier today to enable completion of the acquisition.

Central Petroleum remains as operator of the Mereenie joint venture and manages the gas sales function on behalf of Horizon, New Zealand Oil & Gas and Cue under a joint marketing agreement.

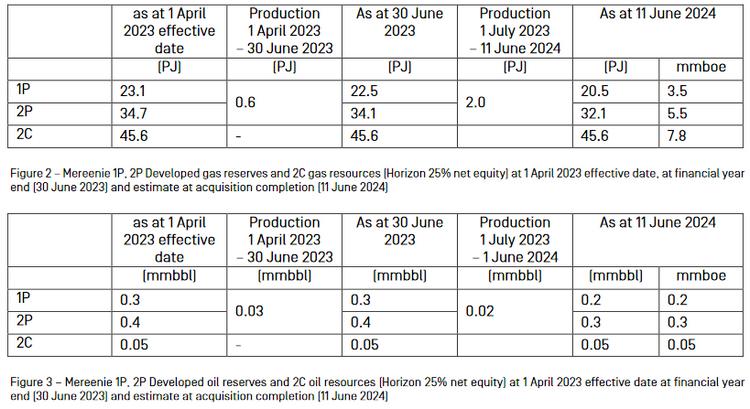

Reserves, resources and production

Horizon’s Mereenie reserves and resources at the 1 April 2023 effective date, at financial year end (30 June 2023) and at acquisition completion (30 June 2024) are shown in the tables below:

Developed reserves have been estimated using deterministic reservoir simulation models, anticipated gas and oil prices and expected capex/opex forecasts. Contingent resources have been estimated using deterministic volumetric methods and include Stairway and Pacoota reservoirs.

The acquisition will increase the Horizon 2P (proved and probable) reserves by 6.4 million barrels of oil equivalent as at an effective date of 1 April 2023 (6.3 mmboe 2P reserves as at 30 June 2023, an increase of ~129% compared to the Company’s 30 June 2023 2P reserves position of 4.9 million barrels of oil equivalent), and the Company’s 2C (contingent resources) by 7.9 million barrels of oil equivalent, an increase of ~114% compared to the company’s 30 June 2023 contingent resource position of 6.9 million barrels of oil equivalent. Based on current Mereenie rates, the Company’s daily production rate will increase by ~1,100 boepd.

Horizon CEO Richard Beament commented:

'We are delighted to finalise the Mereenie acquisition and add a third production asset to our portfolio - complementing, diversifying and expanding our production base. As previously noted, the acquisition plays to Horizon’s strengths as a non-operator, being also right sized, largely self-funded and with material upside.

Based on current production rates at Mereenie, the acquisition will materially increase Horizon’s net daily production by approximately 1,100 boepd, and more than doubled the Company’s 2P reserves position at 30 June 2023.

The asset provides the Company with material exposure to both the Northern Territory and East Coast gas markets, both of which are forecast to have significant supply side opportunities. With domestic gas recognised as key to the energy transition, Mereenie has a strong part to play in providing essential energy to miners and other industrial users to support the energy transition.

The acquisition is expected to meaningfully increase net operating cash flow over the next 5+ years and provide a production base beyond the expiry of our existing assets. We look forward to working with the Mereenie JV participants to further unlock the remaining value in the asset, with planning already underway for a potential two well development drilling program later this calendar year (subject to JV and regulatory approvals, and rig availability).'

Source: Horizon