Woodside and Chevron have agreed to an asset swap under which Woodside will acquire Chevron’s interest in the North West Shelf (NWS) Project, the NWS Oil Project and the Angel Carbon Capture and Storage (CCS) Project, and transfer all of its interest in both the Wheatstone and Julimar-Brunello Projects to

Chevron. Chevron will also make a cash payment to Woodside of up to $400 million.

The transaction highlights include:

- Streamlines Australian portfolio and consolidates focus on operated LNG assets;

- Simplifies NWS joint venture ownership, unlocking economic recovery of existing production and future development opportunities; and

- Strengthens near-term cash flow to support shareholder distributions and ongoing investments.

'The strategic and commercial rationale for this asset swap is compelling for Woodside,' said Woodside CEO Meg O’Neill.

'This transaction simplifies our portfolio, improving our focus and efficiency by consolidating our position in our operated LNG assets. It is immediately cash flow accretive and includes a cash payment upon both execution and completion.

'This year, the North West Shelf Project and its Karratha Gas Plant celebrated 40 years of operations. The Western Australian Government’s recent decision to extend the environmental approval for the North West Shelf Project supports its ongoing contribution to reliable energy supply for local and global customers. This transaction creates greater opportunity to fill emerging processing capacity and maximise value accretive recovery from the North West Shelf Project.

'It also provides greater alignment and improves the commercial prospects for the proposed Browse to North West Shelf Project.

'Additionally, this improves joint venture planning for decarbonisation opportunities at Karratha Gas Plant. Our increased equity in the Angel CCS Project also supports future development of this large-scale, multi-user carbon capture and storage hub in Western Australia.'

Transaction details

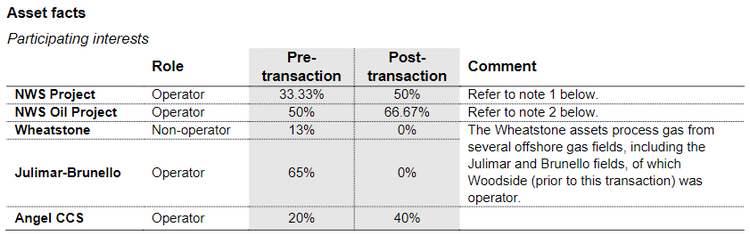

Under the proposed transaction, Woodside will transfer its 13% non-operated interest in the Wheatstone Project and 65% operated interest in the Julimar-Brunello Project and will acquire in exchange Chevron’s 16.67% interests in the NWS Project and the NWS Oil Project and a 20% interest in the Angel CCS Project.

The effective date of the transaction is 1 January 2024.

Completion of the transaction is subject to customary conditions precedent, including Australian Competition and Consumer Commission and Foreign Investment Review Board clearances and other applicable State and Federal and regulatory approvals, relevant third-party consents and pre-emption rights of the continuing joint venture participants. The transaction is also subject to the completion of Julimar Phase 3 Project execution and handover which is expected in 2026, and the completion of certain ongoing abandonment activities. The Julimar Phase 3 Project is a four well tie-back to the existing Julimar field production system and is currently in execution phase. Woodside will continue to operate the execution phase, transferring the asset to Chevron at project start-up. The transaction is expected to close in 2026.

The cash payment by Chevron to Woodside of up to $400 million comprises a cash payment of $300 million at completion, and additional contingent payments of up to $100 million in aggregate related to handover of the Julimar Phase 3 Project and subsequent production performance. In addition, cashflows forecast at approximately $400 million, are expected from utilising otherwise depreciable tax bases on completion. At completion there will be customary adjustments for net working capital and interim period cash flows.

Chevron will provide a $100 million advance payment to Woodside on execution of the transaction, which is refundable by Woodside if the transaction fails to complete.

Production and Reserves

- 2024 production through 30 September 2024 from Woodside’s interest in Wheatstone has averaged ~34.0 kboe/d.

- 2024 production through 30 September 2024 from Chevron’s interest in NWS Project and NWS Oil Project has averaged ~54.5 kboe/d.

- Subject to completion of the transaction, the net impact to Woodside’s Reserves and Resources as at the effective date 1 January 2024 will be a net increase of 9.6 MMboe to Proved plus Probable (2P) Reserves.1

Note 1: The NWS Project consists of a number of active joint ventures. Prior to completion of the transaction, Woodside has a participating interest of 33.33% and Chevron has a 16.67% participating interest in all of these joint ventures, apart from the NWS joint ventures with CNOOC. For CLNG JV with CNOOC,

Woodside’s participating interest is 25% and Chevron’s is 12.5%. For the Extended Interest JVs with CNOOC, Woodside’s participating interest is 31.567% and Chevron’s participating interest is 15.78%.

Note 2: The NWS Oil Project consists of the Cossack, Wanaea, Lambert and Hermes oil fields development, including the Okha floating production storage and offloading (FPSO) facility.

1 Includes 6.1 MMboe of fuel consumed in operations.

Source: Woodside Energy