Neon to proceed into Define phase, on staged commitment basis

- Neon development opportunity achieves key Decision Gate 2 milestone and moves into the Define phase, including Front End Engineering and Design (FEED).

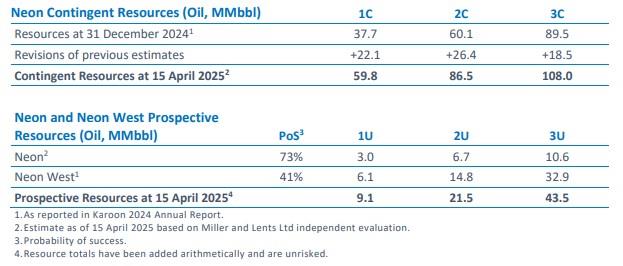

- Neon Contingent Resource estimates materially improved, with 1C up 59% to 59.8 MMbbl, 2C up 44% to 86.5 MMbbl and 3C up 21% to 108.0 MMbbl. 60 - 70 MMbbl targeted under first phase development.

- Neon Prospective Resources of 6.7 MMbbl on a 2U basis recognised for the first time.

- In light of current market volatility, Define phase to take place in three stages, to allow for reassessment by the Karoon Board as each stage is completed.

- First stage capital commitment of US$7 – 10 million, to be funded from cash.

- Farm down process to secure a partner (a prerequisite to taking a Final Investment Decision) to commence during 2Q25.

- Revised Phase 1 concept capital costs (100%) currently estimated at US$0.9 – 1.2 billion, first oil targeted for early 2029 and estimated peak production rate of 40 - 50,000 bopd.

- Mid-case pay-back period approximately two years and IRR above 20%, at a long term Brent oil price of US$65/bbl (2025 real).

Progress through DG-2 and commencement of Define phase

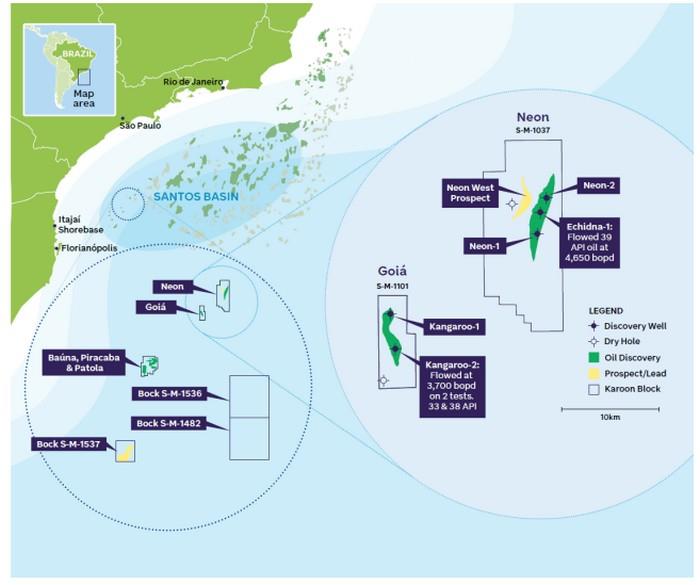

Over the past year, extensive technical and commercial work has taken place on a possible development of the Neon field located in Block S-M-1037, 75 kilometres northeast of the Baúna Project in the Santos Basin, offshore Brazil. Based on this work, the estimated economics for this opportunity have improved materially and confirm that a Neon standalone development has the potential to be an attractive, value accretive growth opportunity. Consequently, Neon has passed Decision Gate 2 and has progressed into the Define phase.

The Define phase will involve undertaking work to further mature the Neon opportunity towards a possible Final Investment Decision (FID), including the following:

- Confirm final well numbers and phasing, location and design.

- Secure an appropriate FPSO for redeployment.

- Define subsea infrastructure required and any modifications required to the FPSO.

- Engage with the market for key supply and service contracts, including a drilling rig.

- Reduce capex uncertainty and optimise the value of the development.

- Undertake a farm-down process.

Define phase activities have been divided into three stages, to mitigate capital exposure prior to farm out. This will provide intermediate review stages, with progression into the next stage dependent on technical and commercial progress, and market conditions.

Resources

Karoon has reassessed the Contingent Resources for the Neon field following a comprehensive review of seismic and subsurface data, updated integrated reservoir modelling and a revised reservoir development plan. The work undertaken has improved the definition of the Neon field and resulted in changes to Neon Contingent Resources, with additional Neon Prospective Resources also recognised for the first time.

Development of the resource is expected to take place in phases, with the first phase targeting 60 - 70 MMbbl of the total Contingent Resource, and with subsequent phases expected to develop additional recoverable volumes. The resource numbers below are based on a full field development.

In addition, the Neon and Neon West Prospective Resources both represent low risk exploration upside with similar seismic direct hydrocarbon indicators as the proven Neon accumulation.

ASX Listing Rule 5.28 Cautionary Statement relating to Prospective Resources: The estimated quantities of petroleum that may potentially be recovered by the application of a future development project(s) relate to undiscovered accumulations. These estimates have both an associated risk of discovery and a risk of development. Further exploration appraisal and evaluation is required to determine the existence of a significant quantity of potentially moveable hydrocarbons.

Notes on calculation of Reserves and Resources and the Governance and Competent Person’s Statement are shown on pages 5 and 6 of this report.

The estimates of Neon Contingent and Prospective Resources are based on an independent evaluation prepared by Miller and Lents Ltd., a global consultant firm specialising in the oil and gas industry, with expertise in reserves estimation and resource quantification, based in Houston, Texas, USA, and are in accordance with SPE PRMS (2018)1 definitions. Miller and Lents’ and Karoon’s own estimates of Neon Contingent and Prospective Resources are based on the same data and are in close alignment. Neon West Prospective Resources are under review and will be updated by mid-2025.

2025 cost guidance and planned farm-down

'The Neon Define phase capital costs will be committed on a staged basis, with Board approval required to move through each stage. The initial stage capex is expected to be US$7 – 10 million, to be spent over the next six months, at which time Neon economics and market conditions will be reassessed. Assuming the opportunity progresses successfully through the various stages, total Define costs are expected to be approximately US$25 - 30 million up to a FID, targeted for mid-20262 . 2025 capital expenditure relating to Neon, including US$1 million spent on Concept Select this year, is expected to be US$22 – 25 million. Karoon expects to open a data room during the third quarter of 2025 and commence a farm down of Neon, which Karoon currently owns 100%. The Company’s aim is to secure a suitable partner to balance the risk and capital demands and share the upside, should Neon progress. A farm down is a prerequisite to Karoon taking a FID.

Dr Julian Fowles, Karoon’s CEO and Managing Director said:

'Moving the potential Neon development into the Define phase is a significant milestone for Karoon. Over the past year, the team has progressed Neon through a number of important steps. This has involved fully reprocessing the existing 3D seismic data, recalibrated with the Neon-1 and 2 well data, and rebuilding the geological models with these data and updated petrophysical evaluations. The result is a full bottoms-up reevaluation of the Neon resource, certified by independent experts Miller and Lents Ltd. We have also validated the preferred concept as a standalone development, enabling a better constrained and more robust Neon development. This has led to improved economics and has demonstrated that Neon has the potential to be an attractive growth opportunity for Karoon that, based on a US$65/bbl long term oil price, would substantially exceed our mid-teens post tax hurdle rate of return.

If it proceeds, the Neon development would significantly increase Karoon’s booked Reserves at FID and production towards the end of this decade, more than offsetting Baúna Project production decline and creating material long-term value for shareholders. A number of infill opportunities have been identified as part of DG-2, and further development phases could extend the economic life of a potential Neon development well into the 2040s. Neon could also become a hub for developing the existing discovered 27 MMbbl of 2U Contingent Resources at Goiá3 and Prospective Resources in the nearby Neon West prospect.

Given the recent volatility in global markets and oil prices, the Karoon Board has taken a measured approach to investing further in Neon, with only the first stage of Define activities currently endorsed. The initial commitment of US$7 – 10 million, for FPSO and surface facility FEED activities, optimising the phasing of development drilling, and undertaking various surveys, will be funded from our existing cash, which at the end of March 2025 was more than US$190 million. The status will be reassessed in the third quarter of 2025, at which point the next phase of Define capital spend will be approved if the results and market conditions continue to be supportive.

The Neon development concept being taken into the Define phase is based on the following parameters:

- A standalone development using a redeployed FPSO with a capacity of approximately 50,000 bopd, capable of accommodating Neon field peak production rates as well as future infill and nearby tieback opportunities.

- An initial phase of development drilling, comprising four subsea production wells and one gas disposal well, and constructing the necessary in-field subsea infrastructure, with potential for a second phase of infill production wells to follow at a later date.

Preliminary estimates of capital costs (gross) for the first phase of development are between US$900 million and US$1.2 billion. Based on a long term real Brent oil price of US$65/bbl (2025 dollars) and the mid-case resource scenario, the Neon first phase development would pay back in approximately two years, with an IRR greater than 20%, which will be further tested and refined during FEED. Development of additional infield and nearby resources could enhance these preliminary economics further.

Our funding plan assumes the farm-down of a 30 - 50% interest in the potential development. While marketing has not yet commenced, several potential farminees have already indicated interest. Subject to a farm down being achieved by late 2025 and supportive project economics and market conditions, we would aim to make a Final Investment Decision in mid-2026, with first oil targeted for 1H 2029.

I look forward to providing further updates as the Neon opportunity progresses.'

Source: Karoon Energy