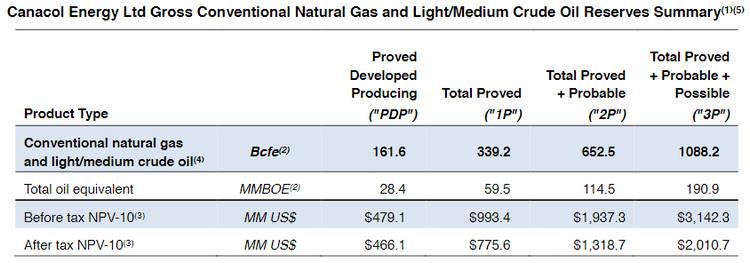

Canacol Energy has reported its conventional natural gas and light/medium crude oil reserves for the fiscal year end December 31, 2022. The Corporation’s conventional natural gas reserves are located in the Lower Magdalena Valley basin, Colombia. Newly discovered light/medium crude oil reserves are located in the Middle Magdalena Valley basin, Colombia.

(1) All reserves are represented at Canacol’s working interest share before royalties.

(2) The term “BOE” means a barrel of oil equivalent and the term “cfe” means cubic feet equivalent of natural gas on the basis of 5.7 thousand standard cubic feet (“Mcf”) of natural gas to 1 barrel of oil (“bbl”) as per Colombian regulatory practice.

(3) Net Present Value (NPV) is stated in millions of USD and is discounted at 10 percent.

(4) Conventional natural gas represents 100% of PDP, 98.3% of 1P, 95.0% of 2P, and 92.9% of 3P volumes with conventional light/medium oil being the remainder.

(5) The numbers in this table may not add due to rounding.

Highlights

Conventional Natural Gas and Light/Medium Crude Oil Proved + Probable Reserves (“2P”):

- Increased by 7.5% since December 31, 2021, totaling 652 billion standard cubic feet equivalent (“Bcfe”) at December 31, 2022, with a before tax value discounted at 10% of US$1.9 billion, representing both CAD$76.67 per share of reserve value, and CAD$53.79 per share of 2P net asset value (net of US$578.2 million of net debt)

- Reserve replacement of 169% based on calendar 2022 conventional natural gas and light/medium crude oil reserve additions of 79.5 Bcf and 5.7 MMBbls, respectively, totaling 112 Bcfe

- 2P Finding and Development Cost (“F&D”) of US$1.87 / Mcfe for the three-year period ending December 31, 2022

- Recycle ratio of 1.7x for the year ended December 31, 2022 (calculated based on the natural gas netback of US$3.68 / Mcf for the year ended December 31, 2022)

- Recycle ratio of 1.9x for the three-year period ending December 31, 2022 (calculated based on the weighted average natural gas netback of US$3.55 / Mcf for the years ended December 31, 2022, 2021 and 2020)

- Reserves life index (“RLI”) of 10.0 years based on annualized fourth quarter 2022 conventional natural gas production of 177,985 thousand standard cubic feet per day (“Mscfpd”) or 31,225 barrels of oil equivalent per day (“BOEPD”)

- RLI of 8.7 years based on conventional natural gas production guidance of 206,000 Mcfpd for calendar 2023 (high end 2023 production guidance as announced December 20, 2022

Conventional Natural Gas and Light/Medium Crude Oil Total Proved Reserves (“1P”):

- Decreased by 7.9% since December 31, 2021, totaling 339 Bcfe at December 31, 2022, with a before tax value discounted at 10% of US$1.0 billion, representing both CAD$39.32 per share of reserve value, and CAD$16.43 per share of 1P net asset value (net of US$578.2 million of net debt)

- Reserve replacement of 56% based on calendar 2022 conventional natural gas and light/medium crude oil reserve additions of 31.5 Bcf and 1.0 MMBbls, respectively, totaling 37 Bcfe

- Concurrent drilling operations through to year end resulted in discoveries at Chimela on the VMM45 block, Saxofon on the VIM5 block, and Dividivi on the VIM33 block. However, by the December 31, 2022 effective date of the report, limited production testing could occur impacting 1P reserve bookings.

- 1P F&D of US$2.60 / Mcfe for the three-year period ending December 31, 2022

- RLI of 5.2 years based on annualized fourth quarter 2022 conventional natural gas production of 177,985 Mcfpd or 31,225 BOEPD

- RLI of 4.5 years based on conventional natural gas production guidance of 206,000 Mcfpd for calendar 2023 (high end 2023 production guidance as announced December 20, 2022)

Conventional Natural Gas and Light/Medium Crude Oil Total Proved + Probable + Possible Reserves (“3P”):

- Increased by 14.3% since December 31, 2021, totaling 1,088 Bcfe at December 31, 2022, with a before tax value discounted at 10% of US$3.1 billion, representing both CAD$124.36 per share of reserve value, and CAD$101.48 per share of 3P net asset value (net of US$578.2 million of net debt)

- Reserve replacement of 304% based on calendar 2022 conventional natural gas and light/medium crude oil reserve additions of 124.8 Bcf and 13.6 MMBbls, respectively, totaling 202 Bcfe.

- 3P F&D of US$1.05 / Mcf for the three-year period ending December 31, 2022

- RLI of 16.8 years based on annualized fourth quarter 2022 conventional natural gas production of 177,985 Mcfpd or 31,225 BOEPD

- RLI of 14.5 years based on conventional natural gas production guidance of 206,000 Mcfpd for calendar 2023 (high end 2023 production guidance as announced December 20, 2022)

Ravi Sharma, COO said:

'We are pleased to report our 2022 year-end reserves. We achieved a 2P Reserve Replacement Ratio of 169%, demonstrating organic growth in both our traditional core area in the Lower Magdalena Valley Basin and a new area of focus in the Middle Magdalena Valley Basin. Over the past decade, we have added more than 880 BCF of 2P conventional natural gas reserves from success in 35 out of 41 drilled exploration wells resulting in a 22% Compound Annual Growth Rate (“CAGR”) in 2P conventional natural gas reserves. With our exploration focused drilling campaign in 2023 and a portfolio of 178 identified prospects and leads containing mean unrisked prospective conventional natural gas resources of 20.5 trillion cubic feet, according to our 2021 third party resource report, we anticipate many more years of successful exploration drilling. Our 2023 work program will also test, appraise and tie in recent discoveries, and bring multiple currently non-producing wells back into production.'

Click here for full announcement

Source: Canacol Energy