Highlights

- Initial development of Unit 1B formally approved and on track for Q1 2025.

- Construction approval received for the next Unit 1B well pad. Additional pads progressing through permitting.

- Oil truck/tankers have arrived in country. All export approvals received.

- Oil offtake contract terms being finalised with an international oil trader.

- Remediation of existing Unit 1B production well planned for November.

- Export of initial oil cargo on track for end of 2024.

Melbana Energy’s Executive Chairman, Andrew Purcell, commented: 'It’s been a busy few months getting everything organised to meet our goal of exporting our first trial cargo of oil by the end of this year. Production from the existing completion in Unit 1B from the Alameda-2 well was recently brought back online to further refine our logistics, storage and processing arrangements as well as to build some more inventory. Remediation of this completion is planned for November, the objective of which is to restore the well’s initial production rate of 1,235 barrels per day. All export approvals are in place and the oil trucks/tankers we requested have arrived in country. Offtake arrangements with a major international oil trader are also in an advanced stage of negotiation.

With regards to the next stage of the development of Unit 1B, the work program and budget for the remediation of the exisitng Unit 1B completion and the installation of two additional production wells has been approved by our partner and the regulator with construction of the new drilling pads planned to commence towards the end of the current rainy season (usually around November). It is planned to continue to drill production wells once the results from these first wells are available. The drilling rig will complete its current work by next month and is available for us again when we need it.

In parallel, we continue to study the results of the Alameda-3 appraisal well and the forward plan for the remediation of these deeper reservoirs will be finalised once the results of the Unit 1B remediation can be incorporated. Our focus, however, remains on the development of new production wells in the shallower Unit 1B reservoir to increase the rate of production from the 46 million barrels of Contingent Resource (100% share, Best Estimate)1 as quickly as possible, which we expect to be able to do with the financial resources currently available to us supplemented by the revenue from oil sales.

We’re looking forward to reaching this important Company milestone – transitioning from being an explorer to becoming a producer'.

Melbana Energy, a 30% interest holder in and Operator of Block 9 PSC onshore Cuba, has provided this operational update.

Field development

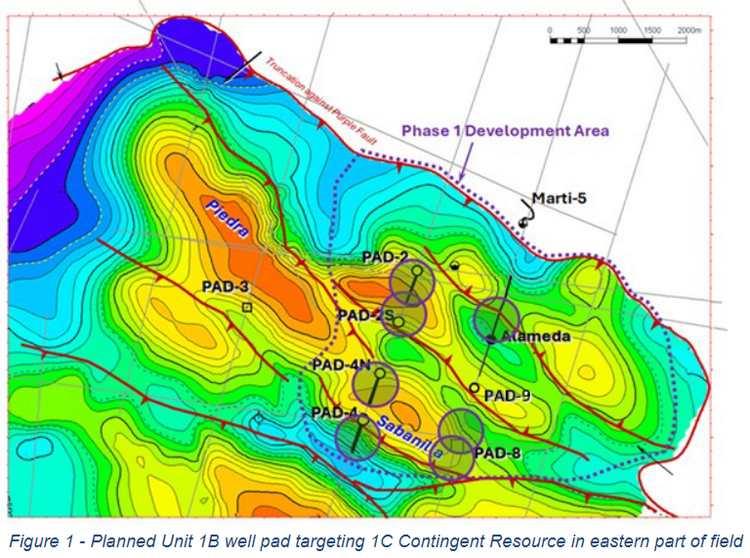

The first of the next seven new well pads (see Figure 1) has been approved for construction with permitting of the remaining pads proceeding satisfactorily. Each of these pads will be permitted for two production wells. The approval demonstrates that Melbana has again completed the required stakeholder consultation, hazard modelling, and economic analyses to the satisfaction of the regulator. The contractor for the required civil works is expected to commence work towards the end of the rainy season (usually about November).

The first phase of the field development plan involves the remediation of the exisitng Unit 1B completion (see below) and the drilling of more production wells into Unit 1B of the Amistad Structure, given our demonstrated ability to quickly access this shallower formation, to increase recovery of the 46 million barrels of Contingent Resource (100% share, best estimate)(1) that was independently estimated to exist there.

Our short-term goal remains to export the first cargo of oil production to test and analyse the performance of logistics, storage and commercial arrangements before the end of this year.

The proposed phased development plan will see us drill a series of new Unit 1B production wells using existing 2D seismic control targeting the highest confidence 1C resource of 16 million barrels (100% share, low estimate)(1). A 3D seismic acquisition planned for next year will allow subsequent development wells

to be more accurately positioned to more efficiently develop the entire recoverable 2C Contingent Resource of 46 million barrels (100% share, best estimate) and pursue the entire 3C Contingent Resource (100% share, high estimate) of 129 million barrels(1).

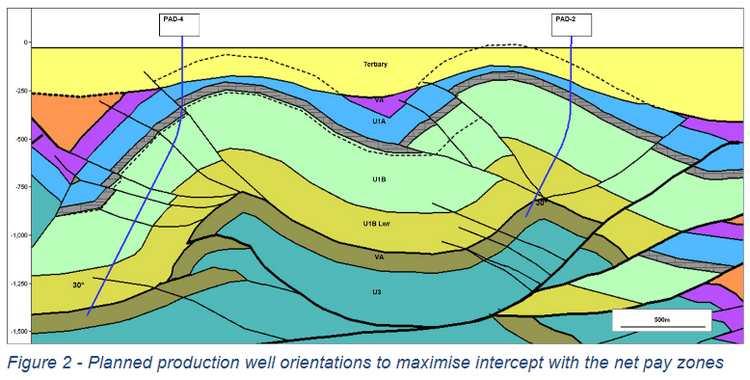

Our engineering team have finalised the Basis of Well Design (BOWD) concept for the upcoming field development wells. The revised BOWD incorporates learnings from Alameda-2 and Alameda-3 regarding mud weight, drilling and completion techniques to minimise costs and formation damage whilst maximising recovery rates by intercepting the entire net pay zone at optimal orientation given the information gained on the dominant fracture system from the appraisal well program (see Figure 2).

Alameda-2 remediation and Unit 1B development drilling

Prior to the drilling of the next production wells, it is planned to remediate the existing Unit 1B completion of Alameda-2 to correct near-wellbore formation damage established by comparison of results from the original Drill Stem Test (DST) and Extended Production Test. The goal of the program is to return the well to the superior rates observed in the initial DST (stabilised flow rate of 1,235 barrels of oil per day(2) obtained from perforations cover only about 20% of the net pay zone). Key steps in the program include using a service rig (available in country) to pull the completion, adding perforations to the lower area of Unit 1B and undertaking an acid wash and squeeze before re-running the completion.

Alameda-3

Melbana’s team have completed scoping and are preparing to commence routine and special core analysis incorporating a formation damage study to inform operations for the upcoming drill program and determine the best corrective course of action for Alameda-3. Petrophysical analysis of Alameda-3 well logs and correlation to core has been conducted, with a key finding that up to 480 metres (TVD) of net pay was observed in the Alameda sheet and up to 103 metres (TVD) for the Marti sheet. Given the similarity of these results to logs obtained whilst drilling Alameda-1, it is believed that the observed poor productivity, particularly for the Alameda sheet, was likely due to a combination of higher than planned mud weight and a long duration of mud/chemical exposure to the reservoir causing formation damage.

Commercialisation

Melbana’s engineering and commercial teams continue to optimise their plans for the delivery of oil produced in Block 9 (see Figure 3), with the plan being a direct trucking route to truck receiving pits connected to oil storage tanks at the Matanzas Supertanker port.

The port has multiple storage tanks options, and the Company is negotiating to gain access to storage of 250,000 barrels to optimise parcel sizes, which at a putative 5,000 barrels of oil per day production rate would support an uplift every other month (Figure 3). Alternatives delivery routes using existing processing and pipeline infrastructure are being pursued in parallel.

The Company is formalising a joint marketing and sales agreement with all Block 9 stakeholders to export 100% of production. Negotiations with major international commodity traders interested in purchasing the 19.8° API and 2.7% sulphur Unit 1B crude are at an advanced stage.

The Company is also in discussions with several potential new partners and credit providers who have demonstrated interest in participating in the development of Block 9.

Source: Melbana Energy