Highlights

- Peak flow to surface 1,903 barrels of oil per day from Unit 1B (stabilised average flow rate 1,235 barrels of oil per day)

- Significantly lighter (19° API) and lower viscosity (30 cP) oil compared to other units in the Amistad Formation

- Over 1,000 barrels of oil produced and trucked away during testing

- No formation water observed during the flow test or from logs

- Unit 1B now being completed to allow for future production

Melbana Energy’s Executive Chairman, Andrew Purcell, commented: 'What an excellent finish to an already successful appraisal well. Unit 1B has really delivered, as we hoped would be the case given the high fracture density and excellent permeability and porosity we observed in the logs when drilling through that unit. That it contains higher quality oil has implications for the value of the oil produced and the possibility of higher recovery rates than were assumed in our original resource estimates, too. Importantly, these results were obtained by perforating less than 20% of the total Net Pay for Unit 1B (when incorporating fractures) and the flow rate exceeded our expectations for a vertical test at such a shallow level.

To recap, the Alameda-2 appraisal well produced oil to surface from Unit 1A, achieved strong flow rates of a higher quality crude from Unit 1B, proved the existence of moveable oil from Unit 3 and confirmed a significant increase in logged Net Pay to 615 metres TVD (with fractures) for the Amistad sheet in total - about 45% of the gross section. It has been a tremendous success and gives us more shorter-term production options to consider when finalising our field development plan.

We’re also now reassessing whether there may be value in not abandoning Alameda-1, which is the current plan, before commencing Alameda-3 to appraise the two deeper intervals.'

Melbana Energy, a 30% interest holder in and operator of Block 9 PSC onshore Cuba, has provided an update on its Alameda-2 appraisal well.

The Alameda-2 appraisal well has completed flow testing of Unit 1B in the Amistad Formation – the last unit to be tested by this well.

Unit 1B was intersected between 649 metres and 1,039 metres TVD, approximately 78 metres up dip and 40 metres to the south of where it was intersected by Alameda-1. The 7” casing which was placed over Unit 1B in Alameda-2 was successfully perforated over 70 metres TVD, less than 20% of the Net Pay interval in Unit 1B. The test was conducted over an initial 24 hour period on a variety of choke sizes, during which a stabilised average flow rate of 1,235 bopd was measured over 12 hours on a 36/64” choke. This was followed by a shut-in period of 48 hours and a further 6 hour flow period, during which additional samples were taken.

The test in Unit 1B has confirmed the presence of moveable oil considerably lighter than that observed in Unit 1A. The fluid produced to surface was close to 100% oil with almost zero comingled water and no formation water observed in either the test or the wireline logs.

Initial laboratory analysis indicates an API of 19° and a lower viscosity (30 cP) than oil recovered elsewhere in the Amistad interval. This oil is of a higher quality and should be suitable for refining. Further laboratory testing of the oil’s properties is in progress to better understand its commercial and production characteristics. A DST run over the Unit 2 interval did not demonstrate moveable hydrocarbons to surface in that location.

To date, over 1,000 barrels of oil have flowed naturally to surface during the testing program and the resultant production trucked to a nearby oil tank battery. The Unit 1B section has now been completed for future production, whilst Units 1A and 3 will be suspended for potential future development and production.

The field development plan for Block 9 is now being reviewed given these results support investigating earlier and quicker production from this Amistad Formation.

Going forward, the rig will next be prepared for a move to the Alameda-1 well head, located on the same pad. A decision on whether to proceed with the plug and abandonment of that well is now being reassessed in light of the Alameda-2 results.

The next appraisal well, Alameda-3, will test the lower two geologically independent oil-bearing formations intercepted by Alameda-1 – designated Alameda and Marti, respectively

ABOUT THE BLOCK 9 APPRAISAL WELL PROGRAM

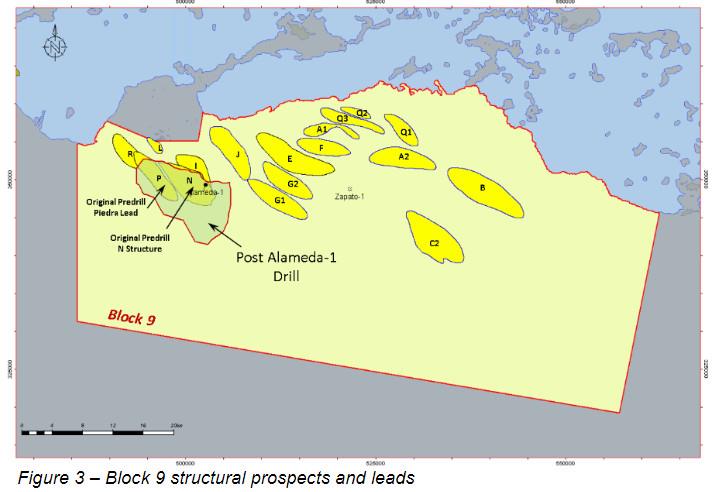

Block 9 PSC is a large onshore area of more than 2,300km 2 located on the north coast of Cuba in a proven hydrocarbon system and along trend with the multi-billion barrel Varadero oil field. Melbana’s technical team has identified 19 structural prospects and leads within Block 9 (see Figure 3).

Melbana completed an initial two well exploration program in 2022, the first of which (designated Alameda-1) encountered three geologically independent oil-bearing intervals, each with moveable oil accompanied by high pressure, that were subsequently independently estimated to contain oil in place of 5.0 billion barrels for a Prospective Resource of 267 million barrels (gross unrisked best estimate) *,1 - an 89% increase of the predrill prognosis.

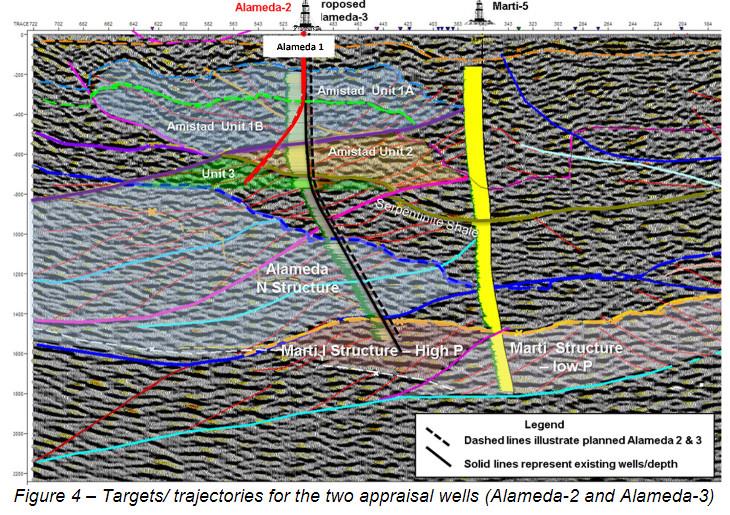

Melbana then designed a two well appraisal program to better understand the characteristics of these intervals and their production potential (see Figure 4). The first of these appraisal wells, designated Alameda-2, is testing the three oil bearing units of the shallowest interval called Amistad. Drilling of Alameda-2 commenced in June 2023.

Following the completion of Alameda-2, the second appraisal well (designated Alameda-3) will test the two deeper intervals called Alameda and Marti. The scope of these appraisal wells includes coring, wireline logging, flow testing and quality analysis.

Source: Melbana Energy