Highlights

- Independently assessed volumes of the Amistad structure in Block 9 (Melbana 30%) are 1.9 billion barrels of Oil in Place and 109 million barrels of Prospective Resource (unrisked gross best estimate).

- Mobilisation notices for drilling this first appraisal well in Block 9, designated Alameda-2, to be given in March 2023.

- Primary objective is to evaluate quality and performance of the productive oil zones in the Amistad (shallowest) reservoir encountered by Alameda-1 in the previous drilling program.

- Amistad structure exhibited strong oil shows over a gross interval of 1,426mMD (with updip potential), fluorescence in samples and elevated mud gas readings.

- Alameda-2 has a planned total depth of 1,960mMD (1,840mTVD). Its general objective is to allow oil to flow from the three productive units encountered previously in Amistad and to, specifically:

- evaluate the quality of the recovered oil;

- assess the production characteristics of these reservoirs;

- take cores to determine petrophysical properties; and

- increase reported net oil and gas pay from the current estimate of 48 metres by successfully logging all of the section, including~290 metres of gross pay excluded previously.

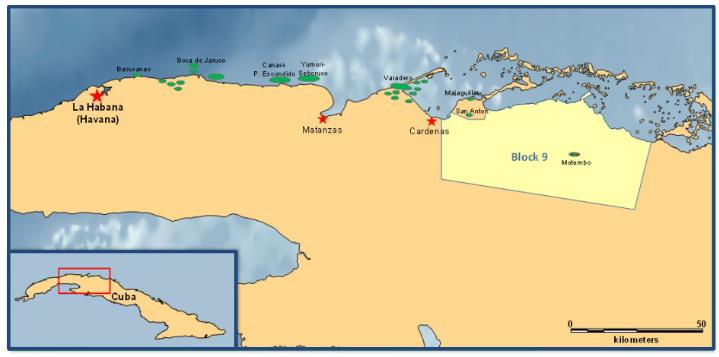

Melbana Energy has provided an update on preparations for its first appraisal well in Block 9 PSC (Melbana 30%).

Preparations for the drilling of the Alameda-2 well to appraise the Amistad reservoir are advanced. Mobilisation notices will be given to contractors in early March and drilling operations will commence following the removal of the Alameda-1 wellhead and plugging and abandonment of that well.

Target Formation

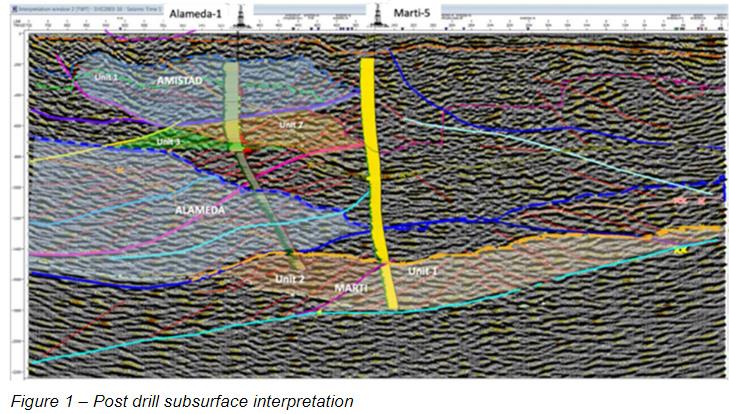

Alameda-1, the first of two exploration wells completed in Block 9 last year, targeted a large compressional structure compose of stacked sheets of limestone separated by thrust faults. Oil was encountered within three gross intervals identified as Amistad, Alameda and Marti structures (see Figure 1). The Alemada-2 well, the first of two appraisal wells planned for this year, will test the Amistad interval which has been subdivided into three units. Mapping of these units reveal that Alameda-1 intercepted them downdip at all levels, thereby suggesting there is considerable updip potential above the established oil-bearing zones with each unit extending over a large prospective area.

The top of the Amistad interval demonstrated strong oil shows over a gross interval of 1,426mMD commencing almost immediately below the surface casing shoe at 466mMD, entered about a week after drilling commenced. Numerous influxes of oil into the wellbore were recorded when flow checks were conducted whilst drilling this interval, in addition to fluorescence within samples and elevated mud gas readings in excess of 40%.

A significant (~290 metres) of this interval did not produce satisfactory logs due to poor hole conditions and therefore could not be factored into the estimates for the volume of oil that may be present. Some of this interval saw the strongest oil influx into the well bore experienced whilst drilling this interval.

Regardless, the interval that was satisfactorily logged allow for an estimate of 48 net metres of oil and gas pay across 11 zones totalling 415 metres of gross section. This was later independently assessed to contain 2.5 billion barrels of oil in place with a combined 88 million barrels of Prospective Resource (gross unrisked Best Estimate)(1).

The second appraisal well, Alameda-3, will be drilled later in the year and will test the deeper Alameda and Marti intervals.

Drilling Plan

Alameda-2 is to be drilled off the same drill pad as was used for Alameda-1. The design of Alameda-2 has been modified to incorporate the lessons learned from drilling Alameda-1. The slimmer hole design now being employed should maintain better hole integrity, thus improving the likelihood of being able to log the sections where this was not possible previously. If successful, it is hoped this additional potential oil pay might allow for an increase of the previous estimates for oil in place and Prospective Resource contained in this interval. Otherwise, the trajectory if Alameda-2 is the same as Alameda-1, other than modifying the

deviation to allow Unit 3 to be penetrated in an updip structural position.

The appraisal will include conducting flow tests in order to better understand the properties of the reservoir as well as take samples to ascertain the quality of the oil encountered therein. To aid in calibrating petrophysical properties and reservoir description, which will be valuable when planning further appraisal and production activities, three fully cored sections are planned within the thicker net pay zones identified whilst drilling Alameda-1.

If successful, allowance has been made to keep Alameda-2 as a future oil producer.

Civil Works

The access roads, camp and pad as were used for drilling Alameda-1 are to be used for drilling Alameda-2. Their physical conditions remain good, but Melbana’s civil contractors have completed any necessary remediation works and the site is now ready to accept mobilisation. Moreover, they have improved the Alameda pad in accordance with Melbana’s instructions to deliver certain operational efficiencies considered desirable given the experiences gained from the previous two well drilling campaign. The pad has also been expanded to accommodate tanks for storing the oil expected to be produced from flow testing and the creation of additional access corridors for the tanker fleet to transport the stored oil without interrupting drilling operations.

Permitting

All material permits for the commencement of drilling operations have been secured.

Contractors

Alameda-2 is to be drilled by the same contractors that drilled Melbana’s first two exploration wells in Block 9. This was considered optimum, given the considerable operational experience that has been gained and the enhancements effected to the rig spread for the conditions encountered subsurface. Maintenance and re-certification work for contractors’ equipment has been completed satisfactorily.

Melbana has also expanded its project management team in Cuba to ensure additional experienced engineering expertise is available for the management of the upcoming program, building on the experience of the existing team that now has good operating history in country. Additional HSE resources have also been engaged to allow for greater oversight of operations, community engagement and further minimisation of any environmental impact our operations may have on the local community.

Office renovations have also recently been completed to accommodate these additional personnel in the project management office in Varadero.

Materials and Inventory

The valuable experienced gained drilling the first two exploration wells in Cuba has been factored into the planning for this year’s appraisal wells. Sufficient materials are in inventory in country for the drilling of Alameda-2 and inventory not already in stores is well advanced and expected to be delivered to Cuba in advance of the projected start of drilling operations.

(1) See ASX announcement dated 14 March 2022

Source: Melbana Energy