Highlights

- Perforations ran successfully between 3272 and 3450mMD on Monday morning Cuba time, evidenced by immediate and significant pressure response at surface.

- Consistent with recent results from the deeper Marti reservoir, drill string fluids were unable to be recovered during flow testing.

- No uncontaminated oil samples were obtained; oil samples were recovered on reverse circulation of the DST string and have been sent for lab analysis.

- Given both the Marti and Alameda reservoirs have behaved similarly under appraisal when both previously showed strong oil shows, studies will focus on what has changed between the drilling of these two wells (given minimal offset).

- In parallel with analysis of these results, the priority remains to export the first shipment of Unit 1B oil from the Amistad structure this year.

Melbana Energy’s Executive Chairman, Andrew Purcell, commented: 'Both the Marti and Alameda reservoirs have previously shown the presence of freely moveable hydrocarbons that flowed to surface unassisted. That both reservoirs should now fail to do so when the appraisal well trajectory is minimally offset to the original exploration well means studies need to focus on the new data that has been acquired and the limited drilling parameters that have changed. We will incorporate local and international expert advice as to how to remedy such reservoir responses into the newly acquired data to help focus our studies.

Our immediate plan is to work on the steps required to export production from the Amistad reservoir this year and to develop more appraisal wells in the Amistad reservoir thereafter.'

Melbana Energy, a 30% interest holder in and Operator of Block 9 PSC onshore Cuba, has provided an operational update for the Alameda-3 appraisal well.

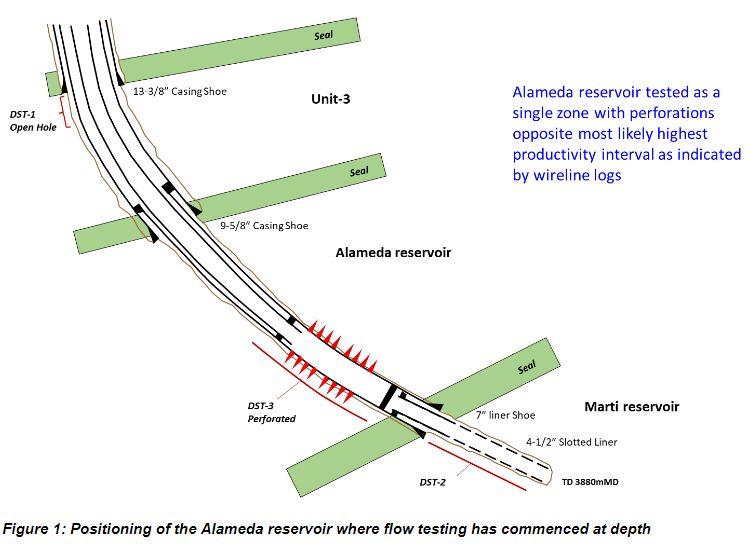

Flow testing of the Alameda reservoir commenced on Monday morning, Cuba time, with the successful perforation of the casing between 3272 and 3450mMD (see Figure 1).

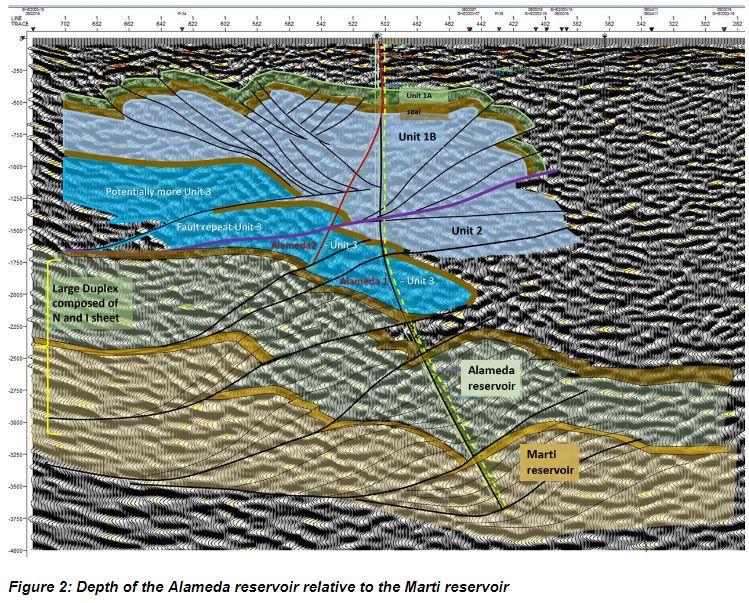

The objective of the testing was to determine oil quality and flow rates for the Alameda reservoir (located above the recently tested Marti reservoir, which is separated by effective seal rocks (see Figure 2) to gain a broader understanding of that reservoir’s production characteristics.

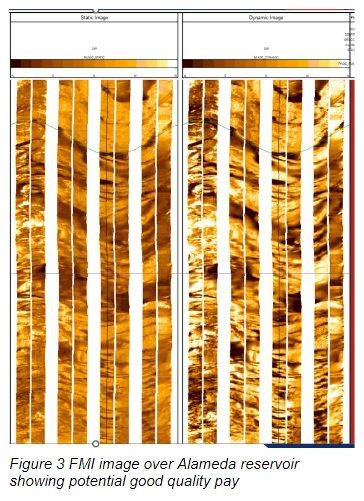

The reservoir was tested as a single zone in the lower section interpreted to contain the highest porosity and productivity interval, as indicated by conventional log analysis and FMI (see Figure 3).

Immediately upon firing the perforation guns, there was positive indication of pressure at surface, which confirmed the perforations had been successful. Pressure then quickly built to 3034 PSI.

Test gauges were opened on variable choke sizes only 14% of load fluid was recovered. The well was then shut in to build pressure, however minimal returns were achieved at surface after reopening.

No uncontaminated oil samples were obtained; oil samples were recovered on reverse circulation of the DST string and have been sent for lab analysis.

The inability of the well to flow does not fit with previous observations and expectations, given wireline and FMI over this interval indicate substantial good quality conventional (i.e. not fracture dependent) pay in addition to the highly fractured pay (see Figure 3).

It is important to note that this result is consistent with the similar recent failure of the deeper Marti reservoir to flow hydrocarbons to surface, despite both reservoirs demonstrating an ability to do so in the Alameda-1 exploration well.

At this stage the Company is unsure whether this is due to formation damage related to the formation of an emulsion, i.e. an oil-drill mud reaction, or a rock-drill mud reaction.

The forward plan is now to suspend the well, after pulling the pressure gauges and DST string, gather all available data, and build an optimum remediation plan based upon all new data, previous drilling experience, and international and local expert knowledge.

The results do not impact initial field development plan based on Amistad Unit 1B which is on track to deliver the first export of oil from Block 9 this year. Melbana will provide regular updates on the development program through to first oil exports later this year.

Source: Melbana Energy