88 Energy has released its financial results for the half-year ending 30 June 2025.

A copy of the Company's Half-Year Financial Report, extracts from which are set out below, has been lodged on the ASX and is also available on the Company's website at www.88energy.com .

OPERATING AND FINANCIAL REVIEW

During the period, the Group continued its principal exploration and appraisal activities in Alaska, complemented by non-operated working interest in onshore Texas Permian Basin production assets. The Group also has 20% non-operated working interest in Petroleum Exploration Licence (PEL 93), Onshore Namibia.

Project Phoenix

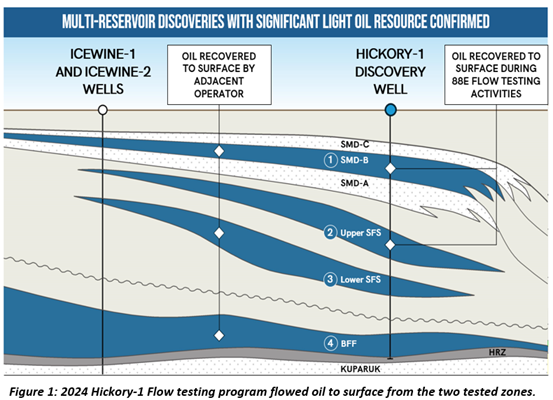

Project Phoenix is an advanced conventional oil project located on the North Slope of Alaska. It is targetIing future potential production from multiple reservoirs identified during the drilling and flow testing of Hickory-1 in 2023/2024, including the Shelf Margin Deltaic (SMD), Slope Fan System (SFS), and Basin Floor Fan (BFF) formations. The Hickory-1 discovery well, drilled in 2023, confirmed the presence of light oil in 2024 from the two-tested target intervals (SMD-B and Upper SFS) and served as the foundation for a potential horizontal well production test.

HICKORY-1 DISCOVERY WELL

Successful outcomes from the Hickory-1 flow test delivered a platform for monetisation of Project Phoenix, justifying further advancement, with key benefits including:

- Strategic location to Dalton Highway, Prudhoe Bay (Deadhorse) services and Trans-Alaskan Pipeline (TAPS)

- Total 2C Contingent Resources of 239MMBOE net to 88E[1]

- Potential capital-light modular Early Production System

- Production from horizontal wells typically produce 6-12 times higher flow rates than vertical wells; and

- An ability to produce concurrently from multiple reservoirs in a single development scenario.

FARM OUT AGREEMENT

In February 2025, 88 Energy entered into a Farmout Participation Agreement (PA) with Burgundy Xploration LLC (Burgundy) in relation to Project Phoenix. Under the agreement, 88 Energy's wholly owned subsidiary, Accumulate Energy Alaska, Inc. (Accumulate), will be fully carried for all costs associated with the planned horizontal well program, including an extended flow test scheduled for mid-2026.

Transaction highlights:

- Burgundy to fully fund up to US$39 million (approx. A$60 million) of Project Phoenix's total gross future work program costs in exchange for up to an additional 50% Working Interest (WI) in Project Phoenix from 88 Energy.

- Provides a clear funding avenue to advance Project Phoenix towards a final development decision via a two-phase farm-in arrangement:

- Phase 1: Burgundy to fund US$29 million (approx. A$45 million) for CY25/26 work program, including drilling of a horizontal well and production testing scheduled for mid-2026 (88E fully carried, Accumulate WI post Phase 1 farmout 35%)

- Phase 2: Upon Phase 1 Success; Burgundy to fund up to US$10 million (approx. A$15 million) for an additional well or other CAPEX program (88E carry up to US$7.5 million, based on the current 75%, with Accumulate WI post Phase 2 farmout to 25%).

88 Energy is progressing collaborative work with Burgundy to advance planning and permitting for the horizontal test well and flowback operation scheduled for mid-CY26 and Burgundy is advancing its funding strategy to finance Phase 1 of the farmout. Burgundy continued to reaffirm its project commitment by paying its outstanding 2024 cash calls in Q1 2025 and 100% of lease payments in 2025, which form part of its carried expenditure under the farm-out agreement.

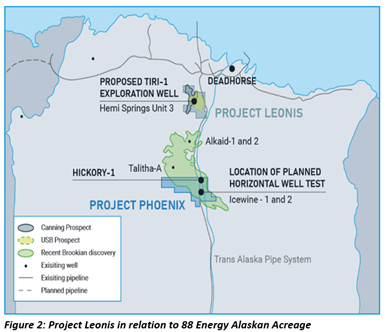

Project Leonis

Multi-reservoir opportunity further enhanced with four new lease blocks awarded in July 2025 and the Canning Formation added as a new reservoir target in January 2025.

Canning Formation (Canning):

- Newly identified Canning Formation announced in January 2025.

- Identifed following reprocessed and interpreted Storms 3D seismic data, and a quantitative interpretation study (rock physics, AVO and seismic inversion).

- Prospective Resource target of 283 MMbbls of oil (net mean); unrisked net 3U (high) 469 MMbbls, 2U (best) 259 MMbbls, and 1U (low) 136 MMbbls[2],[3]

Upper Schrader Bluff (USB):

- Company announced the USB as its maiden internal prospective resource in June 2024, identified follwing review of 3D and 2D seismic data, well logs from Hemi-Springs Unit-3 and Hailstorm-1, along with extensive petrophysical analysis and mapping.

- The USB formation is the same proven producing zone as found in nearby Polaris, Orion and West Sak oil fields to the north-west

- Prospective Resource target of 381 MMbbls of oil (net mean); unrisked net 3U (high) 671 MMbbls, 2U (best) 338 MMbbls, and 1U (low) 167 MMbbls[4],[5]

Planning and permitting for the Tiri-1 exploration well commenced in 2025, with key Alaska North Slope vendors submitting operational proposals at the end of June 2025 refining the authorisation for expenditure (AFE). The optimal Tiri-1 well location is designed to intersect the Canning and USB reservoirs and to test deeper potential upside. 88 Energy's 100% working interest provides a strong position from which to secure a large, proportionate carry upon completion of the active farm-out process, ahead of any drilling event. Third party assessment of the opportunity was ongoing at half-year. Drilling the Tiri-1 well is subject to the completion of a farm-out, with the Company not intending to conduct a capital raising to finance the well.

In Q2, 88E acquired the low-cost Great Bear 3D survey, completed in 2014, which extends the Company's regional 3D seismic database. The dataset overlaps the Storms 3D and Franklin Bluffs 3D datasets, providing an enhanced regional seismic framework from which to assess new opportunities. The new 3D dataset also overlaps the existing Leonis acreage position.

Namibia PEL 93

In November 2023, 88 Energy, via its wholly-owned Namibian subsidiary, executed a three-stage farm-in agreement (FOA) for up to a 45% non-operated working interest in the onshore Petroleum Exploration Licence (PEL 93) covering 18,500km2 of underexplored acreage within the Owambo Basin in Namibia.

In July 2025, 88 Energy announced a 12-month extension to the First Renewal Exploration Period for PEL 93, granted by the Namibian Ministry of Mines and Energy. In conjunction with the license extension, 88 Energy and Monitor executed a variation to the FOA. The amendment introduced a Stage 1A Work Program, comprising:

- A high-resolution airborne gravity, magnetic, and radiometric survey;

- Preparation of a certified prospective resource report;

- Identification of potential drilling locations; and

- Creation of an Authority for Expenditure for the proposed well.

Stage 1A is to be jointly funded on a 50:50 basis by 88 Energy and Monitor, subject to a cost threshold of US$1 million, unless otherwise agreed.

Project Longhorn

In August 2025, 88 Energy announced it had entered into a binding Securities Purchase Agreement (SPA) with Lonestar I, LLC (Lonestar) for the sale of its 75 percent non-operated working interest in Project Longhorn, a package of producing oil and gas assets located in the Permian Basin, Texas, USA, where Lonestar is the project Operator.

Execution of the SPA followed a strategic portfolio review conducted in the first quarter of 2025, during which the Board of 88 Energy determined that Project Longhorn's operating asset base no longer aligned with the Company's longer-term strategy. That strategy is centered on pursuing high-impact exploration opportunities, primarily in Alaska. The decision was shaped by the projected capital intensity (US$2M gross per well over ~12 wells), required to support Project Longhorn's future development plans, which would be necessary to maintain production and cash flow. It was also driven by the Company's broader objective to streamline its portfolio and redeploy capital into assets with greater potential for value creation.

Key terms of the transaction include:

- Total Consideration: US$3.25 million

- Effective Date: 1 July 2025

- Completion Adjustments: Subject to customary reconciliation as at 30 June 2025, including adjustment for cash, receivables, crude oil inventory, and liabilities.

A competitive process was undertaken for the sale. Initially, 88 Energy entered into non-binding terms under a Memorandum of Understanding with a third party. Subsequently, Lonestar exercised its matching rights and, upon completion, will hold all of the assets.

Click here for full announcement

Source: 88 Energy