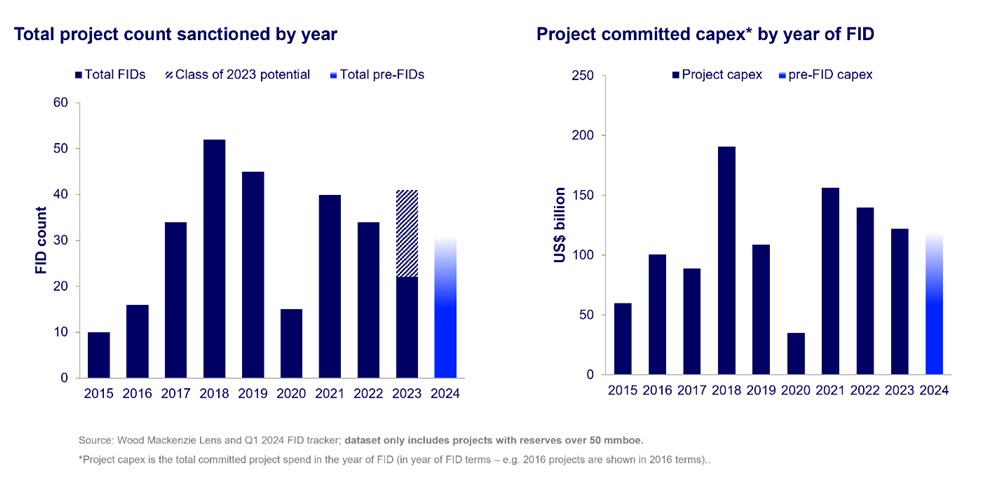

Up to 30 upstream projects larger than 50 million of barrels of oil equivalent (boe) could reach FID in 2024, an increase from 22 in 2023, according to a new report from Wood Mackenzie.

The Wood Mackenzie report 'Class of 2024: benchmarking this year’s upstream FIDs' states that project activity will increase this year, with a total of $US125 billion in investment and the potential for 14 boe up for sanction.

'With many projects delayed or postponed, we expect operators to commit to more projects in 2024 than last year,' said Ross McGavin, principal analyst at Wood Mackenzie. 'National Oil Companies (NOCs) in the Middle East will control the most projects, but the Majors will be busy as well, particularly as they prioritise advantaged deepwater resources.'

According to Wood Mackenzie’s Lens Upstream, as the number of projects rises in 2024, project breakevens are projected to fall, with an associated bounce back in returns (IRRs) which dipped in 2023. The class of 2024 projects require an average of US$47/bbl to generate a 15% IRR, slightly below the class of 2023’s US$49/bbl. The weighted average IRR for the class of 2024 is 23%, helped by a higher liquids weighting of 57% in 2024, compared to 2023’s 46% and the five-year average of 51%.

'The higher liquids weighting and higher long-term price assumptions will improve IRRs for this year’s projects,' said McGavin. 'Most payback periods are less than eight years from FID, as operators focus on rapid execution, lower unproductive capital, and higher returns.'

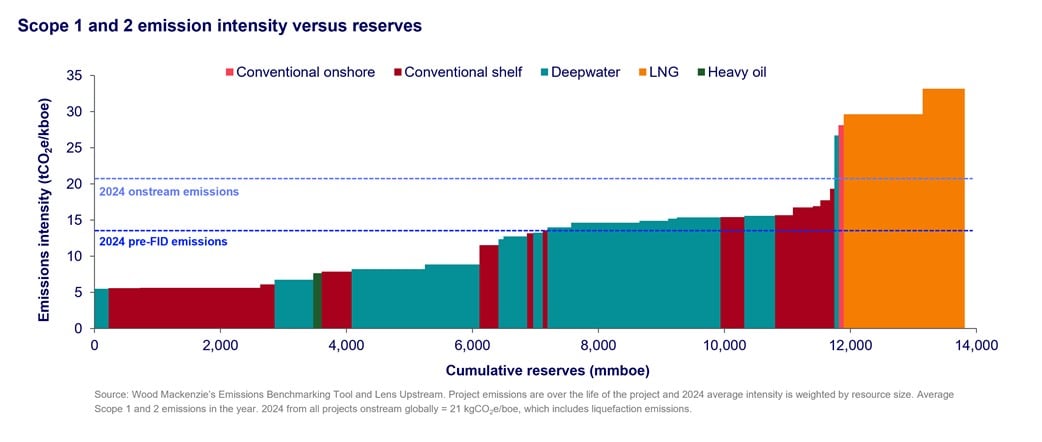

Emissions intensity below global onstream average

With a significant emphasis on deepwater projects and advantaged barrels, the average emissions intensity for the FID class of 2024 is 13.6 kgCO2e/boe, well below the global upstream average of 21 kgCO2e/boe (including liquefaction emissions), according to Wood Mackenzie’s Emissions Benchmarking tool.

'New projects are a lever to meet emission reduction goals, especially those focused on deepwater projects that continue to deliver on low emissions intensity and economic returns,' said McGavin.

Source: Wood Mackenzie