BP Group Results First Quarter 2025

Highlights

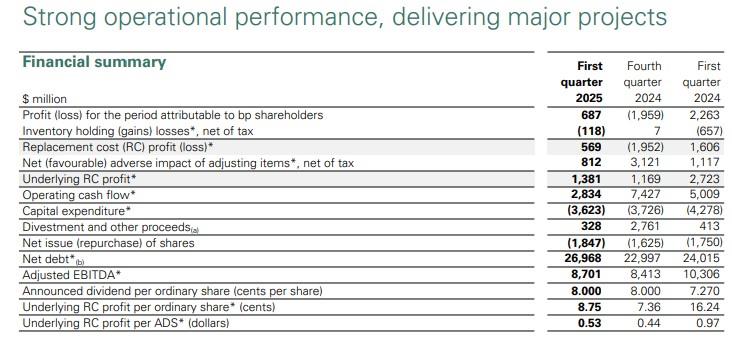

• Resilient financial performance: 1Q25 underlying RC profit $1.4bn; dividend per ordinary share of 8 cents; $0.75bn share buyback.

• Delivering strong operations: 1Q25 upstream plant reliability* 95.4%; 1Q25 refining availability* 96.2%.

• Growing upstream: Safely started up three major projects*; six exploration discoveries.

• Executing our strategy at pace: Good progress on our divestment programme, including the strategic review of Castrol, and the intentions to sell mobility & convenience businesses in Austria and the Netherlands and the Gelsenkirchen refinery.

Murray Auchincloss, Chief executive officer, said:

'In February, we announced a fundamental reset of our strategy - to grow the upstream, focus the downstream and invest with discipline in the transition - and we have already made significant progress. So far this year we have started up three major projects, made six exploration discoveries and have progressed our divestment programme - all while delivering strong operational performance, with over 95% upstream plant reliability supporting the best operating efficiency* on record, and over 96% refining availability. We continue to monitor market volatility and changes and remain focused on moving at pace. I’m confident that our plans to strengthen the balance sheet, reduce costs, and improve cash flow and returns will grow long-term shareholder value and strengthen the resilience of bp'.

Click here for full announcement

Source: bp