BP has announced fourth quarter and full year highlights.

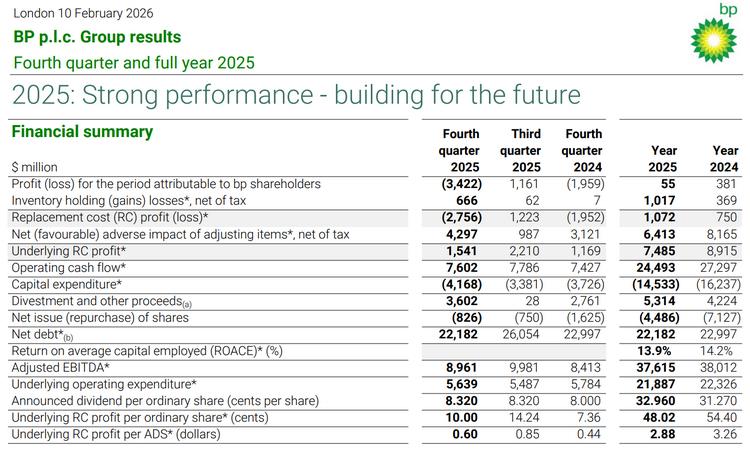

• Strong underlying financial performance: 2025 underlying RC profit $7.5bn delivered against a weaker oil price environment. Operating cash flow $24.5bn, including $2.9bn adjusted working capital* build(c).

• Strong operations and progress across upstream* and downstream*: Record full year upstream plant reliability* 96.1%; 2025 underlying production* held broadly flat vs. 2024; 7 major projects* started up in 2025; reserves replacement ratio* increased to 90%; record full year refining availability* 96.3%; customers delivered its highest underlying earnings since 2019 with all businesses growing year on year.

• Progress on our strategic targets: Expected proceeds from completed and announced divestments now above $11bn; reached an agreement to sell a 65% shareholding in Castrol - resulting in expected net proceeds of approximately $6bn; closed the sale of Netherlands retail, US onshore wind, and non-controlling interests in US midstream assets; increased group structural cost reduction* target to $5.5-6.5 billion by end 2027.

• Positioning the company for the long term: The board has decided to suspend the share buyback and fully allocate excess cash* to accelerate strengthening of our balance sheet. This creates a strong platform to invest with discipline into our distinctive deep hopper of oil & gas opportunities.

' 2025 was a year of strong underlying financial results, strong operational performance, and meaningful strategic progress. We have made progress against our four primary targets - growing cash flow and returns, reducing costs, and strengthening the balance sheet - but know there is more work to be done, and we are clear on the urgency to deliver.

With a continued emphasis on capital discipline and returns, we are reducing capital expenditure for 2026 to the lower end of the guidance range, while continuing to drive down our cost base. We are also taking decisive action to high-grade our portfolio and strengthen our company, including the execution of our $20bn disposal programme and the decision to suspend the share buyback and fully allocate excess cash to our balance sheet. These decisions position us to progress long term value growth through the distinctive opportunity set we are creating in our upstream business, including the Bumerangue discovery in Brazil, where our initial estimates indicate around 8 billion barrels of liquids in place.

We look forward to Meg O'Neill joining as CEO in April as we accelerate our progress to build a simpler, stronger and more valuable bp for the future. We are in action and we can and will do better for our shareholders.' Carol Howle Interim chief executive officer.

(a) Divestment proceeds are disposal proceeds as per the condensed group cash flow statement. See page 3 for more information on other proceeds.

(b) See Note 9 for more information.

(c) Change in working capital adjusted for inventory holding losses, fair value accounting effects relating to subsidiaries and other adjusting items

Source: BP