bp has announced third quarter 2025 results

Highlights

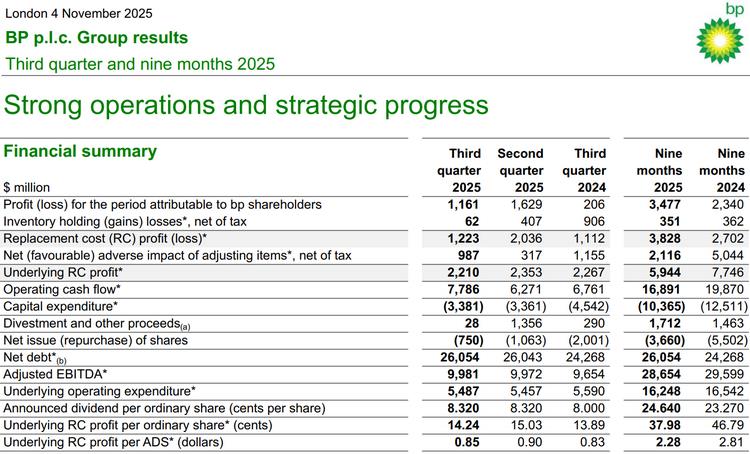

- Good earnings and cash generation: 3Q25 operating cash flow $7.8bn; stronger underlying earnings across the operating segments supporting 3Q25 underlying RC profit $2.2bn.

- Significant progress in upstream*: 3Q25 upstream plant reliability* 96.8% supporting underlying production* +3% quarter-onquarter; six major projects* started up in 2025, FID taken on Tiber-Guadalupe in the Gulf of America; 12 exploration discoveries year-to-date.

- Improved reliability and profitability in downstream*: 3Q25 refining availability* increased to 96.6%; around half of Customers & products' share of the group's 2027 structural cost reduction* target now delivered.

- Continued progress on divestments; disciplined capital allocation: Now expect divestment and other proceeds received in 2025 to be above $4 billion. Full year capital expenditure guidance continues to be around $14.5bn with organic capital expenditure* remaining on track to be below $14bn; net debt broadly flat versus prior quarter despite redemption of $1.2bn hybrid bonds.

'We’ve delivered another quarter of good performance across the business with operations continuing to run well. All six of the major oil and gas projects planned for 2025 are online, including four ahead of schedule. We’ve sanctioned our seventh operated production hub in the Gulf of America and have had further exploration success. We delivered record 3Q underlying earnings in customers and refining captured a better margin environment. Meanwhile, we expect full year divestment proceeds to be higher - underpinned by around $5 billion of completed or announced disposal agreements.

We continue to make good progress to cut costs, strengthen our balance sheet and increase cash flow and returns. We are looking to accelerate delivery of our plans, including undertaking a thorough review of our portfolio to drive simplification and targeting further improvements in cost performance and efficiency. There is much more to do but we are moving at pace, and demonstrating that bp can and will do better for our investors.' Murray Auchincloss Chief executive officer

Highlights

3Q25 underlying replacement cost (RC) profit* $2.2 billion

- Underlying RC profit for the quarter of $2.2 billion, compared with $2.4 billion for the previous quarter, reflects higher profitability in the operating segments offset by a higher underlying effective tax rate (ETR)* in the quarter of 39% which includes changes in the geographical mix of profits. Higher quarter-on-quarter underlying RC profit before interest and tax was driven by significantly lower level of refinery turnaround activity, stronger realized refining margins, and higher production, partly offset by a weak oil trading result, seasonal effects of environmental compliance costs, lower realizations and higher other businesses & corporate underlying charge.

- Reported profit for the quarter was $1.2 billion, compared with $1.6 billion for the second quarter 2025. The reported result for the third quarter is adjusted for inventory holding losses* of $0.1 billion (net of tax) and a net adverse impact of adjusting items* of $1.0 billion (net of tax) to derive the underlying RC profit. Adjusting items include net impairments and losses on sale of businesses and fixed assets of $0.8 billion (see page 25 for more information on adjusting items).

Segment results

- Gas & low carbon energy: The RC profit before interest and tax for the third quarter 2025 was $1.1 billion, compared with $1.0 billion for the previous quarter. After adjusting RC profit before interest and tax for a net adverse impact of adjusting items of $0.4 billion, the underlying RC profit before interest and tax* for the third quarter was $1.5 billion, compared with $1.5 billion in the second quarter 2025. The third quarter underlying result before interest and tax reflects a lower depreciation, depletion and amortization charge and higher production, partly offset by lower realizations. The gas marketing and trading result was average.

- Oil production & operations: The RC profit before interest and tax for the third quarter 2025 was $2.1 billion, compared with $1.9 billion for the previous quarter. After adjusting RC profit before interest and tax for a net adverse impact of adjusting items of $0.2 billion, the underlying RC profit before interest and tax for the third quarter was $2.3 billion, compared with $2.3 billion in the second quarter 2025. The third quarter underlying result before interest and tax reflects higher production, primarily in bpx energy, partly offset by higher exploration write-offs.

- Customers & products: The RC profit before interest and tax for the third quarter 2025 was $1.6 billion, compared with $1.0 billion for the previous quarter. After adjusting RC profit before interest and tax for a net adverse impact of adjusting items of $0.1 billion, the underlying RC profit before interest and tax (underlying result) for the third quarter was $1.7 billion, compared with $1.5 billion in the second quarter 2025. The customers third quarter underlying result was higher by $0.1 billion, reflecting seasonally higher volumes, stronger integrated performance across fuels and midstream, and lower underlying operating expenditure*. The products third quarter underlying result was higher by $0.1 billion, reflecting stronger realized refining margins and a significantly lower level of turnaround activity, partly offset by seasonal effects of environmental compliance costs and the impact of unplanned Whiting outage due to exceptional weather conditions. The oil trading contribution was weak.

Operating cash flow* $7.8 billion and net debt* $26.1 billion

- Operating cash flow of $7.8 billion was around $1.5 billion higher than the previous quarter, reflecting a $0.9 billion working capital* release (after adjusting inventory holding losses, fair value accounting effects and other adjusting items) this quarter compared to a $1.4 billion build in the previous quarter, partly offset by $0.9 billion higher income taxes paid. Net debt was broadly flat at $26.1 billion in the third quarter as higher operating cash flow was partly offset by the redemption of $1.2 billion perpetual hybrid bonds.

Financial frame

- bp is committed to maintaining a strong balance sheet and maintaining 'A' grade credit range through the cycle. We have a target of $14-18 billion of net debt by the end of 2027(a).

- Our policy is to maintain a resilient dividend. Subject to board approval, we expect an increase in the dividend per ordinary share of at least 4% per year(b). For the third quarter, bp has announced a dividend per ordinary share of 8.320 cents.

- Share buybacks are a mechanism to return excess cash. When added to the resilient dividend, we expect total shareholder distributions of 30-40% of operating cash flow, over time. Related to the third quarter results, bp intends to execute a $0.75 billion share buyback prior to reporting the fourth quarter results. The $0.75 billion share buyback programme announced with the second quarter results was completed on 31 October 2025.

- bp will continue to invest with discipline, driven by value and focused on delivering returns. We continue to expect capital expenditure to be around $14.5 billion in 2025. The capital frame of around $13-15 billion for 2026 and 2027 remains unchanged.

(a) Potential proceeds from any transactions related to the Castrol strategic review and announcement to bring a strategic partner into Lightsource bp will be allocated to reduce net debt.

(b) Subject to board discretion each quarter taking into account factors including current forecasts, the cumulative level of and outlook for cash flow, share count reduction from buybacks and maintaining ‘A’ range credit metrics.

Click here for full announcement

Source: bp