- Final dividend of 0.5 cents per share declared, returning a further $3.5 million to shareholders.

- Total of 1.5 cents per share ($10.5 million) in dividends has been declared for FY2025, delivering a 14% yield to shareholders.

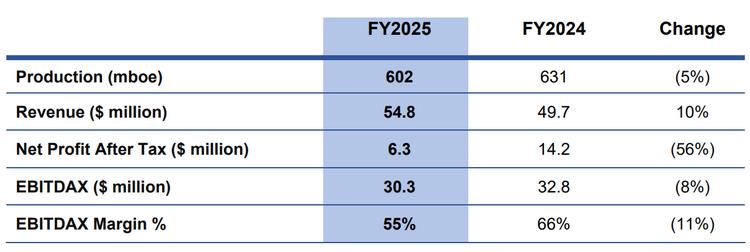

- $54.8 million revenue reported, a 10% increase from the prior year.

- Annual production reached 602 mboe with EBITDAX of $30.3 million delivered.

- Cue generated $24 million net cash from operations, ending FY2025 with a $10.8 million cash balance and no debt.

- 13 production wells completed during the year in Mahato and Mereenie. After year end, two additional Mahato oil wells were drilled delivering excellent results, with an extra 2,000 barrels of oil per day.

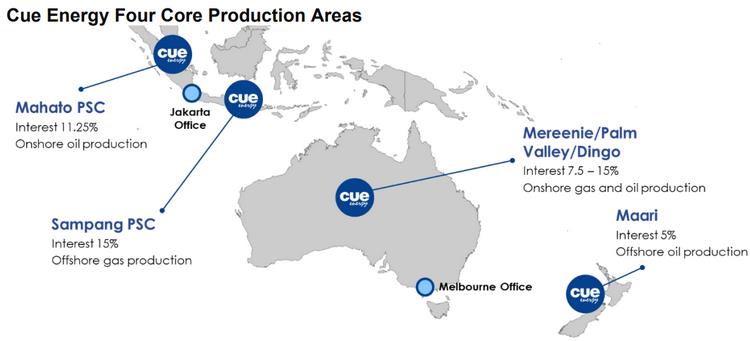

- Future growth underpinned by positive progress across project areas with Paus Biru advancing towards FID and ongoing development at Mahato.

Cue Energy Resources has released its Full Year 2025 (FY2025) results, reporting a 10% increase in revenue from ordinary activities to $54.8 million and EBITDAX(1) of $30.3 million, reflecting continued strong underlying performance. A final dividend of 0.5 cent per share has been declared, bringing the total dividend for FY2025 to 1.5 cents per share.

Cue CEO Matthew Boyall commented on the results, 'Cue delivered strong revenue, navigating a year of global uncertainties and oil price volatility, a testament to the strength of our diversified portfolio.

The FY2025 final dividend marks the fourth consecutive dividend declared under our dividend policy, with a total shareholder return of $31.5 million over two years. The reduction in the final dividend to half a cent per share reflects Cue’s pending investment and capital management decisions while rewarding shareholders with a very attractive 14% yield over FY20252.

We saw significant development activities during the year, with eleven oil production wells completed in the Mahato PSC and two gas wells at Mereenie entering production.

Capital expenditure on accelerated Mahato development impacted profit and cashflow in the short term but is expected to support future production and returns.

Consistent operational performance across our portfolio resulted in $24 million in net operating cashflow, demonstrating the strong cash-generating capabilities of Cue’s assets.

Our total production from all assets has remained relatively stable at 602 mboe with increased production from Mahato and Mereenie offsetting field declines at Sampang.

Development activity is expected to continue with progress being made towards Paus Biru FID, where we have the opportunity to increase our participating interest by 10% to 25% at the expiry of the current PSC term, and in Mahato PSC, where the focus is expected to shift to development of the Telisa reservoir.'

Final Dividend Declared

The Cue Board has declared a final dividend of $0.005 (0.5 cents) per ordinary share, equivalent to approximately $3.5 million. This dividend has been declared as Conduit Foreign Income and is unfranked

Including the $7 million returned to shareholders in March 2025, Cue has declared $10.5 million in returns to shareholders for FY2025, with a total of $31.5m cash return over the past two years.

The record date for the dividend is 11 September 2025, with payment date scheduled for 25 September 2025. Shareholders are encouraged to ensure their details are updated with Computershare, the Company’s registry, to facilitate the dividend payment.

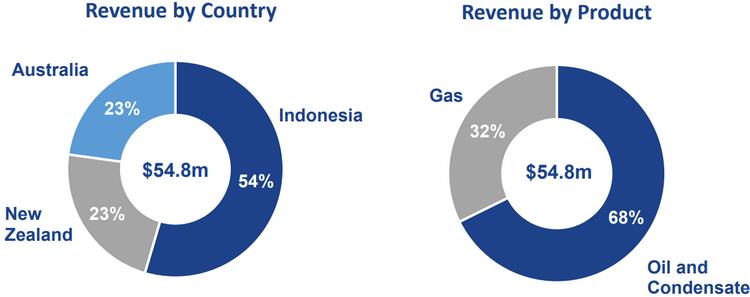

The PB oilfield in the Mahato PSC generated $23.5 million in revenue for FY2025, a 19% increase over FY2024. Maari revenue increased by 23% to $12.4 million, supported by the sale of an additional cargo. The onshore Australia assets (Mereenie, Palm Valley and Dingo) contributed to a combined $12.5 million, with Mereenie gas production increasing 15% increase year-on-year driven by two new development wells.

Oil and condensate volumes continue to achieve Brent-related pricing, representing 68% of total revenue in FY2025. Gas sales, on fixed-price contracts in Australia and Indonesia, continued to perform well in strong domestic markets.

The reduction in profit was primarily driven by production cost increases of $9.9 million. Higher operating costs at Mahato and Mereenie, due to increased field activity, represented approximately half of the production costs increase, with the remainder due to Maari inventory movement and higher amortisation at Maari and Mahato. Despite this, EBITDAX remained solid, reflecting the underlying strength of the portfolio.

Outlook for FY2026

In FY2026, Cue will continue to focus on growing production and reserves and enhancing the performance of its existing assets.

At the Mahato PSC, the joint venture will shift its development focus to the Telisa reservoir. Growth is expected to come from new drilling and recompletions targeting this reservoir. Additionally, an exploration well is planned during the year. The final two wells in the completed OPL 2 development campaign were drilled after the end of FY2025 and delivered strong results, achieving a combined production rate of 2,000 bopd.

Maari production continues to be sustained at over 5,500 bopd. Optimisation activities are ongoing to maximise output and efficiency from the field. A decision from the New Zealand Government regarding the joint venture’s application for a 10-year permit extension is expected in FY2026.

Onshore Australia, Cue and its joint venture partners at the Mereenie and Palm Valley fields are assessing the potential for additional drilling and considering a seismic survey to improve the understanding of the Mereenie structure. These activities aim to guide future development strategies and support long-term production and remain subject to joint venture approvals.

At Sampang, the installation of a compressor at the Grati gas plant is underway and scheduled for completion in the second quarter of FY2026. This infrastructure will reduce wellhead pressure and enable improved gas recovery from the Oyong and Wortel fields.

Discussions are continuing between the Operator, Medco Energi Sampang Pty Ltd (Medco), and the Indonesian Government regarding fiscal incentives for the Paus Biru development and the proposed extension of the Sampang PSC, which currently expires in December 2027.

Joint Venture partner Singapore Petroleum Sampang Ltd (SP Sampang) has notified Medco and Cue that it will not continue as a participant in the PSC for any renewal period beyond December 2027, including participation the Paus Biru development. Under the joint operating agreement, at the expiry of the current PSC term, SP Sampang’s participating interest in the current PSC will be redistributed among Medco and Cue, which could result in an additional 10% participating interest to Cue.

The proposed development plan for Paus Biru includes drilling a single gas well, installing a wellhead platform, and constructing a 27-kilometre subsea pipeline to connect the new well to existing infrastructure at the Oyong field. Subject to final approvals, first gas production from Paus Biru is expected to commence in 2027, with an anticipated production rate of 20 to 25 million cubic feet per day (mmcfd).

Assessment of new ventures opportunities will continue as part of Cue’s strategy to invest in areas that we know.

Source: Cue Energy