EIA expects the price of crude oil to fall to below $60 per barrel by the end of the year and average near $50 per barrel through 2026

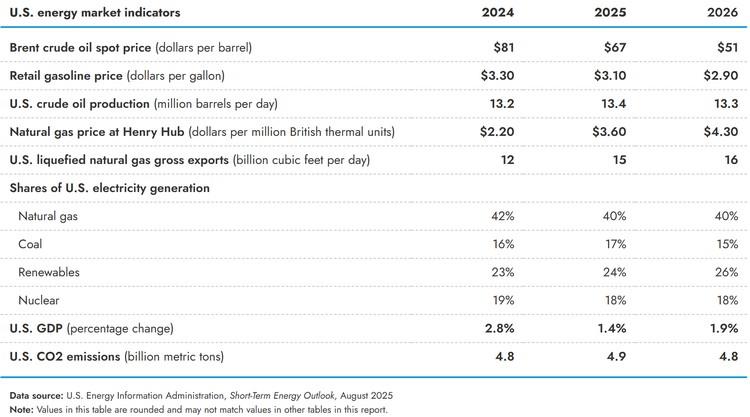

The U.S. Energy Information Administration (EIA) expects a significant decline in the price of oil as growth in the global supply of oil vastly surpasses growth in demand for petroleum products. In its August Short-Term Energy Outlook (STEO), EIA expects the Brent crude oil spot price to average less than $60 per barrel in the fourth quarter of 2025 - the first quarter with average prices that low since 2020.

OPEC+ announced last week that it will unwind its oil production cuts by September 2025, which is a year ahead of its previous schedule. For the first time since EIA began publishing an OPEC+ production forecast in 2023, EIA expects most global oil production growth to come from OPEC+ countries. EIA forecasts the supply growth will outpace demand, leading to quickly growing inventories.

'There’s a lot of uncertainty in the petroleum market. In the past, we have seen significant drops in oil price when inventories grow as quickly as we are expecting in the coming months,' said EIA Acting Administrator Steve Nalley.

EIA expects lower oil prices to lead to lower U.S. retail prices for gasoline and diesel and to pull domestic oil production down from the record highs in 2025.

Other highlights from the August STEO include:

- Global oil prices: EIA expects the Brent crude oil price to decline from more than $70 per barrel in July to average about $58 per barrel in the fourth quarter of 2025. Crude oil averages just above $50 per barrel in 2026 in EIA’s forecast.

- U.S. crude oil production: EIA expects U.S. crude oil production to average an all-time high, near 13.6 million barrels per day, in December 2025, driven by continued increases in domestic well productivity. By 2026, declining oil prices lead EIA to expect U.S. producers will pull back on drilling and well completion activity—a trend that has continued through most of 2025. EIA forecasts U.S. crude oil production will average 13.3 million barrels per day in 2026.

- U.S. retail gasoline and diesel prices: EIA expects the declining oil prices to contribute to significantly lower prices for gasoline and on-highway diesel in 2026. EIA expects retail gasoline to average about $2.90 per gallon and on-highway diesel to average less than $3.50 per gallon in 2026. Both of those average price points are about 20 cents per gallon lower than in 2025.

- Uncertainties: All short-term forecasts are uncertain, but EIA’s petroleum forecasts are subject to heightened uncertainty related to supply-related risks. A break in the Israel-Iran ceasefire and elevated tensions or additional sanctions related to the Russia-Ukraine conflict could affect supply and could offset the supply growth from non-OPEC countries. The evolution of ongoing trade negotiations between the United States and its trading partners could affect economic and oil demand growth, which would affect oil prices. Lastly, the potential for OPEC+ to revisit production plans given the expectations of significant oversupply beginning later this year could affect future production and limit the downward pressure on oil prices.

- Natural gas prices: EIA continues to expect increases in U.S. natural gas prices as production remains relatively flat and exports of liquefied natural gas increase. EIA expects the Henry Hub natural gas spot price will rise from an average $3.20 per million British thermal units (MMBtu) in July to almost $3.60 per MMBtu in the second half of 2025 and $4.30 per MMBtu in 2026.

- Electricity consumption: EIA expects greater than 2% growth in electricity demand in both 2025 and 2026, driven primarily by the commercial and industrial sectors. EIA forecasts electricity sales to the commercial sector to rise by 3.1% in 2025 and 4.9% in 2026, while electricity sales to industrial consumers are forecast to rise by 1.8% in 2025 and 3.0% in 2026.

- Coal production: EIA expects coal production to reach 520 million short tons (MMst) in 2025, about 2% higher than last year. The United States produced more electricity from coal this year because coal became a more economical source of power generation relative to natural gas. EIA forecasts that production will fall to 491 MMst in 2026 with more coal plants scheduled to retire and remaining coal plants holding large coal stockpiles built up in 2025.

- Trade policy assumptions: The U.S. macroeconomic outlook EIA used in STEO is based on S&P Global’s macroeconomic model. S&P Global’s most recent model reflects the tariffs announced in April and includes the 90-day temporary suspension of tariffs granted to most countries. S&P Global forecasts reduced tariffs on imports from China compared with last month, but the model assumes tariffs on imports from other countries remain at 10% after the 90-day pause expired in July.

The full August 2025 Short-Term Energy Outlook is available on the EIA website.

Source: EIA