Energean has announced its half-year results for the six months ended 30 June 2025.

Mathios Rigas, Chief Executive Officer of Energean, commented:

'Our business has remained resilient, despite the external geopolitical and market pressures, underpinned by disciplined capital management and cost control, a clear focus on long-term value creation and delivery of operational excellence; in August alone Group production was 178 kboed, showcasing strong summer demand for our gas in Israel and strong performance of the Energean Power FPSO. Despite the temporary suspension of operations in Israel for two weeks during the peak summer months, as ordered by the Ministry due to geopolitical factors, net profit increased during the period and we are therefore pleased to declare our regular quarterly dividend today.

'So far this year, we have: secured over $4 billion in new, long-term gas contracts that brings the total value of contracted gas to around $20 billion for the next 20 years; ensured that our Katlan project continues to progress on time and on budget; received the first tranche of grant funding for our Prinos carbon storage project; sanctioned the Irena development offshore Croatia; and made positive progress in merging our Egypt concessions to optimise value.

'Looking ahead, our strategic priorities are clear. First, in Israel, we are focused on reliable production and sales to the domestic market which is the bedrock of our cashflow, followed by finalising export opportunities to enhance sales where we see strong long-term demand for our gas in the region. Second, we are working at pace to mature both organic and inorganic options for the continuation of our growth trajectory. And third, for our other two key business drivers, quarterly dividends and deleveraging, we are actively exploring all strategic options within our existing portfolio to maximise value for our shareholders. We are excited by the opportunities before us and remain committed to delivering long-term value across all areas of our business.'

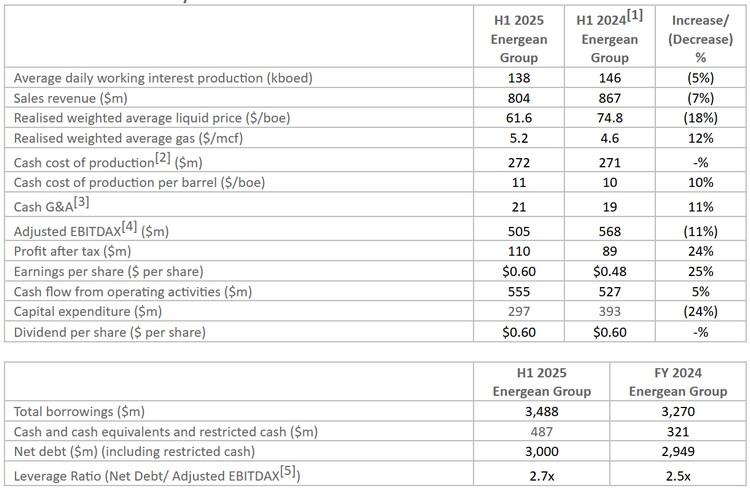

Financial results summary

Operational Highlights

- Strong safety performance and emissions reduction achieved:

- Lost Time Injury Frequency of 0.37 (H1 2024: 0.42) and Total Recordable Injury Rate of 0.37 (H1 2024: 1.27), well below the Group's full year targets.

- Scope 1 and 2 emissions intensity of 8.3 kgCO2e/boe, a 2% reduction year-on-year (H1 2024: 8.5 kgCO2e/boe).

- Group production during H1 2025 was 138 kboed (84% gas) (H1 2024: 146 kboed), down year-on-year due to the temporary suspension of production in Israel in June 2025, following a directive from the Ministry of Energy and Infrastructure due to regional geopolitical developments.

- Group production has subsequently increased since the resumption of production in Israel, with Group output averaging 147 kboed for the eight-months to August 2025 and 178 kboed in August alone.

- Focused on long-term value creation in Israel:

- Core Katlan development project progressing on budget and on schedule for first gas in H1 2027.

- Over $4 billion of new gas sales agreements signed during the period.

- Energean intends to book capacity in the new onshore Nitzana export pipeline to boost future sales. In addition, Energean is working in coordination with potential buyers and the regulator to secure further export opportunities to maximise sales in the shoulder months[6].

- Optimising asset value outside of core Israel base:

- In Egypt, concession merger discussions are well advanced to optimise and extend the economic life of its Abu Qir, NEA and NI concessions.

- In Italy, a work programme amendment was submitted post-period end for the potential Vega West development.

- In Croatia, Final Investment Decision was taken post-period end on the Irena gas field, with first gas expected in H1 2027.

- In Greece, post-period end, the first grant instalment of the Recovery and Resilience Facility ("RRF") was received for its carbon storage project. Drilling, funded by the RRF scope, is targeted in 2026.

Financial Highlights

- H1 2025 financial performance, relative to H1 2024, impacted by: (1) the planned shutdown for essential works for the second oil train development in March in addition to the Ministry ordered suspension of production for security reasons in June and; (2) lower Brent prices.

- Revenues of $804 million (H1 2024: $867 million), adjusted EBITDAX of $505 million (H1 2024: $568 million)

- Profit after tax of $110 million (H1 2024: $89 million) reflecting zero impairments in H1 2025 (compared to a $79 million impairment of exploration and evaluation assets in the prior year). This benefit was partly offset by lower taxable profits and a $27 million foreign exchange loss (H1 2024: $11 million gain).

- Net debt of $3,000 million, an increase versus 31 December 2024 ($2,949 million) primarily due to the temporary suspension of production in Israel.

- Cash and cash equivalents of $487 million and total liquidity of $1,175 million, which includes multiple available liquidity lines.

Corporate and Commercial Highlights

- Dividends of $110 million (60 US cents per share) returned to shareholders in the period.

- Q2 2025 dividend of 30 US cents/share declared today, scheduled to be paid on 30 September 2025.

- Redemption date for the full principal amount of $625 million 2026 Energean Israel Limited ("EISL") notes scheduled for 21 September 2025. Energean Israel's term loan will be drawn to repay the notes.

- $300 million Revolving Credit Facility maturity extended to September 2028.

- Sale of Egypt, Italy and Croatia portfolio terminated in March 2025 due to certain regulatory approvals not having been obtained (or waived) by the buyer as of the longstop date of 20 March 2025 in accordance with the terms of the binding Sale and Purchase Agreement ("SPA") signed on 19 June 2024.

2025 Guidance & Outlook

Energean expects the following for the year ahead for the Group:

- Production guidance of 145-155 kboed, lowered from 155-165 kboed as a direct result of the temporary suspension of production in Israel in June and a deferral of commissioning of the second oil train to late Q4 2025 to avoid non-essential shut-downs during peak demand periods. Standalone Israel guidance is now 105-115 kboed. Rest of Portfolio guidance is unchanged at c. 40 kboed.

- Cost of production (including royalties) of $560-600 million, lowered from $590-640 million. Israel guidance now $320-340 million as a result of lower royalties due to the revised production outlook. Rest of Portfolio guidance now $240-260 million, a lowering of the top end of the range based on actual performance.

- Development and production capital expenditure maintained at $480-520 million.

- Decommissioning expenditure of $60-80 million, lowered from $80-100 million due to a deferral of platform removal activities and cost savings in the UK.

- Year-end 2025 net debt is expected to be $2,900-$3,100 million, reflecting the revised production outlook in Israel.

- Mature organic and inorganic opportunities to grow the business.

- Review strategic options within the portfolio to maximise shareholder value.

Source: Energean