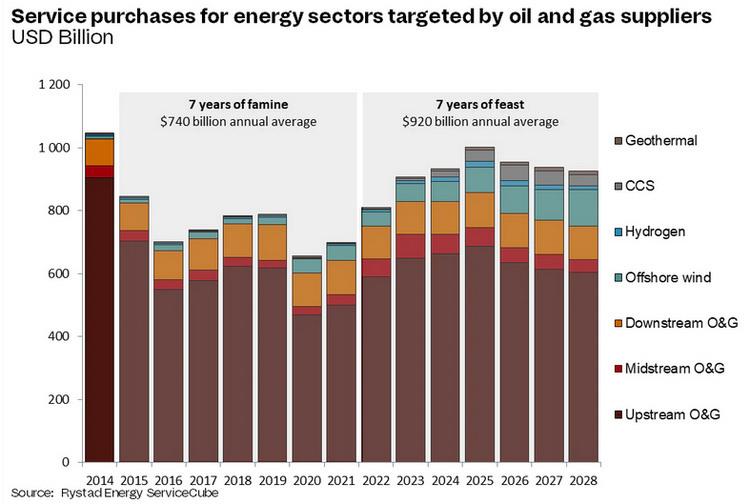

Rystad Energy expects the global market for oil and gas contractors to rise to a peak of $1 trillion in 2025 and remain at high levels for several years thereafter. Helped by strong growth in the midstream part of the industry to liquefy, transport, and re-gasify natural gas, overall oil and gas spending will stay above $920 billion annually on average for the 2022-2028 period.

Despite the risk that another downturn cycle in oil and gas may occur after 2025, oilfield service suppliers should be able to balance out the downturn by branching out into other parts of the wider energy market – and in so doing, expanding the overall target market for contractors. The key for suppliers is to continue chasing obvious opportunities within geothermal energy, hydrogen, offshore wind, and carbon capture, utilization and storage.

Together with oilfield services, this expansion into other energy areas could provide a $1 trillion market for suppliers by 2025, which could be sustained for several years after that. Breaking down the various service segments among the oil and gas suppliers reveals that all segments will grow in nominal terms, led by suppliers targeting equipment and materials and those providing operations and maintenance services.

While we expect the next seven years to provide a strong market for energy services, companies still have to improve their economics to make it a feast. Luckily, overall utilization is improving rapidly as suppliers are careful not to overinvest in more capacity as rigs, vessels, plants, and other units in the supply chain are affected by natural wear and tear. The result is better pricing for suppliers – the past 12 months have driven up prices for offshore rigs, land rigs, frac fleets, proppant, OCTG, vessels, and subsea infrastructure to levels not seen in a decade.

'Global oil and gas suppliers look set to echo the biblical story about the Egyptian pharaoh’s dream of seven years of feast and seven years of famine – only in the opposite order. All signs point towards 2022 being the start of another super cycle for the energy services sector', says Audun Martinsen, partner and head of energy service research at Rystad Energy.

Last year was a turning point with the post-pandemic recovery and record high gas prices and strong oil prices, allowing oil and gas companies to lift their oil and gas investments by 20%. Energy security concerns prompted petroleum producers to raise production and contract goods and services from suppliers, and the oilfield service industry was quickly sold out of fracking fleets, rigs, and casing and tubing steel. The prices that suppliers could charge surged by double-digit percentages, allowing EBITDA margins to climb (EBITDA refers to earnings before interest, taxes, depreciation, and amortization, a key metric for measuring profitability among companies). After the rebound in 2022 we are entering a very promising 2023, with potential for 13% growth both for oil and gas investments and 10% for low-carbon investments.

Factors in the famine

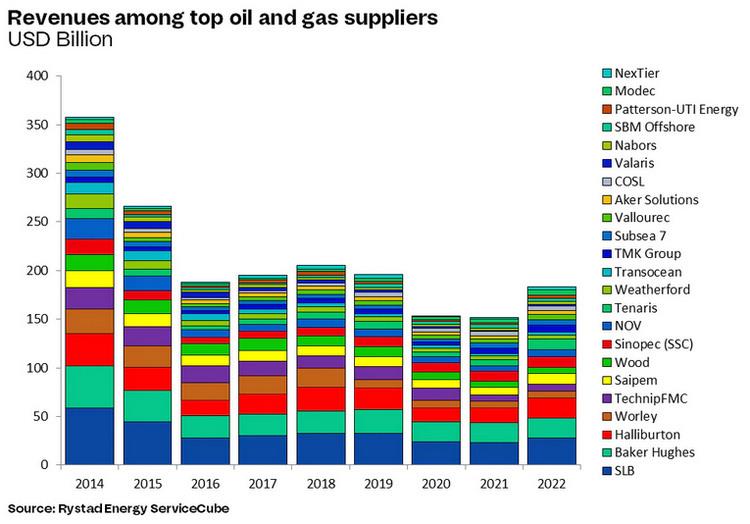

The oilfield service industry has had a rocky ride since 2014. An oversupply of oil volumes driven by the US shale revolution, a volume war led by OPEC, Russia flooding the market, and a two-year long pandemic all contributed to depress oil prices and upstream spending. As a result, oil and gas suppliers did not get the several subsequent years of growth they really needed to convert their operations into a profitable healthy business in the new market environment. From its peak in 2014 to the trough in 2021, revenue fell almost 60% for the biggest contractors. Despite some optimism in 2017-19, the market did not really take off as oil and gas producers maintained strict cash discipline and some segments in the oil and gas supply chain struggled with continued overcapacity.

Some regions and segments saw pockets of lucrative markets in the 2014-21 period, but overall, on a corporate level, global players have not been able to turn the tide. Analyzing the largest publicly listed service players shows that it was not only revenues that were depressed for seven years: overall earnings, operational cash flow, margins, and stock performance have also been challenging.

Suppliers have not been able to cut costs, adjust capacity, and cope with their debt to a degree that would allow them to turn lower market activity into a profitable business. Companies have been clinging on to their assets, hoping to boost their market share quickly in a future market recovery. This recovery has been delayed – until now.

For more analysis, insights and reports, clients and non-clients can apply for access to Rystad Energy’s Free Solutions and get a taste of our data and analytics universe.

Source: Rystad Energy