- 2P Reserve Life Index Increased 80% to 12.7 Years

- 2P Value Per Share (Net Debt-Adjusted) of $15.8

- 2P Finding, Development, and Acquisition Cost of $4.3 Per boe

GeoPark , a leading independent energy company with over 20 years of successful operations across Latin America, has announced its independent oil and gas reserves assessment(1), certified by DeGolyer and MacNaughton Corp. (D&M) under PRMS methodology, as of December 31, 2025(2).

GeoPark’s 2025 reserves represent a significant step-change in the Company’s asset base and reflect the impact of disciplined execution across its organic assets, strategic acquisitions, and the ongoing portfolio optimization the Company outlined at its 2025 Investor Day.

Portfolio Optimization Driven by Vaca Muerta Acquisition and Strong Organic Execution

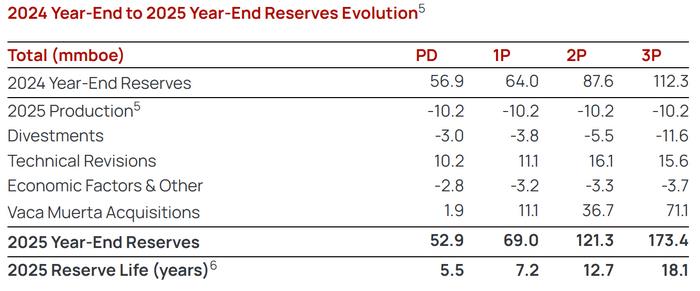

Total 2P reserves increased 38% year-over-year, driven primarily by the addition of 36.7 mmboe in Argentina that resulted in a 2P Reserve Replacement Ratio (RRR) of 430%. The Company’s strategic acquisition of the Loma Jarillosa Este and Puesto Silva Oeste unconventional oil blocks in Vaca Muerta, have transformed GeoPark’s reserves profile and now represents 30% of GeoPark’s total 2025 reserves. Net additions from these acquisitions, after accounting for asset divestments, contributed 31.2 mmboe to the Company’s 2P reserves. GeoPark’s certified 1P reserves totaled 69 mmboe and 2P reserves totaled 121 mmboe, the highest level since 2022. The Company reported a 1P Reserve Life Index (RLI) of 7.2 years and a 2P RLI of 12.7 years. Reserve replacement ratios for 1P, 2P, and 3P reserves were all well above 100%, underscoring GeoPark’s ability to fully replace production and continue building long-term asset value.

GeoPark assumed operational control of the Loma Jarillosa Este and Puesto Silva Oeste blocks in October 2025. The Loma Jarillosa Este Block is currently producing 1,860 boepd from six wells, and GeoPark has already implemented a strategic optimization plan to enhance productivity, including the installation of rod pumps in three wells. Supported by strong results from adjacent blocks, GeoPark submitted the Puesto Silva Oeste block for reserves certification, resulting in the reclassification of 3.4 mmboe as 2P reserves and 24.6 mmboe as 3P reserves that are expected to mature to 2P with successful development drilling. GeoPark continues to advance its transformational Vaca Muerta development plan through a new drilling program scheduled for the second half of 2026 to unlock additional production and reach the 20,000 boepd plateau production target by 2028.

Stable Reserve Base in Colombia with Targeted Additions

Excluding the effect of divestments, 2P reserves in Colombia increased by approximately 2.6 mmboe, mainly driven by technical revisions in the CPO-5 and Llanos 123 blocks. The increase reflects the inclusion of new discoveries in the Currucutú and Toritos fields, as well as enhanced recovery initiatives in the Bisbita field within the Llanos 123 Block. In the CPO-5 Block, reserves growth was supported by improved performance from the Indico field wells. The Llanos 34 Block continues to actively contribute 2P volumes to GeoPark’s Certified Reserves, supported by a diversified set of recovery optimization initiatives including waterflooding, CEOR implementation projects, infill drilling, workovers, and upsizing, anchored by solid baseline performance.

Material Reserve Growth Through Disciplined Capital Allocation

GeoPark’s capital efficiency continues to stand out, with a 2025 finding, development, and acquisition (FD&A) cost of $4.3 per boe(3) on a 2P basis. This figure reflects GeoPark’s disciplined approach to capital allocation and its ability to deliver high-quality, accretive barrels at competitive costs across both conventional and unconventional resource plays.

GeoPark’s acquisition in Vaca Muerta and the continued disciplined execution and strong progress the Company made in 2025 have resulted in a portfolio that is stronger, more balanced and more diversified than before, combining the high-growth potential of Vaca Muerta with the stable, mature production base of the Llanos 34 Block, and outstanding performance at the Llanos 123 Block and the Indico Field at the CPO-5 Block.

Consolidated Reserves Summary(4)

- 1P reserves of 69 mmboe, with a RLI of 7.2 years

- 2P reserves of 121 mmboe, with a RLI of 12.7 years

- 3P reserves of 173 mmboe, with a RLI of 18.1 years

Net Present Value and Value Per Share

- 2P NPV10 After Tax of $1.3 billion

- Net debt-adjusted 2P NPV10 After Tax of $15.8 per share

Felipe Bayon, Chief Executive Officer of GeoPark, said: 'The impressive growth of our 2025 reserves confirms the impact of the strategic decisions we’ve taken to build a more resilient, diversified, and future-ready portfolio. We are already seeing tangible results from our new Vaca Muerta assets, while continuing to maximize value from our core Colombian blocks - particularly in the Llanos Basin and the high-performing CPO-5 Block. Our ability to simultaneously add material reserves across the portfolio, keep costs low, and extend our reserve life index is a testament to our renewed strategic focus, unique operating capabilities, distinct portfolio and enduring long-term commitment to maximizing value for our shareholders.'

For more information on GeoPark’s reserves, including a breakdown by country, NPV per share, and FD&A cost calculations, please refer to the following link:

https://ir.geo-park.com/overview/reserves-annex-2025

Source: GeoPark