Offshore wind specialist TGS - 4C Offshore has reduced its forecast for global offshore wind build-out for the next four years by nearly 25 % compared to its previous forecast, as soaring supply and capital costs are causing developers to delay projects. However, their latest report also gives many causes for optimism.

The quarterly Market Overview Report, published this week, highlights the negative impact of rising inflation, capital costs, and supply chain disruptions. An in-depth analysis of 113 offshore wind projects finds 15 GW has reported some level of financial stress related to the macroeconomic context, with the problem most significant for those securing power offtake contracts between 2019-2022. An additional 10.9 GW is also potentially at risk but has not yet announced any concerns.

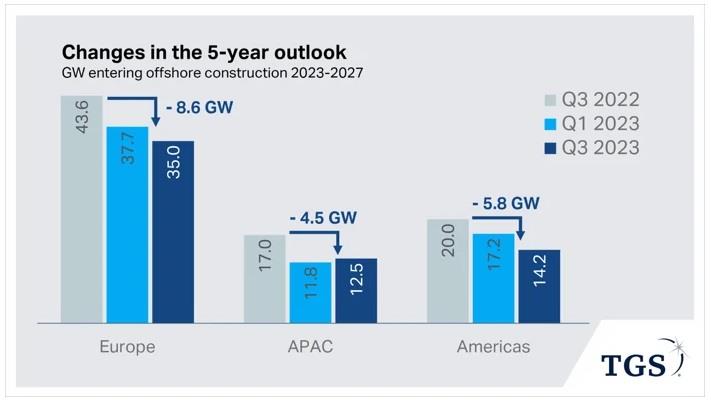

The consequence is project delays and a significant decline in offshore wind projects beginning installation between 2023 and 2027, with a projected global decrease of 17.5 GW (23%), excluding China (fig). The outlook for 2030 sees some recovery, with only a 9% decrease, driven by underlying long-term demand and strong fundamentals.

At the same time, the report notes that several key industry indicators remain strong:

- Lease rounds and seabed awards. Governments worldwide continue to award seabed to developers at a brisk rate. In 2023 to date, 35.5 GW of capacity has already been awarded. While this falls short of the record of 53.5 GW awarded during the first three quarters of last year, it almost doubles the 2016-22 annual average of 18.4 GW. Multiple countries, including Norway, Portugal, Spain, Uruguay and Estonia, are running or planning their first-ever offshore wind lease rounds.

- Construction permits. The report reveals that a record number of construction permit awards were granted in Q3 2023. These awards exceeded 8 GW of capacity across five countries, more than doubling the typical rate. Historically, permitting rates have fallen short of meeting 2030 goals, making this surge a significant step forward

- Final Investment Decisions. Some projects and governments have navigated a way through the challenges. Northland and Orlen have successfully secured project finance for 1.1 GW Baltic Power, showing that revenue contract tweaks by the Polish state have been effective. Elsewhere, the flexibility of corporate PPAs has helped secure investment decisions for RWE's 1 GW Thor project and Northland/Mitsui's 1 GW Hai Long.

Richard Aukland, Director of Research at TGS - 4C Offshore, commented on these findings: 'The delays and cancellations experienced by some present opportunities for others. In the supply chain, vessel operators may benefit from shifting timelines, providing valuable installation capacity when existing contractors are unavailable. Additionally, postponed and canceled projects enable developers to negotiate new terms with recently freed-up supply chain capacity.'

TGS - 4C Offshore releases regular intelligence reports on a wide variety of offshore energy subjects, including wind farms, construction & heavy maintenance, wind logistics, and Offshore Transmission and Cables. For more information, visit 4coffshore.com.

Source: TGS