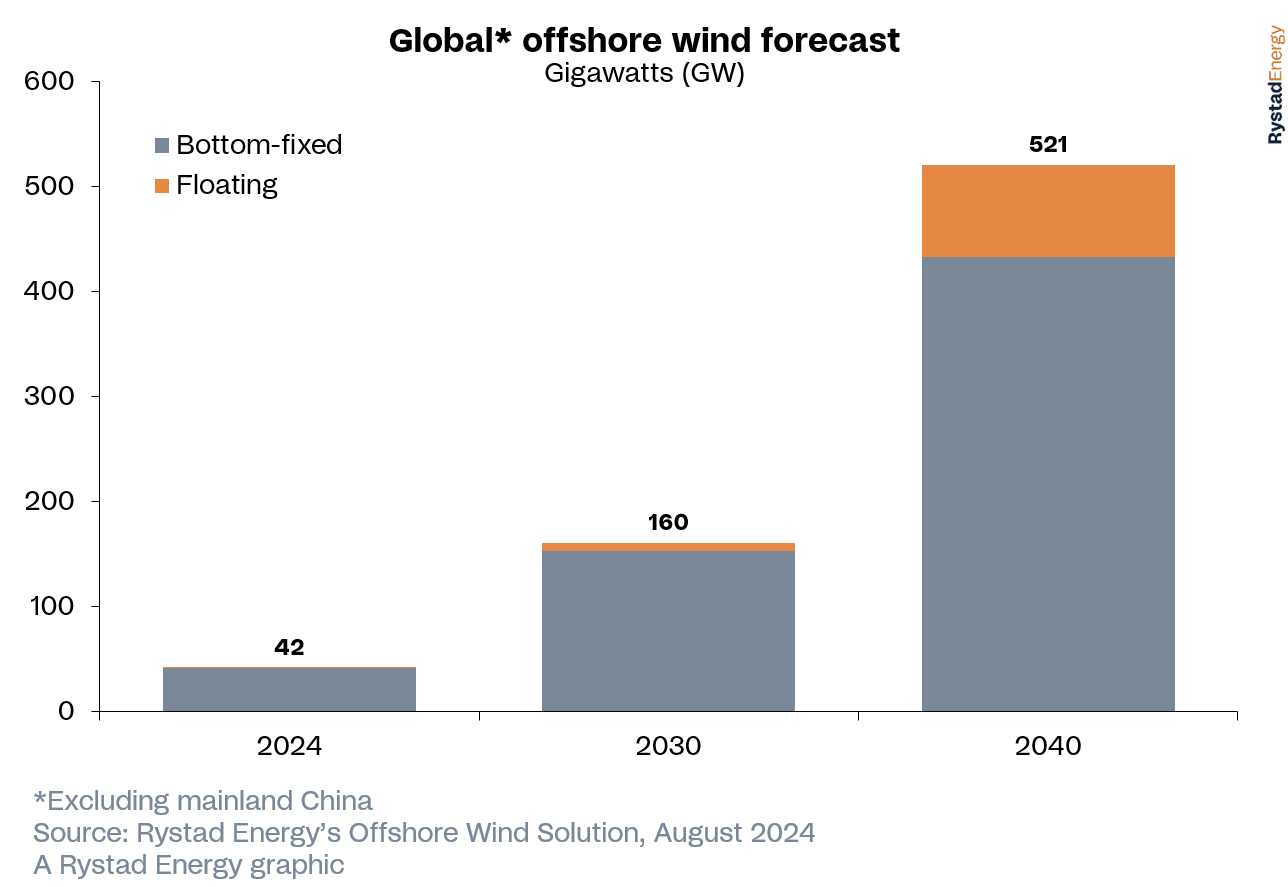

Global offshore wind projects have faced significant headwinds due to recent inflationary pressures and supply chain disruptions, exemplified by postponed permitting processes, delayed auctions and slow supply chain build-ups. Despite these challenges, the sector staved off challenges in 2023, seeing a 7% increase in new capacity additions compared to the previous year. This momentum is expected to accelerate this year, with new capacity additions expected to grow by 9% to over 11 gigawatts (GW) by the end of the year. Rystad Energy expects this growth for the offshore wind sector to continue at a steady pace, and estimates that global installations, excluding mainland China, will exceed 520 GW by 2040.

Europe will play a crucial role in this growth, relying heavily on floating wind to meet ambitious national targets and make the most of its abundant offshore resources. By 2040, the continent is expected to account for more than 70% of global floating wind installations. Although some project delays beyond 2030 are anticipated, there will likely be a strong push to accelerate deployment. As a result, floating wind capacity is projected to approach 90 GW by 2040, with the UK, France and Portugal at the forefront of development. Asia will also be key in advancing floating wind as a mature technology, and the region – excluding mainland China – is expected to capture a share of 20% of global installations by 2040.

While the floating wind sector has seen a recent rise in project announcements, it currently grapples with supply chain constraints similar to the bottom-fixed segment, where wind turbines are installed on fixed foundations in shallow waters. These challenges could hinder the advancement of floating wind technology in the short term, with capacity estimates of less than 7 GW by 2030. To overcome these hurdles, increased government support is crucial.

'The global offshore wind sector is experiencing robust growth, fueled by increased investment and auction activity. However, supply chain bottlenecks present significant challenges to the industry's further expansion. While ambitious targets boost investor confidence, it is crucial to address logistical issues to ensure that offshore wind can successfully take a key role in the energy transition. This will not only help the technology mature, but also foster a supportive ecosystem that inspires investor reliance, said Petra Manuel, Senior Offshore Wind Analyst, Rystad Energy.

Learn more with Rystad Energy’s Offshore Wind Solution.

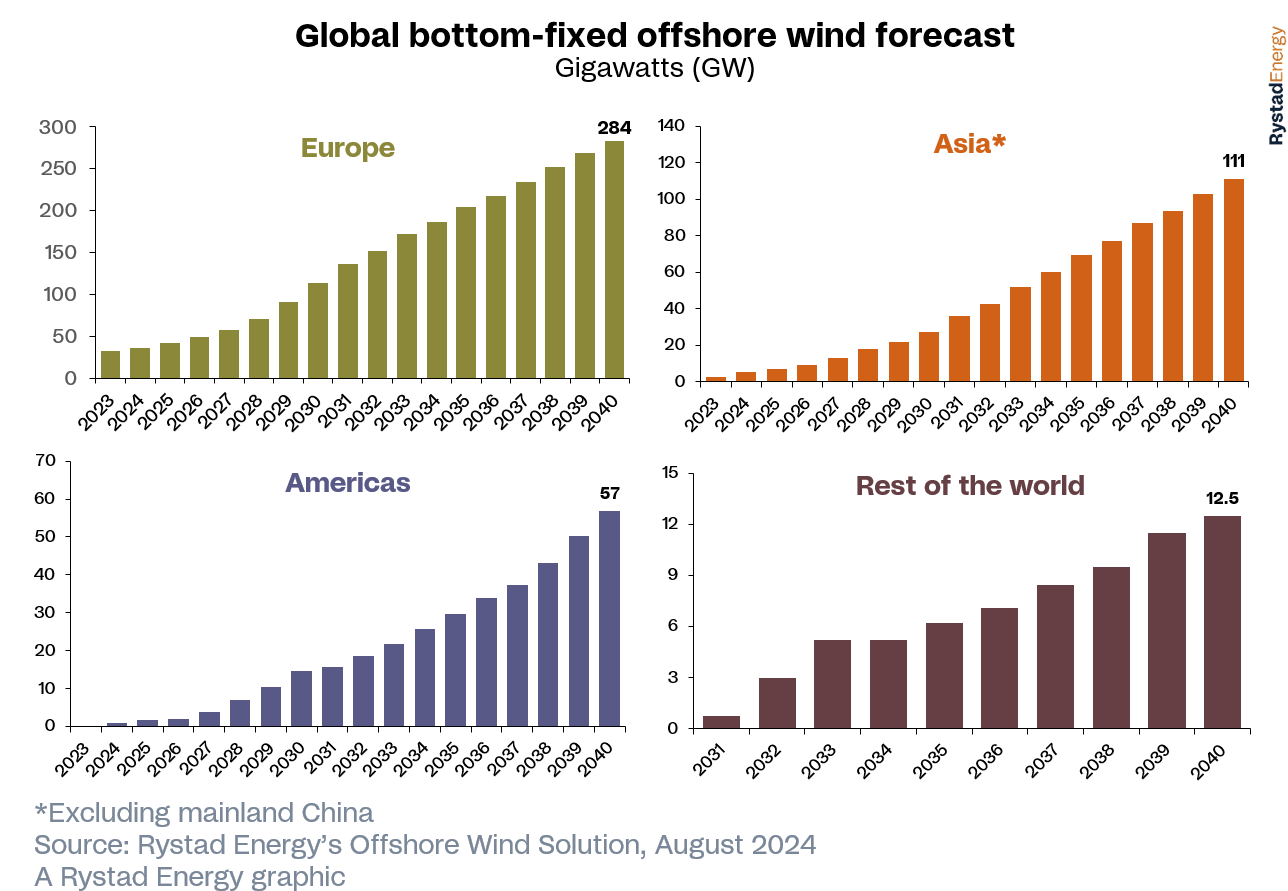

In the bottom-fixed market, we expect the UK, Germany and the Netherlands to emerge as the three dominant players. The countries’ proximity to the North Sea and extensive maritime areas provides a strong foundation for success in offshore wind, bolstered by their installation and net-zero targets. Together, these three countries are projected to account for a total of 150 GW of installed capacity by 2040, followed by the US with less than 40 GW. The future of the US market is contingent on its political landscape, with concerns that if presumptive Republican presidential nominee Donald Trump were to win, his administration might significantly impede offshore wind development.

Between 2025 and 2030, the Americas, led by the US, will experience significant growth, beginning with close to 2 GW of installed capacity in 2025. Asia, excluding mainland China, will follow, with 7 GW in 2025 and reaching nearly 28 GW by 2030, with Taiwan (China), South Korea and Vietnam emerging as major markets in the region. Europe is projected to have 41 GW of installed capacity by 2025 and more than 112 GW by 2030, driven by a steady stream of projects awarded through competitive auctions.

Looking ahead to between 2030 and 2035, an increase in growth is anticipated in Asia, excluding mainland China, followed by the Americas and Europe. During this period, Latin America, particularly Brazil and Colombia, is also expected to begin contributing to offshore wind capacity in the Americas.

Rystad Energy’s long-term forecast for the floating wind sector differs significantly from the upward trend observed in the bottom-fixed market. From 2025 to 2030, we anticipate that only Asia and Europe will be actively installing floating wind capacity. By 2030, we expect Europe to have installed almost 5 GW of floating wind, while Asia, excluding mainland China, is projected to add 2 GW.

In the following five-year period from 2030 to 2035, we foresee a substantial ramp-up in installations. Europe is expected to add 20 GW of floating wind capacity, and Asia, excluding mainland China, up to 5 GW. We do not expect floating wind projects to be installed in other regions until the period of 2035 to 2040 period, when we anticipate the technology to advance toward maturity. By 2040, we predict that Europe will have installed more than 65 GW of floating wind capacity, while installations in Asia, excluding mainland China, will have reached 17 GW.

Contacts

Petra Manuel

Senior Analyst, Offshore Wind Research

Phone: +44 20 3936 4393

Petra.manuel@rystadenergy.com

Kartik Selvaraju

Media Relations Manager

Phone: +65 8779 4619

kartik.selvaraju@rystadenergy.com

Source: Rystad Energy