Strong H1 production performance, continued strategic and operational progress

Ithaca Energy, a leading UK independent exploration and production company, has announced its unaudited financial results for the six months ended 30 June 2023.

H1 2023 Operational and strategic highlights

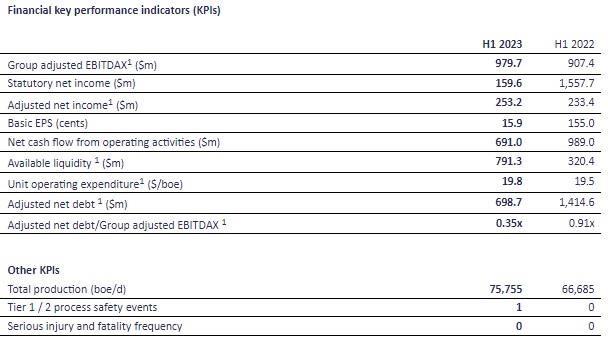

- Strong H1 production of 75.8 thousand barrels of oil equivalent per day (kboe/d), supporting full year 2023 production guidance (H1 2022: 66.7 kboe/d)

- Production growth driven by the contribution of producing asset additions from M&A transactions completed in the first half of 2022

- Production split 66% liquids and 34% gas

- Good progress made in H1 2023 against our BUY, BUILD and BOOST strategy preserving optionality across our portfolio with the aim of maximising value to shareholders

BUY

- Acquired the remaining 40% stake in the Fotla Discovery, together with three exploration licences, providing Ithaca Energy with full control over pre-final investment decision (FID) work and timing (subject to completion)

- Entered into marketing agreement with Shell U.K. Limited in relation to its interests in the Cambo field, representing a meaningful step towards securing an aligned joint venture partnership that would enable the future progression of the Cambo project towards FID, subject to regulatory and licensing approval processes and market conditions

BUILD

- Pre-FID work continues across the Group's high-value greenfield and brownfield development portfolio. Focus remains on finalising development plans and financing for Rosebank

- Positive exploration drilling results at K2 prospect, with the decision to proceed with an appraisal side-track (Ithaca Energy operated, working interest 50%) highlighting Ithaca Energy's impressive exploration track record

BOOST

- Production performance in H1 2023 driven by high production efficiency across our operated assets in Q2 of 93%

- Material project scopes completed at Captain Enhanced Oil Recovery (EOR) Phase II with four of the seven wells drilled. Critical EOR turnaround scopes scheduled for H2 2023

- Front End Engineering Design (FEED) activity ongoing to explore the potential for electrification of the Captain field, demonstrating our continued focus on decarbonisation initiatives across our portfolio

H1 2023 Financial highlights

- Announced second interim 2023 dividend of $133 million payable in September 2023, taking our total year to date interim 2023 dividend to $266 million, with targeted total dividend of $400 million reaffirmed for financial year 2023

- Group adjusted EBITDAX up 8% to $979.7 million (H1 2022: $907.4 million), driven by higher production, despite lower average oil and gas prices

- Realised oil and gas prices (respectively) of $85/boe and $82/boe before hedging results and $83/boe and $125/boe after hedging results (H1 2022: $107/boe and $144/boe before hedging results and $93/boe and $105/boe after hedging results)

- Strong cost control, despite inflationary headwinds, delivering operating costs of $272.1 million ($19.8/boe (H1 2022: $19.5/boe)), allowing the Group to narrow its full year 2023 guidance range

- Adjusted net income of $253.2 million (H1 2022: $233.4 million)

- Statutory net income $159.6 million (H1 2022: $1,557.7 million) reflecting a $73.7 million post-tax impairment of the Greater Stella Area due to reduction in planned activity, as a direct result of the Energy Profits Levy (EPL) and falling gas prices; H1 2022 includes $1,324.3 million gain on bargain purchase which arose from the acquisitions of Marubeni UK and Siccar Point Energy

- Net cash flow from operating activities of $691.0 million (H1 2022: $989.0 million)

- Producing asset capex of $188 million, allowing the Group to reduce its full year 2023 guidance range

- Strong cash flow generation supporting further deleveraging of the balance sheet in the period. Adjusted net debt of $698.7 million at 30 June 2023 (31 December 2022: $971.2 million; 30 June 2022: $1,414.6 million)

- Group leverage position of 0.35x adjusted net debt to adjusted EBITDAX (30 June 2022: 0.91x)

- Successful redetermination of Reserves Based Lending (RBL) facility in June 2023

- Post period end, signed extension of bp offtake agreement and, in parallel, entered into new five- year $100 million loan facility agreement with bp (yet to be drawn)

Outlook

FY 2023 Management Guidance and Outlook

- Management provides the following updates to previously provided guidance ranges and activities for full year 2023 (FY 2023):

- Production guidance reaffirmed for FY 2023 of 68-74 kboe/d;

- Operating cost guidance narrowed at the lower end of the range for FY 2023 from $560-$630 million to $560-$610 million; and

- Producing asset capital cost guidance for FY 2023 reduced from $400-$460 million to $390-$435 million

- Turnaround activity across operated and non-operated base scheduled for Q3 2023

- Captain EOR Phase II project H2 2023 activities include the continued drilling of Area E wells before moving to Area D to commence drilling operations and turnaround activity in Q3 that will support polymer injection into the subsea wells in 2024

- Continued focus on maturing high-value development projects and preserving optionality across our portfolio while prioritising capital allocation to maximise sustainable shareholder returns

- Management reaffirms its commitment to targeted total dividend of $400 million for financial year 2023

Energy Profits Levy impact beyond 2023

- In June 2023, the UK government published terms of reference for the oil and gas fiscal regime review and committed to engaging with industry stakeholders. One of HM Treasury's stated objectives is to achieve a "simpler, more predictable, and stabler regime" (HM Treasury)

- In the meantime, until the fiscal regime is improved, as a direct result of the Energy Profits Levy, investment across our operated and non-operated portfolio has and will reduce, including the deferral and cancellation of certain 2023 and 2024 projects, impacting medium-term production outlook, with production in 2024 expected to be lower than 2023 levels. As part of the Group's strategy, we continue to leverage our M&A capabilities evaluating potential inorganic opportunities with the clear intention to increase our production in the medium-term

- We are in the process of working through our medium-term outlook, incorporating the full impact of EPL at an asset level and updating subsurface models for the latest production history along with the potential positive effect of new opportunities we are currently reviewing and we will share an updated view of our medium-term production outlook later in the year

Gilad Myerson, Executive Chairman, commented: 'Ithaca Energy's robust H1 performance demonstrates continued strong delivery across our BUY, BUILD and BOOST strategy and our capital allocation policy in H1 2023. I am delighted to announce today the second tranche of our 2023 interim dividend, taking our total year to date dividend in 2023 to $266 million, in line with our commitment to shareholders at IPO.

The Energy Profits Levy continues to have a direct impact on investment in the UK North Sea and Ithaca Energy's own investment programme across its diverse high-quality operated and non-operated asset base. We continue to constructively engage with the UK government to highlight the impact of the current fiscal regime to the industry's outlook and to the UK government's stated energy security and Net Zero ambitions.'

Alan Bruce, Chief Executive Officer, commented: 'We are pleased to share a strong set of results for the first half of 2023, with growing Adjusted EBITDAX as a result of production of over 75 kboe/d in the period. Production efficiency across our operated assets has been high demonstrating our strong operational capabilities.

We continue to take a disciplined approach to capital investment including at our Captain asset where we are progressing the EOR Phase II project construction activities as well as evaluating emissions reduction options. We reported successful exploration drilling at our K2 prospect in July which further strengthens our high-quality development portfolio.'

Source: Ithaca Energy