SUMMARY

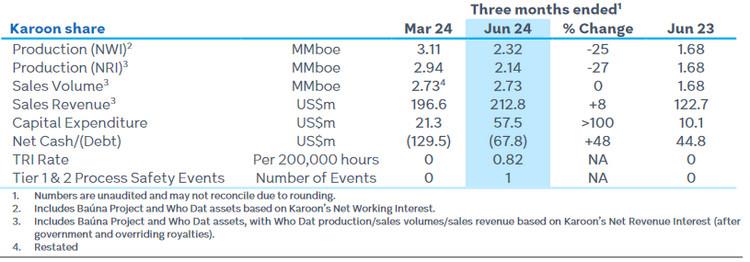

- 2024 second quarter production was 2.14 MMboe on a Net Revenue Interest basis (NRI), 27% lower than the prior quarter, largely due to the scheduled three week maintenance outage at Baúna.

- Sales revenue (NRI basis) for the quarter rose 8% to US$212.8 million, based on sales volumes of 2.73 MMboe, which was higher than production primarily due to the timing of Baúna liftings.

- Karoon’s capital returns policy has been finalised. The policy comprises paying 20-40% of underlying Net Profit after Tax (NPAT) to shareholders by way of a dividend and/or share buyback, subject to market conditions and Board approval. The policy will be applied from the 2024 half year results.

- In addition, given the Board considers that Karoon’s current share price does not accurately reflect the underlying value of the Company’s assets, it has launched a US$25 million share buyback. The buyback represents an opportunity to add value to the remaining shares on issue.

- Due to ongoing delays in receiving regulatory approvals and finalising contracts, there is a risk that the SPS-88 well intervention will not take place in the third quarter of 2024, although Karoon continues to work to enable the activity to take place as soon as possible.

- The Who Dat East well was drilled during the quarter and discovered hydrocarbons with a total aggregate net pay thickness of 45 metres measured depth. The well was suspended as a potential future producer, pending further evaluation.

- Subject to receipt of regulatory approvals and the drillship remaining on schedule, the Who Dat South exploration well is expected to commence drilling in the third quarter of 2024.

- Two recordable personal safety incidents were reported during the quarter (one Lost Time Injury and one medical treatment case), as well as a Tier 2 Process Safety Event.

- CY24 production and costs remain unchanged. Unit DD&A guidance for CY24 is provided, of US$16 – 17/boe.

Karoon CEO and MD, Dr Julian Fowles, said:

'Karoon’s 2024 second quarter (NRI) production was 27% lower than the first quarter, primarily due to the three week scheduled maintenance shutdown at Baúna. Nonetheless, revenues increased 8% to US$212.8 million, reflecting the timing of shipments in Brazil as well as higher oil price realisations.

The Company’s key focus during the quarter was to safely improve reliability and increase production at Baúna and Who Dat. In Brazil, the FPSO annual maintenance shutdown was completed in June. Following the resumption of production, rates peaked at more than 31,000 barrels of oil per day (bopd), declining to

approximately 27,000 bopd by the end of the quarter. A heightened level of maintenance activity will continue over the balance of 2024 and into 2025, to support the ongoing integrity and reliability of the FPSO. This will impact production rates periodically as systems are taken off-line for maintenance.

Unfortunately, a Lost Time Injury and a Medical Treatment Case occurred during the quarter, the first reportable injuries at Baúna in more than 18 months. Together with our contractors, additional steps to improve the focus on safety are being taken, as we believe all injuries can be prevented. A Tier 2 process safety event occurred on 1 May, with a gas release from one of the FPSO’s gas compressors which has been taken offline pending inspection and repair.

With the delays to regulatory environmental approvals currently being experienced across the industry in Brazil, it is now unlikely that we shall receive the permits required for the SPS-88 well intervention to take place this quarter, as targeted. We are working to ensure contracts can be finalised in the case of delayed approvals to enable the intervention to still take place this calendar year, but there is a risk of deferral into 2025. If the SPS-88 intervention is delayed to 2025, Baúna 2024 production will likely be in the lower half of current guidance, while 2024 capex would be reduced by US$20-30 million, with SPS-88 expenditures moved into CY25.

In the US Gulf of Mexico, the Who Dat Joint Venture continued to evaluate opportunities for production optimisation. Towards the end of the quarter, gross Who Dat production reached a new high for the year of approximately 43,000 barrels of oil equivalent per day (boepd). The Joint Venture has identified other opportunities that have the potential to improve production performance which, subject to further evaluation, may be implemented over the next six to 18 months.

During the quarter, the Who Dat East exploration/appraisal well was successfully drilled. The results will help us to update the Resources and evaluate the commerciality of a potential Who Dat East tieback development.

Any revisions in Resources will be included in the year end 2024 Hydrocarbon Reserves and Resources Statement. The Seadrill West Neptune drillship is now scheduled to spud the Who Dat South exploration well in the third quarter of 2024. The well has been delayed due to Hurricane Beryl and operational complexities on the prior well. Consequently, a short lease extension application will be filed. The well will test a prospect containing an estimated 31 MMboe (gross) of 2U Prospective Resources.

In May, Karoon successfully accessed the US 144A bond market, with an inaugural US$350 million high yield bond issue. The bond lengthens Karoon’s debt maturity profile and supplements our Reserve Based Lending facility, which was fully repaid during the quarter. Importantly, the bond issue gives Karoon access to a new, long term, strategic funding source, at a time when commercial banks are reducing the funding available to E&P companies. Karoon Energy Ltd was assigned a corporate credit rating of “B” with a stable outlook by both S&P Global and Fitch Ratings.

As indicated at our 2024 AGM, Karoon has announced its capital returns policy. Under the new policy, which will be applied from the 2024 half year, we intend to pay 20-40% of NPAT to shareholders by way of a dividend and/or a share buyback, subject to market conditions and Board approval. The Board believes this will provide a good balance between rewarding shareholders and retaining sufficient funds within the business to support ongoing operations and value accretive growth. In addition to the new policy, we have announced the launch of a US$25 million share buyback, based on our view that the current share price does not reflect Karoon’s underlying value.

I look forward to updating the market further at our 2024 first half results briefing next month.'

Click here for full announcement

Source: Karoon Energy