HIGHLIGHTS

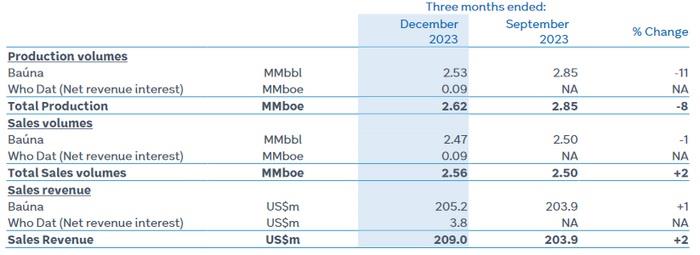

- December 2023 quarter production was 2.62 million barrels of oil equivalent (MMboe), down 8% from the previous quarter, taking total production for the 2023 six month transition year (TY23) to 5.47 MMboe.

- Baúna Project December quarter production declined 11% to 2.53 million barrels (MMbbl), while TY23 production was up 47% on the prior six months to 30 June 2023 at 5.38 MMbbl, in line with guidance.

- Sales revenue for the quarter was US$209.0 million, including US$3.8 million from Who Dat, 2% higher than in the September 2023 quarter.

- Acquisition of the Who Dat interests in the US Gulf of Mexico (US GoM) completed on 21 December 2023, funded by drawdowns from a new finance facility, a US$312 million equity raise and from cash.

- No recordable personal safety, Lost Time Injury or Tier 1 or 2 Process Safety incidents in the December quarter.

- Awarded two deepwater explorations blocks in the Santos Basin, Brazil.

- Binding agreement executed to purchase verified carbon units from REDD+ project in Brazil.

- TY23 results to be released on Thursday 29 February 2024. Guidance for TY23 key metrics narrowed.

- CY24 capex guidance has been revised up US$10 million to US$50-57 million, to include additional drilling costs associated with completing a new reservoir zone encountered in the G2-ST2 well at Who Dat and the Brazilian deepwater block signature bonuses (see page 8 for details)

Karoon CEO and MD, Dr Julian Fowles, said:

'The December 2023 quarter was a transformational period for Karoon. In November, Karoon announced that it was acquiring a 30% working interest in the Who Dat and Dome Patrol oil and gas fields in the US Gulf of Mexico (GoM), plus interests in surrounding exploration acreage, for US$720 million(1). The transaction, which was completed on 21 December 2023, is expected to increase CY24 production by approximately 50% (on a Net Revenue Interest basis) and lift 2P Reserves by approximately 75% (Net Working Interest).

The acquisition of assets in the US GoM is an important milestone for Karoon. It marks the evolution of the Company from a single asset operator to an oil and gas producer with high quality assets in two of the world’s leading offshore oil and gas producing regions. It also provides another platform for Karoon’s growth. The transaction was funded by a new debt package, a well-supported equity raising and the draw down of existing cash. After completing the transaction, the Company’s balance sheet remains robust, with modest gearing, reflecting ongoing strong cash flows from operations and a conservative debt position.

The Baúna Project produced 5.38 MMbbl in TY23, slightly above the middle of our guidance range of 4.5 – 6 MMbbl and a record for the Company. December quarterly production was impacted towards the end of the period by operational issues related to the gaslift dehydration unit on the FPSO. While remediation of the topsides and downhole hydrate issues was completed on 20 January 2024, a deeper mechanical blockage was identified in the SPS-88 well, which will require a well intervention to replace the Gas Lift Valve. We have assumed this will take place in the fourth quarter of 2024, based on internal estimates of the time required to identify and contract an appropriate vessel and receive regulatory approvals. On the basis that SPS-88 is offline for much of 2024, taking into account scheduled downtime in April 2024 and forecast FPSO efficiency of 90-95%, CY24 Baúna Project production is expected to be 7.2-9.0 MMbbl. Importantly, Baúna Project reservoir performance continues to be in line with our expectations. Daily production will continue to fluctuate as part of normal operations andongoing maintenance programs.

EIG recently announced that it is acquiring Ocyan, the 50% owner and contract operator of the Baúna FPSO. EIG is a leading institutional investor in the global energy and infrastructure sectors and has a comprehensive Brazilian oil and gas infrastructure business. We look forward to working with EIG and Altera, Ocyan’s 50% partner, on optimising the current operations of the Baúna FPSO as well as progressing the Baúna field life extension project.

The quarterly results included just 11 days’ contribution from the Who Dat assets, from the transaction completion date of 21 December to 31 December 2023. The development program being undertaken by the operator, LLOG, is nearing completion, with two wells, G2-ST2 and G4, expected to be brought onstream during February. These two wells are expected to have the potential to add an initial 9,000 to 12,000 boepd (gross) to Who Dat production, prior to natural decline.

There were no Lost Time or Recordable incidents in Brazil during the quarter, and no significant environmental incidents, continuing the excellent safety performance seen in the prior quarter. This was a pleasing result, reflecting Karoon’s focus on ensuring a safe and healthy working environment.

Technical and commercial feasibility studies for the potential Neon development are almost complete. We are on track to make a decision later this quarter whether to enter the Concept Select phase, subject to the results of the feasibility studies. Concepts being considered include a stand-alone FPSO, or a subsea tieback from Neon to the Baúna FPSO or from Baúna to an FPSO at Neon.

Karoon has executed a binding agreement to purchase 340,000 verified carbon units over CY23-27 from a REDD+ forest conservation project located in the Amazon region in north-western Brazil. We continue to evaluate additional carbon opportunities, including ARR projects, to help offset additional Scope 1 & 2 emissions resulting from the GoM acquisition, to continue to achieve our aim of being carbon neutral.

I look forward to updating the market further next month at our TY23 results briefing.

(1) The Acquisition includes a carry of US$39.2 million for the Who Dat East, Who Dat South and Who Dat West exploration acreage.

Click here for full announcement

Source: Karoon Energy