In November 2020, Karoon completed the acquisition of 100% of Concession BM-S-40, comprising the Baúna and Piracaba producing oil fields and the Patola discovered resource (collectively known as the Baúna Project) from Petrobras.

- 13.7 MMbbl increase in Baúna Project 2P Reserves after 1H25 production, reflecting Baúna FPSO acquisition, facility operating life extension, and better reservoir performance than anticipated.

- Baúna Project 2P Reserves are 35% higher at 30 June 2025 than at 31 December 2024.

- Baúna Project economic field life extended by seven years to 2039, limited by the current Production Concession expiry(1) .

- Baúna Revitalisation and Life Extension projects initiated, with forecast expenditure of approximately US$55-65 million in 2026 and US$80-90 million over the period 2030-2034.

- 2P recoverable volumes have increased by 120% since Karoon acquired Baúna in November 2020(2).

- AGR has performed an independent evaluation (Competent Person’s Report - CPR). The CPR Reserves are within 5% of the Reserves in this release.

Dr Julian Fowles, Karoon’s CEO and Managing Director said:

'One of the key drivers underpinning the 1H25 Baúna FPSO acquisition was the potential to reduce future operating costs, which would allow us to access some or all of the existing Contingent Resources.

A comprehensive analysis has now been completed, which has confirmed that, with our expected new cost structure and implementation of life extension plans, the economic life of the Baúna Project can be extended by approximately seven years, from 2032 to 2039, when the Production Concession expires. In addition, over the past 18 months, the Baúna decline rate has been lower than our expectations, indicating a higher Ultimate Recovery from the project.

Consequently, 2P Reserves as at 30 June 2025 were revised upwards to 52.7 MMbbl, which is 35% higher than at 31 December 2024. With the majority of 2C Contingent Resources having been moved into the Reserves category, 3.0 MMbbl remained in the 2C Contingent Resource category at 30 June 2025 (11.2 MMbbl at 31 December 2024), based on production extending to 2040, the end of the assessed facility operating life.

The Reserves upgrade highlights the material value that has been added by the Baúna FPSO purchase and the continued strong performance of the Baúna Project reservoirs.'

Baúna Project Reserves and Contingent Resources Review

Karoon has reassessed the Reserves and Contingent Resources for the Baúna Project as at 30 June 2025. This follows completion of the acquisition of the Baúna FPSO, the Cidade de Itajaí, on 30 April 2025 and lower production decline rates than anticipated over 2024 and 2025 to date.

The studies included an assessment of the following:

- An updated reservoir performance, modelling and activities outlook.

- Removal of Altera&Ocyan (A&O) FPSO charter costs, leading to a reduction in minimum economic production rates.

- An updated assessment of long term operating costs.

- Updated assessment of field abandonment costs.

- The Production Concession expiry date of February 2039.

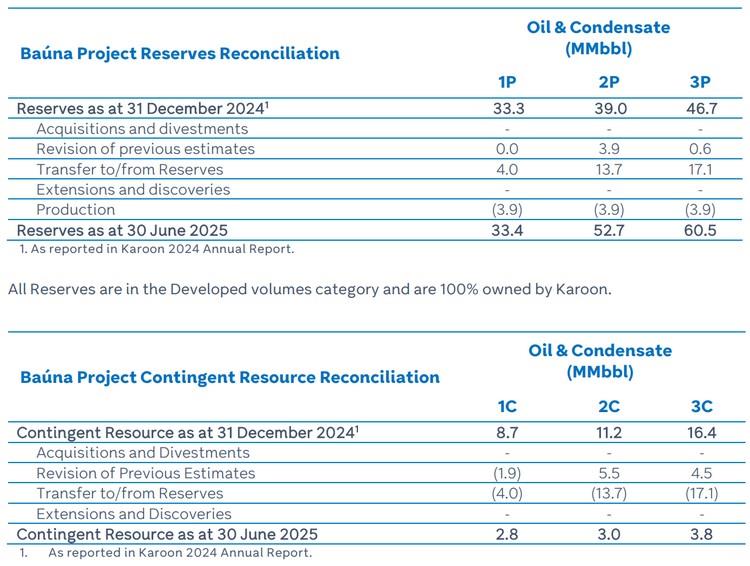

As a result, 2P Reserves have been revised upwards by 17.6 MMbbl. After production of 3.9 MMbbl for the first half of 2025, 2P Reserves as at 30 June 2025 were 52.7 MMbbl, compared to 39.0 MMbbl at 31 December 2024.

2C Contingent Resources have reduced from 11.2 MMbbl to 3.0 MMbbl over the same period. This reflects an upwards revision of 5.5 MMbbl, less the transfer of 13.7 MMbbl to the 2P Reserves category. The reassessment of Contingent Resources was based on the potential to produce until the assessed end of the facility operating life of 2040.

AGR (ABL Group Norway AS), an internationally recognised expert in petroleum resources evaluation, has performed an independent evaluation (CPR) of the Reserves. The Reserves presented in the CPR are within 5% of the Reserves presented in this release.

2P recoverable volumes have increased by 120% since acquisition of the asset in November 2020, before taking into account production over that period.

The Contingent Resources represent potentially recoverable volumes which are not yet technically mature and/or commercially viable. All Contingent Resources are 100% owned by Karoon.

Key Assumptions

Karoon expects to invest US$55-65 million in an FPSO revitalisation campaign in 2026, and approximately US$80 – 90 million (in 2025 $)for life extension activities between 2030 and 2034. The life extension CAPEX is expected to include two flotel campaigns and associated equipment upgrades.

In conjunction with expert third parties, abandonment costs, including the full demobilisation of the FPSO, have been reviewed. Due to the inclusion of the FPSO, as well as changes in scope, activity durations and vessel rates, abandonment costs have increased from US$174.9 million in 2032, to US$260.0 million in 2039.

(1) The Baúna Project comprises the Baúna, Piracaba and Patola fields in Concession BM-S-40 offshore Brazil. Reserves and Resources are as at 30 June 2025 and are based on revised technical and commercial assumptions after completion of the Baúna FPSO acquisition.

(2) Based on Reserves as at 30 June 2025 and Reserves reported at the time of acquiring Baúna (see ASX release dated 9.11.20 “Baúna - Competent Persons Report Summary”), excluding production during the calculation period.

Source: Karoon Energy