Argentina, Guyana and Brazil are poised to lead Latin American oil production growth in 2026, even though the possible return of Venezuelan barrels poses questions for the region’s long-term capital expenditure strategy. While the supermajors continue to flag Venezuela as difficult to underwrite on a long-term basis, traders and players like Trafigura and Hillcorp are increasingly drawn to near-term, structured opportunities in the country, signaling a possible rebalancing of portfolios. Although legal uncertainties persist and institutional legitimacy remains thin, recent reforms, such as the lifting of sanctions and the overhaul of Venezuela’s hydrocarbons law, reinforce US efforts to market Venezuelan barrels. Rystad Energy analysis estimates that flagship projects in Argentina, Guyana and Brazil, which are expected to add more than 700,000 barrels per day (bpd) of oil production this year, will continue to outcompete Venezuela through at least 2030. In the short term, 300,000 bpd of Venezuelan supply could be added to the market, but the likelihood of shifting investment from current Latin American powerhouses to beleaguered Venezuelan infrastructure amid an uncertain business environment remains limited.

Radhika Bansal, Vice President, Oil & Gas Research, Rystad Energy: A Venezuelan oil industry makeover will be costly and lengthy, with the big three in the region – Argentina, Guyana and Brazil – remaining largely indifferent to the estimated, near-term return of Venezuelan crude. Oversupply, whether from Venezuelan or even Iranian barrels, is what is truly testing the financial resilience of operators who would otherwise gain from a revived oil industry in the Bolivarian Republic.

Learn more with Rystad Energy’s Upstream solution.

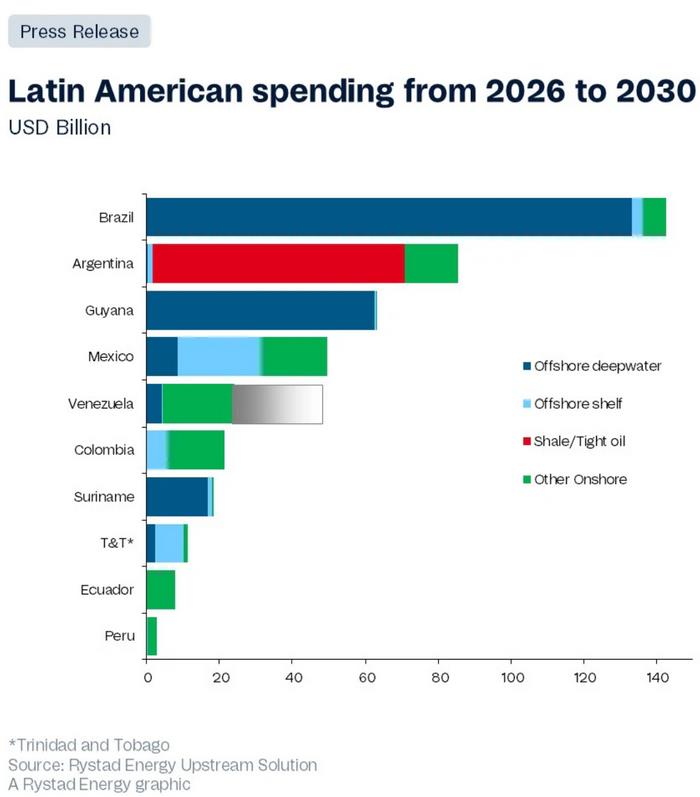

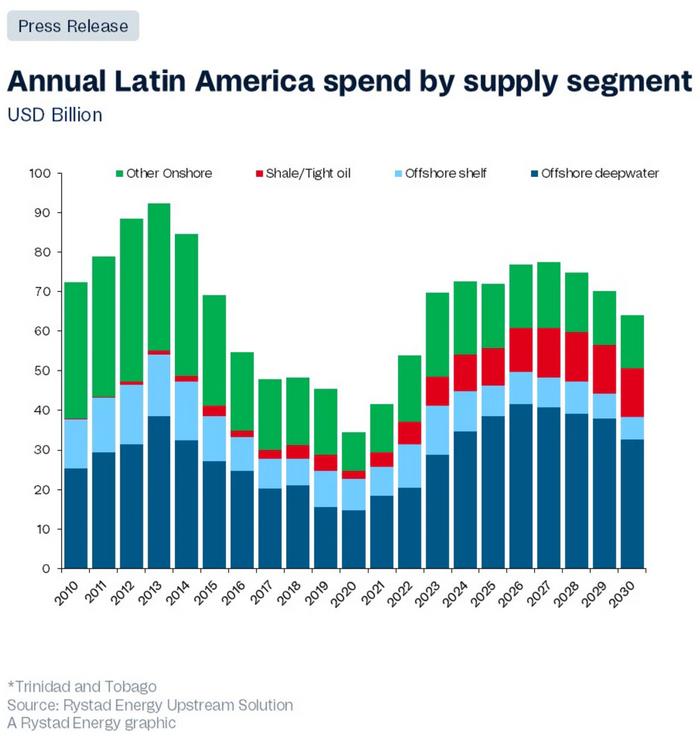

While overall investment in Latin America is expected to increase in 2026, the total volume of conventional reserves put into production will be 45% smaller than last year, signaling a consolidation of investment on projects with nearly guaranteed return on investment (ROI). Final investment decisions (FIDs) were significantly lower in the region last year, and 2026 is expected to be no different. Investment flows will be heavily routed toward greenfield projects in Guyana and Suriname, while Argentina is slated to lead the brownfield investment charge as Vaca Muerta production aggressively ramps up.

Overall, the region’s oil production forecast is expected to exceed 8.8 million bpd this year, driving the majority of non-OPEC+ supply growth and underscoring Latin America no longer moving as a single oil region, with multiple players falling behind as the ‘big three’ dictate its future. Brazil will remain the primary growth engine of 2026, with forecast production exceeding 4.2 million bpd, underpinned by the scale, resilience and cost competitiveness of its pre-salt developments. Brazil’s production growth this year is tied to new floating production, storage and offloading (FPSO) vessel ramp-ups and start-ups.

The true driver of accelerated investment in the region, however, is its shale sector, which is expected to grow from $9.4 billion in 2025 to nearly $11 billion this year, all from Argentina. Additionally, the offshore deepwater sector is expected to drum up $42 billion in investment in 2026, up 7.7% from the previous year. This trajectory has been anchored by strong fundamentals for Vaca Muerta shale and resilient barrels on the pre-salt and on new frontiers in Guyana and Suriname.

As for Venezuela, interest from smaller players is supported by license-enabled access that lowers upfront capital costs, in addition to securing heavy crude feedstock for US Gulf Coast refiners at attractive prices, and the ability for traders to manage the logistics, blending and licensing constraints required to sell Venezuelan barrels. However, projects with long lead times and heavy upfront investments, like offshore Brazil, Guyana and Suriname, remain economically viable in current oil price variations and are anchored by competitive breakeven prices, making these short-term shifts toward Venezuela less consequential. The Vaca Muerta play, although a shorter cycle shale development, has committed to building new infrastructure, so it should also react to Venezuela’s potential comeback with resilience amid declining prices.

Radhika Bansal, Vice President, Oil & Gas Research: 'Supposing oil demand stays resilient through 2035, and the impact of years-long underinvestment is fully felt, Venezuelan barrels would become far more relevant. If the industry starts making more long term, economically rational choices now, Venezuelan oil production could make sense in a higher oil price environment. However, more attractive barrels will still be at play, with Venezuela’s extra-heavy, emissions-intensive oil posing persistent challenges.'

Outside of the big three and in the near term, countries geographically closer to Venezuela may develop a different relationship in an open exploration and production (E&P) market. Trinidad and Tobago, for example, has opportunities to bring Venezuelan offshore gas to supply their liquefied natural gas (LNG) trains. Colombia, on the other hand, could see more competition for capital given the country has little remaining opportunities for oil developments. Colombia could even face labor competition, given the revamp of Venezuela's production would require a specialized workforce available in their neighbor country.

Source: Rystad Energy