- Approximately $740 million in new contract value since August fleet status report, backlog increased to $7.0 billion.

- $0.50 per share cash dividend declared for Q4, bringing 2025 total shareholder capital returns to $340 million.

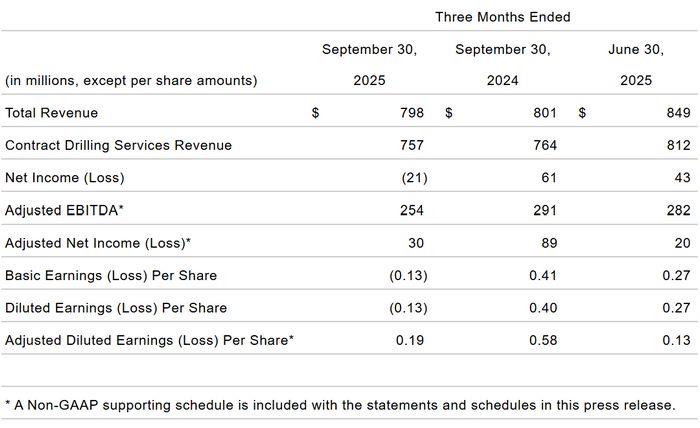

- Q3 Net Loss of $21 million, Loss per Share of $0.13, Adjusted Diluted Earnings per Share of $0.19, Adjusted EBITDA of $254 million, net cash provided by operating activities of $277 million, and Free Cash Flow of $139 million.

- Guidance for 2025 narrowed as follows: Total Revenue of $3,225 to $3,275 million ($3,200 to $3,300 million previously); Adjusted EBITDA of $1,100 to $1,125 million ($1,075 to $1,150 million previously); and Capital Expenditures (net of reimbursements) of $425 to $450 million ($400 to $450 million previously).

Noble Corporation has reported third quarter 2025 results.

Robert W. Eifler, President and Chief Executive Officer of Noble, stated 'We achieved solid operational performance and cash flow in the third quarter, while several key contract awards have enabled Noble to expand backlog compared to prior quarter and year ago levels. These contracting wins deepen our position in our customers' core basins and reflect Noble's commitment to driving value for our customers and shareholders in a capital disciplined energy environment.'

Third Quarter Results

Contract drilling services revenue for the third quarter of 2025 totaled $757 million compared to $812 million in the prior quarter, with the sequential decrease driven primarily by rig utilization. Utilization of the 35 marketed rigs was 65% in the third quarter of 2025 compared to 73% in the prior quarter. Contract drilling services costs for the third quarter were $480 million, down from $502 million in the prior quarter. Net income (loss) decreased to $(21) million in the third quarter of 2025, down from $43 million in the prior quarter, and Adjusted EBITDA decreased to $254 million in the third quarter of 2025, down from $282 million in the prior quarter. Net cash provided by operating activities in the third quarter of 2025 was $277 million, capital expenditures were $138 million, and free cash flow (non-GAAP) was $139 million. Additionally, net disposal proceeds during the quarter totaled $87 million.

Balance Sheet & Capital Allocation

The Company's balance sheet as of September 30, 2025, reflected total debt principal value of $2 billion and cash (and cash equivalents) of $478 million.

On October 27, 2025, Noble's Board of Directors approved an interim quarterly cash dividend on our ordinary shares of $0.50 per share for the third quarter of 2025. The $0.50 per share dividend is expected to be paid on December 18, 2025, to shareholders of record at close of business on December 4, 2025. Future quarterly dividends and other shareholder returns will be subject to, amongst other things, approval by the Board of Directors.

Operating Highlights and Backlog

Noble's fleet of twenty-four marketed floaters was 67% contracted during the third quarter compared with 78% in the prior quarter. Recent backlog additions since last quarter have added over four rig years of total backlog, bringing total rig years of backlog added during 2025 to 22 rig years. Recent dayrate fixtures for Tier-1 drillships have remained in the low to mid $400,000s. Utilization of Noble's eleven marketed jackups was 60% in the third quarter versus 63% utilization during the prior quarter. Leading edge dayrates for harsh environment jackups in the North Sea have remained stable across a limited number of contract fixtures.

Subsequent to last quarter's earnings press release, new contracts with a total contract value of approximately $740 million include the following:

- Noble Black Lion and Noble Black Hornet were both awarded two-year contract extensions with bp in the U.S. Gulf, extending the rigs into September 2028 and February 2029, respectively. These extensions are valued at $310 million per rig, excluding MPD, and both have an additional one-year priced option.

- Noble Venturer received a contract from Amni International for one exploration well in Ghana at a dayrate of $450,000. This contract is expected to follow in direct continuation of the rig's current program in Ghana.

- Noble Resolute was awarded a one-year contract from Eni in the North Sea at a dayrate of $125,000, expected to commence in December 2025.

- Noble Interceptor was awarded a contract for a 150-days accommodation scope in Norway, scheduled to commence in August 2026. Total contract value is $38.7 million including mobilization and demobilization.

- Noble Developer had an option exercised by Petronas for one additional well in Suriname in early 2026.

Backlog as of October 27, 2025, stands at $7.0 billion. Backlog excludes mobilization and demobilization revenue. The previously announced sales of the jackup Noble Highlanderand drillship Pacific Meltem closed in the third quarter, generating combined net proceeds of $87 million. Subsequently, the Noble Reacher, previously employed as an accommodation and intervention unit, was sold in October for $27.5 million. The Noble Globetrotter II remains held for sale.

Outlook

For the full year 2025, Noble narrows guidance as follows: Total Revenue guidance in the range of $3,225 to $3,275 million (previously $3,200 to $3,300 million); Adjusted EBITDA in the range of $1,100 to $1,125 million (previously $1,075 to $1,150 million), and Capital Expenditures (net of reimbursements) in the range of $425 to $450 million (previously $400 to $450 million).

Commenting on Noble's outlook, Mr. Eifler stated, 'Our recent backlog expansion and constructive customer dialogue continue to support the formation of a deepwater utilization recovery by late 2026 or early 2027. While we anticipate a moderately lower earnings and cash flow profile in H1 2026 compared to H2 2025, the foundation for an improving market and corresponding earnings inflection is well underway. In the meantime, Noble remains committed to our meaningful dividend program in expectation of providing a durable cash yield for our shareholders through the cycle.'

Due to the forward-looking nature of Adjusted EBITDA and Capital Expenditures (net of reimbursements), management cannot reliably predict certain of the necessary components of the most directly comparable forward-looking GAAP measure, net income, and capital expenditures, respectively. Accordingly, the Company is unable to present a quantitative reconciliation of such forward-looking non-GAAP financial measure to the most directly comparable forward-looking GAAP financial measure without unreasonable effort. The unavailable information could have a significant effect on Noble's full year 2025 GAAP financial results.

Source: Noble Corp