Noble Corporation reports fourth quarter and full year 2025 results.

Robert W. Eifler, President and Chief Executive Officer of Noble, stated, 'Solid fourth quarter performance brought our full year 2025 Adjusted EBITDA to the upper half of the original guidance range and contributed to another year of strong free cash flow. Noble’s commercial success continues to build with the recent award of nearly 10 rig years of new bookings comprising $1.3 billion of high quality backlog. Meanwhile, we have continued to sharpen and high-grade our fleet posture and balance sheet with the announced divestitures of six jackups – collectively creating a platform of optimal focus, scale, and financial strength.'

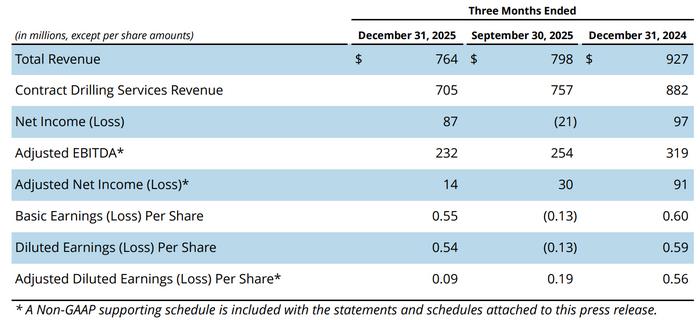

Fourth Quarter Results

Contract drilling services revenue for the fourth quarter of 2025 totaled $705 million compared to $757 million in the prior quarter, with the sequential decrease driven by lower average utilization and dayrates. Marketed fleet utilization was 64% in the three months ended December 31, 2025, compared to 65% in the prior quarter. Contract drilling services costs for the fourth quarter were $471 million, down from $480 million in the prior quarter. Net income (loss) increased to $87 million in the fourth quarter, up from $(21) million in the prior quarter, and Adjusted EBITDA decreased to $232 million in the fourth quarter, down from $254 million in the prior quarter. Net cash provided by operating activities in the fourth quarter was $187 million, Capital Expenditures were $152 million (including $18 million associated with the termination of the BOPs service agreement), and free cash flow (nonGAAP) was $35 million.

Balance Sheet and Capital Allocation

The Company's balance sheet as of December 31, 2025, reflected total debt principal value of $2 billion and cash (and cash equivalents) of $471 million. Share repurchases for 2025 totaled $20 million, and $318 million in dividends were paid during the year.

Today, Noble’s Board of Directors approved a quarterly interim dividend of $0.50 per share for the first quarter of 2026. This dividend is expected to be paid on March 19, 2026 to shareholders of record at close of business on March 4, 2026. Future quarterly dividends and other shareholder returns will be subject to, amongst other things, approval by the Board of Directors, and may be modified as market conditions dictate.

Operating Highlights and Backlog

Noble's marketed fleet of 24 floaters was 62% contracted through the fourth quarter, compared with 67% in the prior quarter, primarily due to contract rollovers on the Noble BlackRhino and Ocean Apex. Recent backlog additions since last quarter have added 9.3 rig years of total floater backlog and support renewed utilization for four currently idle rigs. Recent dayrate fixtures for Tier-1 drillships have been in the +/- $400,000 range, with 6th generation floater fixtures between the low $300,000s to low $400,000s per day.

Utilization of Noble's 11 marketed jackups was 68% in the fourth quarter versus 60% utilization during the prior quarter. Excluding the six jackups whose divestiture is completed or pending, contracted utilization of Noble’s five ultra-harsh jackups is anticipated to improve from 60% in the first quarter to 100% by early in the third quarter this year.

Subsequent to last quarter’s earnings press release, new contracts with total contract value of over $1.3 billion (including additional services and mobilization payments, but excluding extension options) include the following:

• ExxonMobil has awarded two additional rig years of backlog under the Commercial Enabling Agreement (“CEA”) in Guyana, which has been assigned evenly across the four drillships, extending each rig to February of 2029.

• Noble GreatWhite was awarded a three-year contract with Aker BP in Norway valued at $473 million, including mobilization but excluding additional fees for integrated services and bonus potential.

• Noble Gerry de Souza was awarded a two-year contract with ExxonMobil in Nigeria, valued at $292 million and estimated to commence in mid-2026. Plus three years of optional extensions.

• Noble BlackRhino was awarded a contract for one well with Beacon Offshore Energy in the US Gulf scheduled to commence in March 2026 with an estimated duration of 50 days. The contract includes an option for an additional well with an estimated duration of 100 days.

• Noble Developer was awarded a three-well contract with estimated duration of 240 days with bp in Trinidad scheduled to commence in Q1 2027 at a dayrate of $375,000. Plus options for up to three additional wells with an estimated combined duration of 240 days.

• Noble Endeavor was awarded an 11-well contract with an undisclosed operator in South America, estimated to commence in late 2026 at a dayrate of $300,000 per day plus mobilization and demobilization fees with the potential for additional revenue from a performance incentive provision.

Noble's backlog as of February 11, 2026, stands at $7.5 billion.

Outlook

For the full year 2026, Noble announces a guidance range for Total Revenue of $2,800 to $3,000 million, Adjusted EBITDA in the range of $940 to $1,020 million, and Capital Expenditures between $590 to $640 million. This range of Capital Expenditures includes 50% of the estimated $160 million project capital for the Noble GreatWhite, as well as approximately $25 million of reimbursable capital.

Commenting on Noble’s outlook, Mr. Eifler stated, 'Recent improvement in our contract coverage, coupled with ongoing customer dialogue, indicate a likelihood of a tightening market as we progress through this year. While 2026 is anticipated to be a transitional year from an earnings perspective, the foundation for a meaningful inflection is becoming increasingly tangible, supported by the unique circumstance of our 2027 backlog now already eclipsing current year backlog. In the meantime, we remain highly focused on safe and efficient service delivery for our customers, and a compelling return of capital proposition for shareholders.'

Due to the forward-looking nature of Adjusted EBITDA, management cannot reliably predict certain of the necessary components of the most directly comparable forward-looking GAAP measure, net income. Accordingly, the Company is unable to present a quantitative reconciliation of such forward-looking non-GAAP financial measure to the most directly comparable forward-looking GAAP financial measure without unreasonable effort. The unavailable information could have a significant effect on Noble’s full year 2026 GAAP financial results.

Source: Noble Corporation