Ørsted’s Board of Directors has approved the annual report for 2022.

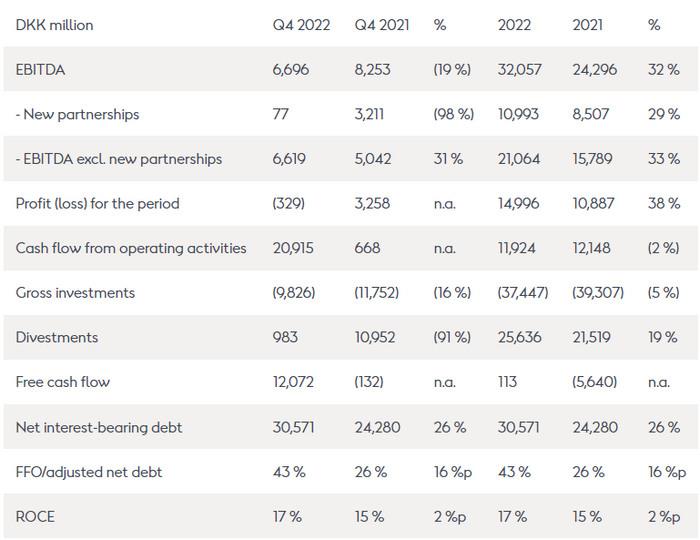

The operating profit (EBITDA) for the year amounted to DKK 32.1 billion, the highest EBITDA ever, of which the gain from the 50% farm-downs of Hornsea 2 and Borkum Riffgrund 3 amounted to DKK 11.0 billion in total.

EBITDA excluding new partnership agreements amounted to DKK 21.1 billion, an increase of DKK 5.3 billion compared to 2021. The Company benefitted from its diverse portfolio and achieved significantly higher earnings from the onshore wind and solar PV business, its combined heat and power plants, and its gas activities than expected at the beginning of the year, while earnings in Offshore decreased. The unexpected decrease in Offshore was primarily due to adverse impacts from hedges and delays at the Hornsea 2 and Greater Changhua 1 & 2a construction projects.

Net profit amounted to DKK 15.0 billion, and return on capital employed (ROCE) came in at 17%.

The Board of Directors recommends a dividend of DKK 13.5 per share (DKK 5.7 billion in total), up 8.0 % and in line with our dividend policy.

In 2023, EBITDA excluding new partnership agreements is expected to be DKK 20-23 billion, and gross investments are expected to be DKK 50-54 billion.

Mads Nipper, Group President and CEO of Ørsted, says:

'In a year with unusual market conditions, not least the very volatile energy prices and a substantial increase in inflation, we’re happy to achieve a record-high operating profit for 2022.

We achieved strong operational performance with our assets remaining fully operational and having robust availability rates. Our CHP plants supported the much-needed security of supply in Denmark.

Furthermore, we achieved significant strategic results across our business, and we remain confident in our long-term financial estimates and growth ambitions. The world is facing a climate crisis, and it’s indisputable that a transition to a sustainable energy system is needed. We’re ready to be part of this much-needed renewable energy build-out.'

Ørsted achieved significant strategic results during 2022, including:

Offshore

- In the UK, we were awarded a contract for difference for building Hornsea 3, the world’s single biggest offshore wind farm, and we commissioned Hornsea 2, the world’s largest operating wind farm.

- In the US, we continued the development of our portfolio of offshore wind projects off the East Coast, including taking final investment decision on South Fork.

- Despite challenges in Taiwan, we continued the progress in all areas of the construction of Greater Changhua 1 & 2a and expect to commission the wind farm in H2 2023.

- We took significant steps into floating wind in Scotland and Spain.

Onshore

- We took further steps in Europe by completing the acquisition of Ostwind, which has a development project pipeline of more than 1.5 GW in Germany and France.

- We entered new partnerships in Spain to pursue early-stage solar and onshore wind projects.

- In the US, we added 1.3 GW to our portfolio following our final investment decision of three large onshore and solar PV farms (Sunflower, Mockingbird, and Eleven Mile), which will increase our installed capacity with more than 30 %.

P2X

- We took FID and acquired the remaining 55 % of FlagshipONE, the largest e-methanol project under construction in Europe.

- Our ‘Green Fuels for Denmark’ project and our Haddock P2X project in the Netherlands received IPCEI funding.

- We signed a landmark letter of intent with A.P. Moller – Maersk to deliver 300,000 tonnes of e-methanol on the US Gulf Coast.

Financial key figures for 2022:

The annual report and reports about remuneration, sustainability and ESG performance are available for download at: https://orsted.com/en/investors/ir-material/annual-reporting-2022

Source: Ørsted