Panoro Energy has reported financial and operational performance for Q3 and the first nine months of 2025.

Julien Balkany, Executive Chairman of Panoro, commented:

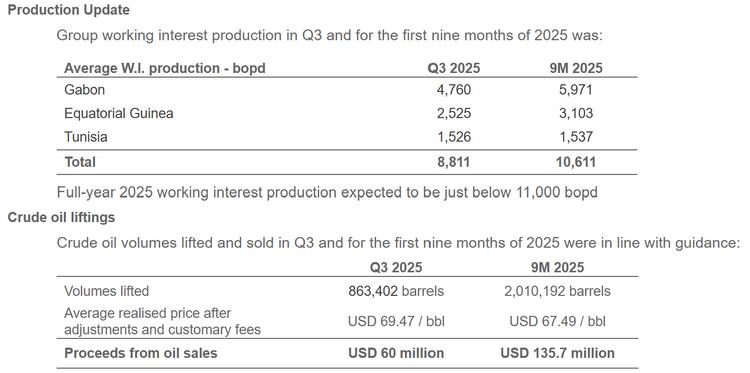

'As previously communicated our group working interest production of 10,611 bopd in the first nine months is a 15 per cent increase compared to the same period last year, and reflects continued strong performance at our flagship Dussafu block offshore Gabon where we are set to resume development drilling in the coming months at MaBoMo Phase 2 and are also progressing the Bourdon discovery to final investment decision. Output in Tunisia has been stable partially offsetting the unplanned downtime in Equatorial Guinea, where deferred volumes are in the process of being restored at Block G. Our financial performance in the first nine months has tracked our crude oil lifting schedule which has been in line with expectations.

On the exploration side we are accelerating workstreams and seeing some positive activities across our portfolio. On the Niosi and Guduma blocks offshore Gabon that have vastly increased our footprint in the vicinity of Dussafu, we are about to start acquiring new 3D seismic. In Equatorial Guinea, our promising block EG-23 offers significant discovered resources with an extensive inventory of prospects that are under evaluation and could be tied back to nearby existing infrastructure.

The Board has today declared a Q3 cash distribution of NOK 80 million, bringing aggregate cash distributed year-to-date to NOK 320 million. Together with share buybacks year-to-date of NOK 83.2 million we have returned over NOK 403 million so far in 2025 to shareholders in line with our shareholder returns policy.'

Note: Proceeds from oil sales differs to total reported revenue which includes a gross up for state profit oil in Gabon with a corresponding amount included as deemed income tax for reporting purposes

- Realised price of USD 69.47/bbl in Q3 represents a premium of ~1 percent over the actual average Brent oil price in the same period

- Major crude oil lifting of 949,102 barrels completed in Gabon mid-November at a price of USD 61.17 /bbl after customary adjustments and fees

- 2025 crude oil liftings expected to be 3.1 to 3.4 million barrels subject to scheduling

Financial Update

- Reported revenue in Q3 was USD 63.5 million (Q2: USD 67.0 million)

- Q3 EBITDA was USD 19.3 million (Q2: USD 35.4 million) and reflects an inventory movement of negative USD 14.1 million arising from the expensing of Q2 inventory build up which was lifted and sold in Q3

- Q3 profit before tax was USD 1.5 million (Q2: USD 16.1 million) and net loss USD 3.1 million (Q2: net profit USD 11.2 million)

- EBITDA for the first nine months was USD 70 million (9M 2024: USD 101.4 million) with profit before tax of USD 12.2 million (9M 2024: USD 46.6 million) and net loss of USD 5.0 million (9M 2024: net profit 24.4 million)

- Net cash from operations for the first nine months was USD 23.9 million (9M 2024: USD 81.5 million)

- Full year 2025 capital expenditure guidance is unchanged at USD 40 million. Capital expenditures in the first nine months were USD 29.7 million

- Cash at bank at 30 September 2025 was USD 43.7 million which includes advances taken against future oil liftings of USD 15 million

- Gross debt outstanding at 30 September 2025 comprised solely of USD 150 million senior secured notes

- Net leverage ratio 1.04x at 30 September 2025 based on trailing 12 month EBITDA

Shareholder returns

- In line with the Company’s previously communicated 2025 shareholder returns policy, permitted distributions for calendar year 2025 are USD 45 million (NOK ~500 million) inclusive of all amounts returned year-to-date

- Q3 cash distribution declared of NOK 80 million will bring cumulative cash 2025 distributions to NOK 320 million when paid on or around 10 December 2025. Cash distributions are paid as a return of paid in capital

- As at market close on 19 November cumulative 2025 year-to-date share buybacks were NOK 83.2 million

Operations Update

Gabon

- Field delivery remains strong and steady at the Dussafu Marin Permit offshore Gabon (Panoro 17.5 percent). Three weeks of planned annual maintenance was completed on schedule during Q3, limiting production availability to 80 percent for the period

- Final Investment Decision (“FID”) taken for MaBoMo Phase 2 drilling programme (previously Hibiscus Ruche Phase 2), comprising four planned development wells. First oil targeted in H2 2026

- Bourdon discovery being matured towards FID with an expected initial three wells and a development cluster concept based on the MaBoMo blueprint

- 3D seismic acquisition is due to commence shortly across the Niosi, Guduma and Dussafu licenses with completion anticipated during Q1 2026

Equatorial Guinea

- As previously communicated, production at Block G offshore Equatorial Guinea (Panoro 14.25 percent) has been impacted by unplanned facilities related downtime at the Ceiba field

- Progress towards recovery of deferred volumes is being made with partial restoration of production at Ceiba achieved. The expectation is that production will be normalised by Q1 2026

- At Block EG-23 offshore Equatorial Guinea (Panoro 80 percent, operator) seismic reprocessing and subsurface studies are ongoing with particular focus on existing discoveries (some of which have been tested) and surrounding prospectivity in shallow water depths of ~60 metres

- Estrella discovery has been high-graded as a potential fast-track development candidate within tie-back distance to existing infrastructure (early concepts being evaluated)

- Estrella-1 well discovered 60 metres net hydrocarbon pay in 2001 and was tested at 6,780 bopd (48 - 50° API) and 48.7 MMscfd

- Six further oil, gas and gas/condensate discoveries have been made on the block

Tunisia

- Production has remained stable at the TPS Assets in Tunisia (Panoro 49 percent) where ongoing workovers and upcoming optimisation campaigns are expected to positively impact production

Source: Panoro Energy