Petrofac has issued its financial results for the year ended 31 December 2023 and an update on progress with respect to its review of strategic and financial options. The Company is in discussions with the Financial Conduct Authority to seek a reinstatement of trading in its shares.

OPERATIONAL AND FINANCIAL PERFORMANCE:

- Strong order intake of US$7.1 billion, driving significant backlog growth to US$8.1 billion

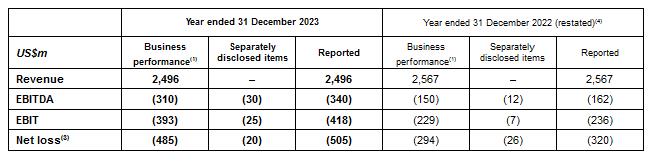

- Group business performance EBIT loss of US$(393) million

- Full year cash outflow of US$223 million, with neutral cash flows in the second half

- Year-end net debt of US$583 million and gross liquidity of US$201 million

Tareq Kawash, Petrofac’s Group Chief Executive, commented:

'2023 was a challenging year for Petrofac. Our financial results reflect additional losses on the legacy contract portfolio, in particular the Thai Oil Clean Fuels contract where we are in negotiations to seek reimbursement of a proportion of the additional costs. In addition, the challenges in obtaining guarantees for our new EPC contracts, and the impact on liquidity, resulted in the business seeking to deliver a critical financial restructure, which is ongoing and has the full focus of the Board.

'However, 2023 was also one of the strongest years in the Group’s recent history with respect to new contract awards, demonstrating Petrofac’s capability, strong customer relationships, differentiated delivery model, and competitiveness.

'We are focused on the restructuring with the aim of materially strengthening the Group’s financial position and enabling Petrofac to deliver on its future opportunities. I am grateful to our employees and our stakeholders for their continued support as we work to deliver a positive future for Petrofac.'

Click here for full announcement

Source: Petrofac