Shell has released its fourth quarter results and fourth quarter interim dividend announcement for 2022.

Shell Chief Executive Officer, Wael Sawan, said:

'Our results in Q4 and across the full year demonstrate the strength of Shell's differentiated portfolio, as well as our capacity to deliver vital energy to our customers in a volatile world.

We believe that Shell is well positioned to be the trusted partner through the energy transition. As we continue to put our Powering Progress strategy into action, we will build on our core strengths, further simplify the organisation and focus on performance. We intend to remain disciplined while delivering compelling shareholder returns, as demonstrated by the 15% dividend increase and the $4 billion share buyback programme announced today.'

STRONG RESULTS, DISCIPLINED CAPITAL ALLOCATION

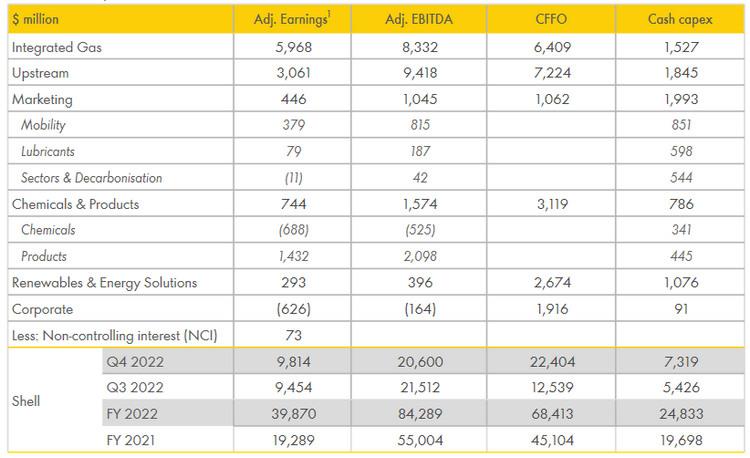

- Strong performance in a continuing uncertain economic environment. Q4 2022 Adjusted Earnings of $9.8 billion, with Adjusted EBITDA of $20.6 billion, despite lower oil and gas prices compared with Q3 2022, with higher LNG trading and optimisation results.

- 15% dividend per share increase for the fourth quarter. $4 billion share buybacks announced, expected to be completed by Q1 2023 results announcement.

- 2022 full year shareholder distributions $26 billion. Total distributions in excess of 35% of CFFO for 2022.

- Strengthening the portfolio with the announced acquisition of Nature Energy (Denmark), a renewable natural gas producer, winning the wind tender for Hollandse Kust (west) VI as part of the Ecowende joint venture and further simplifying the portfolio with the merger of Shell Midstream Partners (USA).

- 2023 cash capex outlook: $23 - 27 billion.

(1) Income/(loss) attributable to shareholders for Q4 2022 is $10.4 billion. Reconciliation of non-GAAP measures can be found in the unaudited results, available on www.shell.com/investors.

Click here for full announcement

Source: Shell