Shell has announced its fourth quarter 2024 results.

Shell Chief Executive Officer, Wael Sawan, said:

'2024 was another year of strong financial performance across Shell. Despite the lower earnings this quarter, cash delivery remained solid and we generated free cash flow of $40 billion across the year, higher than 2023, in a lower price environment. Our continued focus on simplification helped to deliver over $3 billion in structural cost reductions since 2022, meeting our target ahead of schedule, whilst also making significant progress against all our other financial targets(1).

Today, we announce a 4% increase in our dividends and another $3.5 billion buyback programme, making this the 13th consecutive quarter of at least $3 billion of buybacks, all whilst further strengthening our balance sheet this year to position us well for the future.

We will outline the next steps in our strategy to deliver more value with less emissions at our Capital Markets Day in March.'

SOLID CASH FLOW GENERATION; RESILIENT DISTRIBUTIONS

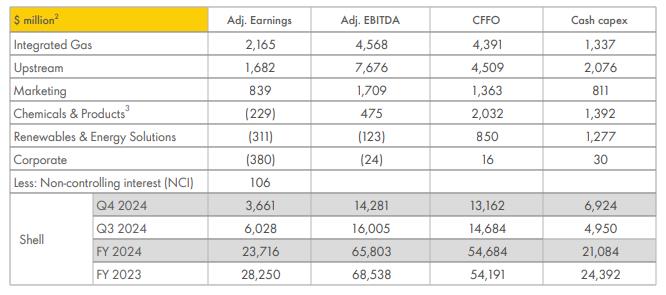

• Robust CFFO of $13.2 billion in Q4 2024, with CFFO of $54.7 billion and free cash flow of $39.5 billion for the full year 2024. $22.6 billion distributed to shareholders in 2024, representing 41% of CFFO generated.

• Q4 2024 Adjusted Earnings(2) of $3.7 billion reflect lower prices and margins, higher exploration well write-offs, and the noncash impact of expiring hedging contracts on LNG trading and optimisation results.

• Structural cost reductions of $3.1 billion achieved since 2022, meeting the 2023 Capital Markets Day (CMD23) target a year early, with significant progress against the other CMD23 financial targets(1) .

• Focus on disciplined capital allocation drove down 2024 cash capex to $21.1 billion; our cash capex range for the full year 2025 is expected to be lower than our 2024 range, with more guidance to come at the Capital Markets Day in March.

• Increasing dividend per share by 4% to $0.358 for the fourth quarter, while commencing a $3.5 billion share buyback programme, expected to be completed by Q1 2025 results announcement.

(1) Progress to date on the financial targets that were announced during Capital Markets Day in June 2023 is available at www.shell.com/2024-progress-on-cmd23.html.

(2) Income/(loss) attributable to shareholders for Q4 2024 is $0.9 billion. Reconciliation of non-GAAP measures can be found in the unaudited results, available at www.shell.com/investors

(3) Chemicals & Products Adjusted Earnings at a subsegment level are as follows - Chemicals $(0.3) billion and Products $0.0 billion.

Click here for full announcement and Quarterly Results Presentation

Source: Shell