Shell has announced its Q4 2025 results.

Shell Chief Executive Officer, Wael Sawan said: '2025 was a year of accelerated momentum, with strong operational and financial performance across Shell. We generated free cash flow of $26 billion, made significant progress in focusing our portfolio and reached $5 billion of cost savings since 2022, with more to come. In Q4, despite lower earnings in a softer macro, cash delivery remained solid and today we announce a 4% increase in our dividend and $3.5 billion share buyback, making this the 17th consecutive quarter of at least $3 billion of buybacks.'

CONSISTENT DELIVERY WITH MORE TO COME

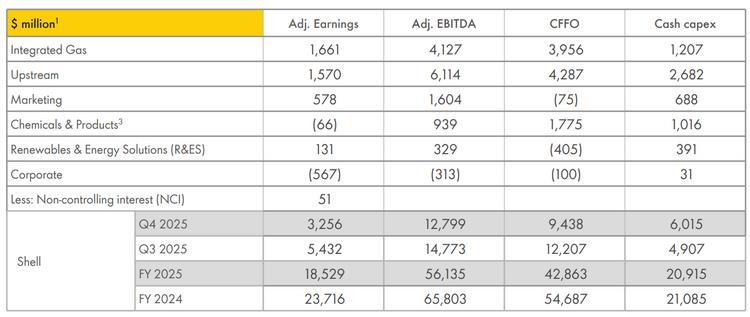

- Q4 2025 Adjusted Earnings1 of $3.3 billion and CFFO of $9.4 billion, supported by strong operational performance in Upstream and Integrated Gas in a lower price environment, offset by year-end movements(1).

- Resilient CFFO of $42.9 billion for the full year of 2025. Shareholder distributions of ~52% of CFFO.

- Strong balance sheet with net debt of ~$45.7 billion ($16.8 billion excluding leases), gearing 20.7%.

- Structural cost reductions of $5.1 billion achieved since 2022; delivered $2.0 billion in 2025(2).

- Disciplined capital allocation with 2025 cash capex of $20.9 billion; cash capex outlook for 2026: $20 - 22 billion.

- Increasing dividend per share by 4% to $0.372 for the fourth quarter, while commencing a $3.5 billion share buyback programme, expected to be completed by Q1 2026 results announcement.

- Significant strategic portfolio actions taken throughout 2025, including Nigeria Onshore, Canadian Oil Sands and Singapore Chemicals & Refinery exits, while strengthening our Integrated Gas and Upstream portfolios with Pavilion acquisition & equity increases across our Deepwater portfolio.

Click here for full announcement

Source: Shell