Shell has released its second quarter 2023 results.

Shell Chief Executive Officer, Wael Sawan, said: 'Shell delivered strong operational performance and cash flows in the second quarter, despite a lower commodity price environment. Today we are delivering on our Capital Markets Day commitment of a 15% dividend increase. We are going further on our buyback guidance by commencing a $3 billion programme for the next three months and, subject to Board approval, at least $2.5 billion at the Q3 2023 results. As we deliver more value with less emissions, we will continue to prioritise share buybacks, given the value that our shares represent.'

STRONG OPERATIONAL AND CASH PERFORMANCE, ENHANCED DISTRIBUTIONS

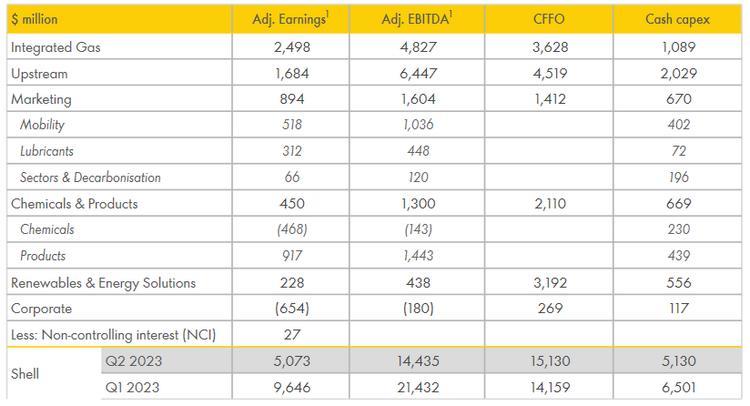

- Q2 2023 Adjusted Earnings of $5.1 billion, with lower oil and gas prices and refining margins, lower volumes and lower LNG trading & optimisation results. CFFO of $15.1 billion for the quarter, with a $4.8 billion working capital inflow offsetting tax payments.

- $3 billion share buybacks announced, expected to be completed by Q3 2023 results announcement. Quarterly dividend increase of 15% to $0.331 per share.

- Cash capex outlook range for 2023 lowered to $23 - 26 billion.

(1) Income/(loss) attributable to shareholders for Q2 2023 is $3.1 billion. Reconciliation of non-GAAP measures can be found in the unaudited results, available on www.shell.com/investors.

Click here for full announcement

Source: Shell