Shell has announced its second quarter 2024 results.

Shell Chief Executive Officer, Wael Sawan, said:

'Shell delivered another strong quarter of operational and financial results. We further strengthened our leading LNG portfolio, and made good progress across our Capital Markets Day 2023 financial targets, including $1.7 billion of structural cost reductions since 2022. Today, we have also announced a further $3.5 billion buyback programme for the next three months. We continue to demonstrate that we are delivering more value with less emissions.'

ANOTHER QUARTER OF STRONG RESULTS

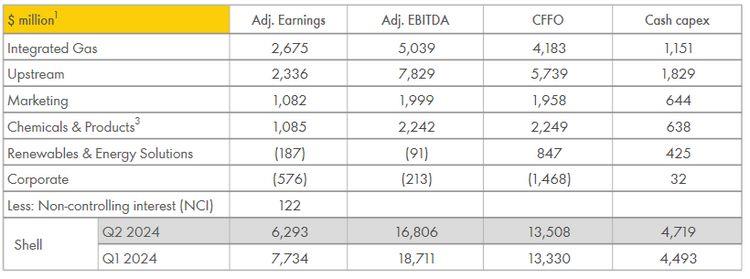

- Q2 2024 Adjusted Earnings(1) of $6.3 billion, reflecting strong operational performance at the start of the summer season. CFFO of $13.5 billion for the quarter includes a working capital outflow of $0.3 billion.

- Commencing a $3.5 billion share buyback programme, expected to be completed by Q3 2024 results announcement. Over the last 4 quarters, total shareholder distributions paid were 43% of CFFO. Dividend stable at $0.344 per ordinary share.

- $0.7 billion of structural cost reductions(2) delivered in the first half of 2024, bringing the total reductions since 2022 to $1.7 billion against a Capital Markets Day 2023 target of $2 - 3 billion by the end of 2025.

- 2024 cash capex outlook unchanged ($22 - 25 billion).

- Further strengthened our leadership position in LNG, with agreement to acquire Pavilion Energy in Singapore, partner in the ADNOC Ruwais LNG project in Abu Dhabi, and taking final investment decision (FID) on the Manatee backfill project in Trinidad and Tobago. Enhanced our advantaged Upstream portfolio with a focus on cash flow longevity by taking FID on Atapu-2 in Brazil.

(1) Income/(loss) attributable to shareholders for Q2 2024 is $3.5 billion, and includes non-cash post-tax impairments of $0.8 billion in Marketing principally relating to a biofuels facility located in the Netherlands and $0.7 billion in Chemicals & Products principally relating to an Energy and Chemicals park located in Singapore. Reconciliation of non-GAAP measures can be found in the unaudited results, available at www.shell.com/investors.

(2) Structural cost reductions describe decreases in underlying operating expenses as a result of operational efficiencies, divestments, workforce reductions and other cost saving measures that are expected to be sustainable compared with 2022 level. The 2025 target reflects annualised savings achieved by end-2025.

(3) Chemicals & Products adjusted earnings at a subsegment level are as follows - Chemicals $0.05 billion and Products $1.0 billion.

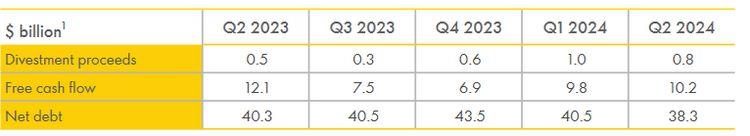

CFFO of $13.5 billion for Q2 2024 includes a working capital outflow of $0.3 billion. CFFO reflects tax payments of $3.4 billion. Net debt reduced by $2.2 billion over the quarter to $38.3 billion.

(1) Reconciliation of non-GAAP measures can be found in the unaudited results, available at www.shell.com/investors.

Click here for full announcement and Presentation

Source: Shell