Shell has released its third quarter 2023 results.

Shell Chief Executive Officer, Wael Sawan, said:

'Shell delivered another quarter of strong operational and financial performance, capturing opportunities in volatile commodity markets. We continue to simplify our portfolio while delivering more value with less emissions. Shell is commencing a $3.5 billion buyback programme for the next three months, bringing the buybacks for the second half of 2023 to $6.5 billion, well in excess of the $5 billion announced at Capital Markets Day in June. This takes total announced shareholder distributions for 2023 to ~$23 billion.'

CONSISTENT PERFORMANCE, SUPPORTING ENHANCED DISTRIBUTIONS

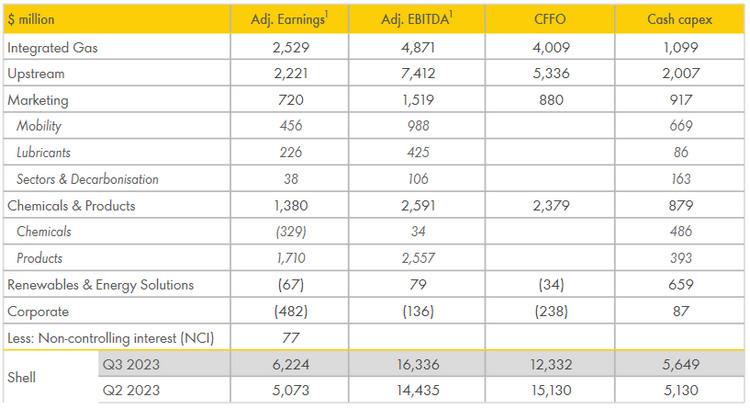

- Q3 2023 Adjusted Earnings of $6.2 billion, reflecting robust operational performance and higher oil prices and refining margins. CFFO of $12.3 billion for the quarter, with a $0.4 billion working capital inflow, despite higher oil prices.

- Enhancing shareholder distributions with $3.5 billion share buybacks announced, expected to be completed by Q4 2023 results announcement. Total announced distributions for 2023 ~$23 billion, with dividend per share this quarter being 32% higher than in Q3 2022.

- Demonstrating capital discipline with cash capex outlook for 2023 of $23 - 25 billion.

(1) Income/(loss) attributable to shareholders for Q3 2023 is $7.0 billion. Reconciliation of non-GAAP measures can be found in the unaudited results, available on www.shell.com/investors.

Source: Shell