Subsea 7 has announced results of Subsea7 Group for the third quarter which ended 30 September 2025.

Highlights

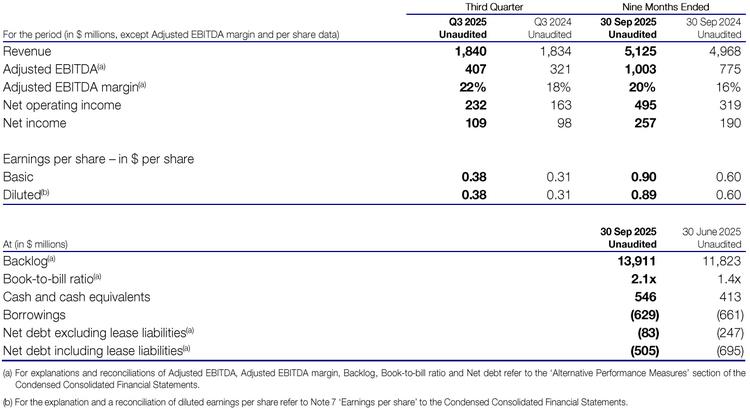

- Third quarter Adjusted EBITDA of $407 million, up 27% on the prior year period, equating to a margin of 22%

- Solid operational and financial performance from both Subsea and Conventional and Renewables, with Adjusted EBITDA margins of 24% and 17%, respectively

- Full year 2025 revenue is expected to be in a range between $6.9 and 7.1 billion while margins are expected to be between 20 and 21%

- Record high, quality backlog of $13.9 billion including $6.0 billion for execution in 2026 and $3.8 billion in 2027

- Based on our firm backlog of contracts for execution in 2026, we expect revenue within a range of $7.0 to 7.4 billion, while our Adjusted EBITDA margin is expected to be approximately 22%

- Strong balance sheet, with net debt including lease liabilities of $505 million, equating to 0.4 times the Adjusted EBITDA generated in the last four quarters

John Evans, Chief Executive Officer, said:

'Subsea7 delivered 27% growth in Adjusted EBITDA in the third quarter of 2025 driven by a strong performance in Subsea and Conventional and Renewables. Group revenue remained at a high level while our Adjusted EBITDA margin increased by more than 460 bps year-on-year. This was the result of both solid execution, particularly in Subsea and Conventional, as well as the continued mix-shift of our backlog towards contracts with a more favourable risk-reward balance.

The resilience of our strategy - focused on long-cycle energy projects with advantaged economics - was demonstrated in the third quarter with order intake of $3.8 billion representing a book-to-bill of over 2 times, equating to a book- to-bill of 1.4 times for the first nine months of 2025. The award in August of a third subsea scope for the Sakarya gas development in Türkiye was a strong endorsement of the ability of our 3,000 engineers and project managers, as well as our experienced offshore crews, to leverage our differentiated solutions to create value for clients.

We expect the positive momentum in our business to continue supported by a record backlog approaching $14 billion as well as active tendering on a strong portfolio of future opportunities.'

Third quarter project review

Within Subsea and Conventional, our vessels remained busy across the world, achieving a high level of utilisation. Seven Vega spent the majority of the quarter in Norway, installing pipe-in-pipe at Yggdrasil. Seven Oceans, Seven Navica and Seven Arctic were also active in Norway, at Irpa and Øst Frigg. In addition, in September, Seven Navica worked at Murlach and Bittern-Belinda in the UK. Seven Borealis and Seven Pacific continued working in Angola. In the third quarter, the second of our four pipelay support vessels (PLSVs) in Brazil - Seven Waves - commenced a new three-year contract for Petrobras, following the award in 2024. The final two PLSVs have rolled onto new contracts during the fourth quarter.

In Renewables, we delivered a robust financial result despite challenging market conditions. Seaway Strashnov successfully completed the installation of all 87 monopiles at Dogger Bank C in the UK, while Seaway Alfa Lift made good progress adding transition pieces. After a yard stay for a crane repair, Seaway Ventus continued work at the East Anglia THREE project in the UK. In August, Seaway Aimery transited to the US where, after 20 days on standby pending the lifting of a stop-work order, it began laying cables at the Revolution project.

Third quarter financial review

Revenue was $1.8 billion, in line with the prior year period. Adjusted EBITDA of $407 million equated to a margin of 22%, up from 18% in Q3 2024. After depreciation and amortisation of $175 million, net operating income was $232 million, equating to a margin of 13%, up from 9% in the prior year period. After net foreign exchange losses of $38 million, net finance costs of $12 million and taxation of $73 million, net income was $109 million.

Net cash generated from operating activities in the third quarter was $283 million, including a $82 million unfavourable movement in net working capital. Net cash used in investing activities was $34 million mainly related to purchases of property, plant and equipment, while net cash used in financing activities was $123 million including lease payments of $79 million. During the quarter, cash and cash equivalents increased by $132 million to $546 million and, at 30 September 2025, net debt was $505 million, including lease liabilities of $421 million. This represents a significant improvement both sequentially, from $695 million in Q2 2025, and year-on-year, from $857 million in Q3 2024.

Third quarter order intake was $3.8 billion comprising new awards of $3.3 billion and escalations of $0.5 billion resulting in a book-to-bill ratio of 2.1 times. Backlog at the end of September was $13.9 billion, of which $2.0 billion is expected to be executed in the remainder of 2025, $6.0 billion in 2026 and $5.9 billion in 2027 and beyond.

Guidance

We anticipate that revenue in 2025 will be between $6.9 and 7.1 billion, while our Adjusted EBITDA margin is expected to be within a range from 20 to 21%.

Based on our firm backlog of contracts for execution in 2026, we expect revenue to be within a range of $7.0 to 7.4 billion, while our Adjusted EBITDA margin is expected to be approximately 22%.

Source: Subsea 7