Subsea 7 has announced results of Subsea7 Group for the second quarter and first half of 2024 which ended 30 June 2024.

Second quarter highlights

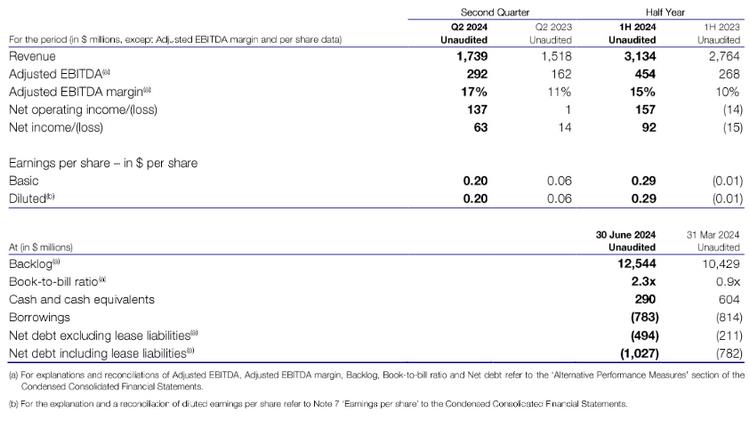

- Adjusted EBITDA of $292 million, up 80% on the prior year period, equating to a margin of 17%.

- Order intake of $4.0 billion, equivalent to a book-to-bill ratio of 2.3 times, resulted in a record backlog of $12.5 billion. Of this, $3.3 billion is due to be executed in the remainder of 2024, $4.9 billion in 2025 and $4.3 billion in 2026 and beyond.

- Full year 2024 guidance increased. Revenue expected to be in a range from $6.5 to $6.8 billion (from $6.0 to $6.5 billion) while Adjusted EBITDA is expected to be between $1,000 and $1,050 million (from $950 to $1,000 million).

- High tendering activity supports management's confidence in the outlook for order intake and margin expansion.

John Evans, Chief Executive Officer, said:

Subsea7 achieved several milestones in the second quarter of 2024 that support management's confidence in the outlook for the Group.

First, our confidence in the future is underpinned by the strength of our delivery in the second quarter. Adjusted EBITDA of $292 million - equating to a margin of 17% - was driven by operational performance from both our project teams executing major contracts, and by our offshore crews delivering high utilisation and efficiency of our global enabler vessels.

Second, our order intake continues to extend visibility for the coming years. A record intake of $4.0 billion in the second quarter increased our backlog to $12.5 billion, including the renewal of long-term contracts for four PLSVs in Brazil. We see good demand for capacity stretching to the end of the decade, with major new prospects continuing to replenish our bidding pipeline.

Finally, the quality of the backlog continued to improve in the second quarter, underpinning our outlook for Adjusted EBITDA margins within a range of 18 to 20% in 2025 and in excess of 20% in full year 2026. This improving embedded profitability gives us confidence in the outlook for strong cash generation and supports our commitment to shareholder returns of at least $1 billion in 2024 to 2027.

With the right teams and assets in place, we are confident that the Group's differentiated, value accretive solutions and collaborative client relationships position us to deliver strong financial performance in the coming years.

Second quarter operational highlights

During the second quarter, good progress was made in Subsea and Conventional on our major projects. For Yggdrasil, we completed the rigid pipelay fabrication at the Vigra spoolbase in Norway, while fabrication of the pipeline bundles continued at the Wick spoolbase in Scotland. In Brazil, we commenced stalk fabrication for Mero 4 at the Ubu spoolbase, and at the Bintan spoolbase in Indonesia we completed the fabrication and loadout of pipeline for Barossa.

During the quarter utilisation of our subsea global enabler vessels was very high. Seven Borealis completed its pipelay scope for the Gas to Energy project in Guyana while, in Brazil, Seven Vega completed the main pipelay scope for Bacalhau before mobilising for Mero 3. In Australia, Seven Oceans completed its scope for Scarborough as well as, on 2 July, its second offshore campaign for Barossa. In Norway, Seven Navica completed offshore activities for the Northern Lights carbon capture project.

In Renewables, utilisation of our key installation vessels was high including Seaway Strashnov and Seaway Alfa Lift at Dogger Bank B, and Seaway Aimery at Moray West, both in the UK. Seaway Ventus completed its inaugural turbine installation scope for Gode Wind 3 in Germany and commenced Borkum Riffgrund 3 in the UK. Seaway Phoenix continued activities in Taiwan for Zhong Neng and Yunlin, and Seaway Moxie transited to Taiwan to support the Yunlin project.

Second quarter financial review

Revenue of $1.7 billion increased 15% compared to the prior year period. Adjusted EBITDA of $292 million equated to an Adjusted EBITDA margin of 17%, up from 11% in Q2 2023. This was driven by a strong performance in Subsea and Conventional, reflecting high utilisation of the global enabler vessels as well as good progress in engineering and procurement activities.

After depreciation and amortisation of $156 million, net operating income was $137 million, compared to net operating income of $1 million in the prior year period. Net finance costs of $24 million, a net foreign exchange loss of $8 million, and taxation of $41 million, resulted in net income for the quarter of $63 million compared with $14 million in the prior year period. Net cash generated from operating activities in the second quarter was $187 million, including a modest $12 million increase in net working capital.

Net cash used in investing activities was $202 million mainly comprising the final payment of $153 million relating to our investment in OneSubsea. Net cash used in financing activities was $213 million including dividend payments of $82 million, share repurchases of $19 million and lease payments of $55 million. Restricted cash increased by $83 million related to the purchase of a vessel, to be renamed Seven Merlin (formerly African Inspiration), which was completed in July 2024. Overall, cash and cash equivalents decreased by $314 million to $290 million at 30 June 2024. This resulted in net debt of $494 million excluding lease liabilities, or $1,027 million including lease liabilities of $533 million.

Second quarter order intake was $4.0 billion comprising new awards of $3.8 billion and escalations of $0.2 billion resulting in a book-to-bill ratio of 2.3 times. Backlog at the end of June was $12.5 billion, of which $3.3 billion is expected to be executed in 2024, $4.9 billion in 2025 and $4.3 billion in 2026 and beyond.

Guidance

Revenue expected to be in a range from $6.5 to $6.8 billion (previously $6.0 to $6.5 billion) while Adjusted EBITDA is expected to be between $1,000 and $1,050 million (previously $950 to $1,000 million). In full year 2025, as the mix of activity continues to shift to projects won in a more favourable environment, our Adjusted EBITDA margin is expected to be within an 18 to 20% range. We expect the margin to continue to improve, exceeding 20% in full year 2026.

Source: Subsea7