- TotalEnergies once again demonstrates its ability to generate strong results in a softening oil & gas price environment

- As part of its multi-energy strategy, TotalEnergies presents for the first time the results of the Integrated Power segment

The Board of Directors of TotalEnergies SE, chaired by CEO Patrick Pouyanné, met on April 26, 2023, to approve the first quarter 2023 financial statements. On the occasion, Patrick Pouyanné said:

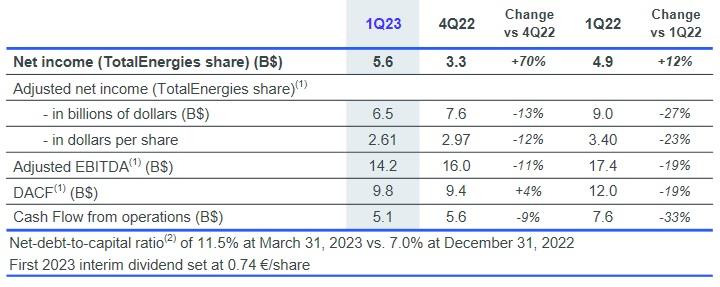

'TotalEnergies once again demonstrates its ability to generate strong results, posting in the first quarter 2023 adjusted net income of $6.5 billion, cash flow of $9.6 billion, and return on average capital employed of 25%, in an environment of lower oil and gas prices. IFRS net income was $5.6 billion for the quarter.

In an environment with Brent prices averaging $81/b, Exploration & Production generated adjusted net operating income of $2.7 billion and cash flow of $4.9 billion with production growth of 2% compared to the previous quarter*, benefiting in particular from the start-up of gas production on Block 10 in Oman and the acquisition of a 20% interest in the SARB / Umm Lulu oil fields in the United Arab Emirates.

Integrated LNG delivered adjusted net operating income and cash flow of $2.1 billion, leveraging its integrated global portfolio, in an environment of European and Asian gas prices returning to levels close to Brent parity at $16-17/Mbtu, given the mild winter and high inventories in Europe. The Company launched this quarter the integrated engineering studies (FEED) on the Papua LNG project, which will contribute to the future growth of the LNG portfolio.

The Integrated Power segment generated adjusted net operating income and cash flow of $0.4 billion in the first quarter. ROACE was nearly 10% over 12 months, confirming the Company's ability to profitably grow this business. TotalEnergies closed this quarter the acquisition of a 34% interest in Casa Dos Ventos in Brazil, contributing to the growth of its installed renewable power generation capacity to 18 GW.

Downstream posted adjusted net operating income of $1.9 billion and cash flow of $2.2 billion, benefiting from strong refining margins. TotalEnergies announced the sale for €3.1 billion to Alimentation Couche-Tard of its retail networks in Germany and the Netherlands as well as a 40%/60% partnership with them to operate the stations in Belgium and Luxembourg.

Given these strong results, the Board of Directors confirmed the increase of 7.25% in the first interim dividend for the 2023 financial year, to €0.74 per share, as well as the repurchase of up to $2 billion of shares in the second quarter of 2023.'

1. Highlights

Social and environmental responsibility

- Publication of the Sustainability & Climate – 2023 Progress Report presenting the progress made on TotalEnergies’ transformation strategy and the update of its climate ambition

- TotalEnergies ranked Number 2 in employee share ownership in Europe according to the report of the European Federation of Employee Share Ownership

- TotalEnergies guarantees customers that its fuel price will not exceed 1.99 €/l in its stations in France

Upstream

- Acquisition of CEPSA's upstream assets in the United Arab Emirates, representing a share of 50 kboe/d

- Agreement with the Iraqi Government to move forward with the multi-energy project in Iraq

- Launch of the Lapa South-West project in Brazil

Downstream

- Sale to Alimentation Couche-Tard of retail networks in Germany and the Netherlands and 40%/60% partnership in Belgium and Luxembourg

- Agreement with waste recycling company Paprec to develop chemical plastic recycling projects in France

- Creation of a joint venture with Air Liquide to develop a network of more than 100 hydrogen stations for trucks in Europe

Integrated LNG

- Production start-up on Block 10 and signed a long-term LNG contract for 0.8 Mt/year in Oman

- Launch of Papua LNG Integrated Engineering Studies in Papua New Guinea

- Delivery of the first LNG cargo to the Dhamra LNG terminal in India

- Commissioning of the floating LNG regasification terminal in Lubmin, Germany

- Authorization by the French and European authorities for the installation of the floating LNG regasification terminal in Le Havre in France

Integrated Power

- Closing of the acquisition of a 34% interest in Casa dos Ventos, leading renewable developer in Brazil

- Acquisition from Corio Generation a 50% interest (minus 10 shares) in the 600 MW Formosa 3 offshore wind project in Taiwan

- Signature of renewable power purchase agreements with Sasol and Air Liquide in South Africa

Decarbonization & new molecules

- Acquisition of PGB, Poland's leading biogas producer

- Entry on two permits for the storage of CO2 in the North Sea, Denmark

Click here for full announcement

Source: TotalEnergies