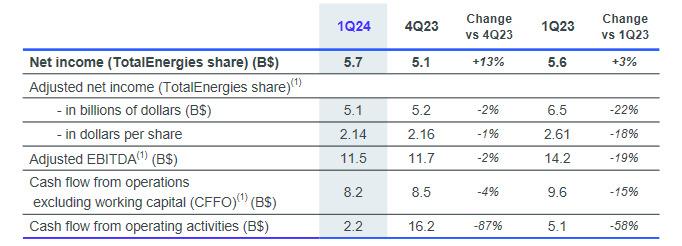

- With $5.1B adjusted net income and $8.2B CFFO, TotalEnergies delivers strong results in line with its ambitious 2024 objectives

The Board of Directors of TotalEnergies SE, chaired by CEO Patrick Pouyanné, met on April 25, 2024, to approve the first quarter 2024 financial statements. On the occasion, Patrick Pouyanné said:

'Celebrating its 100th year anniversary in 2024, TotalEnergies demonstrates once again this quarter the relevance of its balanced transition strategy that is anchored on two pillars, hydrocarbons and power, delivering strong results and an attractive shareholder return. In a context of sustained oil prices and refining margins but softening gas prices, the Company announced first quarter 2024 adjusted net income of $5.1 billion and cash flow of $8.2 billion, in line with its ambitious 2024 objectives.

During the first quarter, Oil & Gas production was 2.46 Mboe/d, benefiting from 6% quarter-to-quarter production growth in LNG and from start-ups at Mero 2 in Brazil and Akpo West in Nigeria. The Company positively appraised the Venus discovery in Namibia and Cronos in Cyprus. Exploration & Production delivered adjusted net operating income of $2.6 billion and cash flow of $4.5 billion, and confirms its leadership as a low-cost operator with upstream production costs below 5 $/boe.

Integrated LNG achieved adjusted net operating income of $1.2 billion and cash flow of $1.3 billion for the quarter in a softening and less volatile price environment. The Company strengthened its integration in the LNG value chain with the acquisition of Lewis Energy Group’s upstream natural gas assets in the Eagle Ford Basin in the United States, and with the signature of an LNG sales agreement to Sembcorp in Asia. The Company further deployed its multi-energy strategy in Oman, launching the fully-electric and very low emissions (3 kg/boe) Marsa LNG project that targets in priority the marine fuels market and developing an 800 MW portfolio of wind and solar projects, including the 300 MW solar project that will supply Marsa LNG.

During the first quarter, Integrated Power generated sequentially higher adjusted net operating income of $0.6 billion and $0.7 billion of cash flow, with a return on average capital employed reaching 10%, confirming the Company's ability to profitability grow across the electricity value chain. TotalEnergies enhanced its integrated position in Texas through a 1.5 GW flexible gas capacity acquisition that closed this quarter.

Downstream adjusted net operating income was $1.2 billion and cash flow was $1.8 billion, benefiting from strong refining margins. The Company finalized the divestment of part of its European retail network to Alimentation Couche-Tard and advanced its development in Sustainable Aviation Fuels (SAF) through partnerships with Airbus and SINOPEC.

Given these strong results, in line with TotalEnergies’ ambitious 2024 objectives, the Board of Directors decided the distribution of a first interim dividend of 0.79 €/share for fiscal year 2024, an increase close to 7% compared to 2023, and authorized the Company to buy back shares for $2 billion in the second quarter of 2024.'

1. Highlights

- 100th anniversary of TotalEnergies on March 28, 2024, and launch of the “100 for 100” operation:

- 100 TotalEnergies free shares allocation plan to the 100,000 employees of the Company

- €100 offer to the first new 100,000 electricity customers and to 100,000 individual gas station customers in France subject to conditions

Social and environmental responsibility

- Publication of the Sustainability & Climate – 2024 Progress Report presenting the progress made by the Company in 2023 in the implementation of its strategy and its climate ambition

- TotalEnergies ranks #1 in the Net Zero Standard for Oil & Gas benchmark published by Climate Action 100+

- Launch of Care Together by TotalEnergies program, reflecting the Company’s commitment to social responsibility towards its employees

- Continuation of the €1.99/L gas price cap in France

- Launch of the 2024 annual share capital increase reserved for employees, TotalEnergies ranking #1 in employee share ownership in Europe according to the European Federation of Employee Share Ownership

- Deployment of a generative artificial intelligence tool for all TotalEnergies’ employees

Upstream

- Production start-up of the second phase of the Mero field in Brazil

- Production start-up from the Akpo West field in Nigeria

- Gas production restart at the Tyra offshore hub in Denmark after a major redevelopment

- Agreements with OMV and Sapura Upstream Assets to acquire 100% of SapuraOMV shares, an independent gas producer and operator, in Malaysia

- Acquisition of an interest in block 3B/4B, offshore South Africa

- Positive appraisal of the Cronos gas discovery in block 6, in Cyprus

- Expansion of the partnership with Sonatrach in the Timimoun region in Algeria

- Creation of a joint venture with Vantage (75%/25%) to acquire the Tungsten Explorer drillship

- Launch of an innovative subsea technology to separate and reinject CO2-rich gas at the Mero field in Brazil

Downstream

- Closing of the divestment of retail networks in Belgium, Luxemburg and the Netherlands to Couche-Tard

- Partnership with Bapco Energies in Bahrain in petroleum products trading

- Strategic partnership with Airbus in Sustainable Aviation Fuels (SAF)

- Partnership with SINOPEC to jointly develop a SAF production unit at SINOPEC’s refinery in China

Integrated LNG

- Launch of the 1 Mt/y Marsa LNG project, which is a fully electrified and very low emissions (3 kg CO2/boe) LNG plant in Oman, supplied by a 300 MW solar farm

- Acquisition of the 20% interest held by Lewis Energy Group in the Dorado leases in the Eagle Ford shale gas play in Texas

- Signature of a long-term LNG contract to supply 0.8 Mt/y to Sembcorp in Singapore for 16 years

- Extension of the 2 Mt/y LNG supply contract with Sonatrach in Algeria until 2025

Integrated Power

• Closing of the 1.5 GW acquisition of flexible power generation capacity in Texas

• Launch of a new 75 MWh battery storage project, in Belgium

• Over 1.5 GW of PPAs signed with 600 industrial and commercial customers worldwide Decarbonization and low-carbon molecules

• Acquisition of carbon storage projects from Talos Low Carbon Solutions, in the United States

• Creation of a joint-venture with Vanguard Renewables (50%/50%), a BlackRock subsidiary, to produce biomethane in the United States

• Founding member of the international “e-NG Coalition” to support the development of production and use of synthetic methane

Click here for full announcement

Source: TotalEnergies