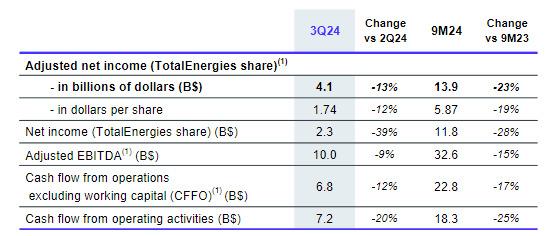

TotalEnergies proves resiliency in a volatile oil environment thanks to its integrated model with $4.1B adjusted net income for the 3rd quarter and $13.9B for first 9 months of the year.

The Board of Directors of TotalEnergies SE, chaired by CEO Patrick Pouyanné, met on October 30, 2024, to approve the third quarter 2024 financial statements. On the occasion, Patrick Pouyanné said:

'In a volatile oil environment with sharply declining refining margins, TotalEnergies demonstrates the resilience of its integrated multi-energy model with $4.1 billion adjusted net income and $6.8 billion CFFO in the third quarter of 2024.

This resilience is firstly underpinned by Exploration & Production, posting solid adjusted net operating income of $2.5 billion, down only 7%, stable cash flow of $4.3 billion and an attractive return on capital employed of 15.6%. During the third quarter, Upstream production was 2.41 Mboe/d, benefiting from the ramp up of Mero 2 in Brazil that partially offset production losses at Ichtys LNG and in Libya. In the third quarter, TotalEnergies commenced production from the high-margin Anchor oil project in the US, as well as from the Fenix gas project in Argentina. The Company also launched the GranMorgu project in Suriname, which will support its production growth target of 3%/year through 2030.

Integrated LNG achieved adjusted net operating income of $1.1 billion and cash flow of $0.9 billion, with gas and LNG trading not fully benefiting from markets characterized by low volatility. TotalEnergies continues to strengthen future cash flows by successfully marketing its LNG volumes through signing several medium-term sales contracts in Asia this quarter.

Given the very sharp decrease in refining margins in Europe (-66% quarter-to-quarter) and in the Rest of the World, Downstream posted adjusted net operating income of $0.6 billion and cash flow of $1.2 billion, down around 40% quarter-to-quarter, with marketing and trading activities compensating for the very sharp decline in refining.

Integrated Power also contributes to the resilience of the Company’s results, with reported adjusted net operating income of $0.5 billion and cash flow of more than $0.6 billion. Year-to-date cash flow is strong at $1.95 billion at the end of the third quarter, which is up 35% year-on-year and in line with annual guidance of more than $2.5 billion. During the third quarter, TotalEnergies continued to deploy its differentiated Integrated Power model through the start up of two giant solar farms with battery storage in Texas, the acquisition of a CCGT in the United Kingdom and the strengthening of its partnerships with Adani in India and RWE in offshore wind in Germany and the Netherlands.

Comforted by these robust results, the Board of Directors decided the distribution of the third interim dividend of 0.79 €/share for fiscal year 2024, an increase of close to 7% compared to 2023, and authorized the Company to execute share buybacks of $2 billion* in the fourth quarter of 2024, in line with the objective of reaching $8 billion throughout the year.'

Highlights

Upstream

- Production start-up of Mero-3 oil field, for 180,000 b/d, in Brazil

- Production start-up of Anchor oil field, for 75,000 b/d, in Gulf of Mexico

- Production start-up of Fenix gas field, for 10 Mm3/d, in Argentina

- Launch of GranMorgu oil project, for 220,000 b/d, on Block 58 in Suriname

- Exit from offshore Blocks 11B/12B and 5/6/7, in South Africa

- Closing of the Brunei assets sale

- Discovery of new gas condensate resources in offshore Harald field, in Denmark

Downstream

- Signature of agreements for the sale of a 50% stake in Total Parco Pakistan Ltd to Gunvor

- Signature of agreements for the sale of petroleum products retail networks in Brazil to SIM Distribuidora

Integrated LNG

- Acquisition from Lewis Energy of interests in producing assets, in the Eagle Ford shale gas play in Texas

- Signature of LNG contracts

- 1.1 Mt/year over 10 years with BOTAS delivered in Turkey from 2027

- 0.2 Mt/year over 7 years with HD Hyundai Chemical delivered in South Korea from 2027

- 5-year extension, until 2034, of a 1.25 Mt/year contract with CNOOC delivered in China

Integrated Power

- Start of commercial operations at two solar farms with integrated battery storage in Texas for a combined capacity of 1.2 GW

- Investment in a new solar portfolio of over 1 GW with Adani Green, in India

- Acquisition from RWE of a 50% stake in two 2 GW offshore wind projects, in Germany

- Acquisition of stakes in renewable hydroelectric projects in Africa, through an agreement with Scatec

- Signature with Saint-Gobain of a Clean Firm Power PPA for 875 GWh over 5 years

Decarbonization and low-carbon molecules

- SAF supply agreement with Air-France-KLM for up to 1.5 Mt over a 10-year period

- Signature of a charter contract for an LNG bunker vessel, notably for Marsa LNG, in Oman

- Launch of a floating wind turbine pilot project supplying renewable power to Culzean platform, in British

North Sea

- Agreement with Anew Climate and Aurora Sustainable Lands for deployment of sustainable preservation of natural carbon sink projects

- Investment in the “Japan Hydrogen Fund,” dedicated to developing the low-carbon hydrogen value chain

Click here for full announcement

Source: TotalEnergies