Tullow Oil has issued the following statement in advance of the Group's Annual General Meeting (AGM). The Group will publish its 2024 Half Year Results on 7 August 2024. The information contained herein has not been audited and may be subject to further review and amendment.

Rahul Dhir, Chief Executive Officer, Tullow, commented today:

'I would first like to thank our investors, host nations and host communities for their support. At the AGM meeting later today, I look forward to reflecting on the substantial progress Tullow has made and the strong outlook for the future as we continue our trajectory to build a unique pan-African platform for growth.

Since the start of the year, we have seen good delivery of our operational programme. We are on track to deliver our free cash flow expectations of c.$600 million over 2024 to 2025 at $80/bbl and we are well placed to capitalise on a higher oil price environment. At the same time, we are positioning ourselves to deliver material sustainable free cash flow in 2026 and beyond.'

Financial update

- Full year free cash flow guidance remains $200-300 million at $80/bbl, with a weighting towards the second half of the year largely driven by the timing of cash tax payments, liftings and revenue receipts and phasing of capital spend.

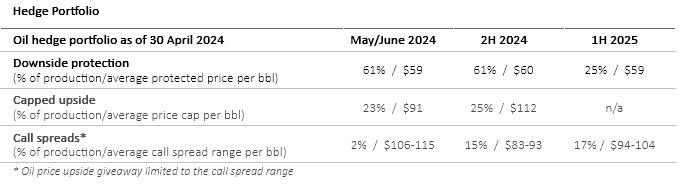

- Increased access to oil price upside for the remainder of 2024 and 2025 as legacy hedges fully roll off in May 2024 (see table below for latest position).

- An increase of $10/bbl across the year to $90/bbl would generate an additional c.$100 million of free cash flow.

- On track to reduce net debt to less than $1.4 billion and cash gearing of net debt to EBITDAX to c.1x at $80/bbl by the end of 2024.

- On track to deliver c.$600 million free cash flow over 2024 to 2025 at $80/bbl and sustainable free cash flow generation thereafter.

Operations update

Group Production

- Group working interest production in the first quarter of 2024 was c.59 kboepd, including c.7 kboepd of gas production, within the expected range for the period. 2024 Group working interest production guidance remains 62-68 kboepd, with the full-year outcome expected to be towards the lower end of the range.

Ghana

Jubilee

- Jubilee oil production in the first quarter was c.93 kbopd gross (c.36 kbopd net). Three new wells were brought on stream during the period and production efficiency was high at c.99%.

- In April 2024, a further production well was brought onstream and a water injector well is expected online later in the second quarter. This will bring the current drilling programme to an end, approximately six months ahead of schedule.

- Rates from the most recent production wells are lower than pre-drill expectations as work continues to optimise pressure support across the field.

- Lower incremental production from these wells will likely result in Group full-year production towards the lower end of the guided range. This does not impact Tullow's cash flow guidance as the total number of liftings expected from Ghana remains unchanged.

- Net gas export during the first quarter was c.6.5 kboepd. The interim gas sales agreement that is currently in place for Jubilee associated gas has been extended for 18 months at c.$2.95/mmbtu with applicable indexation.

TEN

- TEN production in the first quarter was ahead of expectations at c.19 kbopd gross (c.10 kbopd net), supported by production efficiency of c.99% and optimisation of existing wells.

- Work and engagements continue on the future development options for the TEN fields including the long-term gas sales agreement and the potential to unlock further opportunities around the existing TEN infrastructure.

Non-operated and exploration

- Production from our non-operated portfolio in Gabon and Côte d'Ivoire was in line with expectations at c.13 kboepd net in the first quarter.

- Tullow was deeply saddened to learn of the incident at the Perenco-operated Simba field in Gabon on 20 March 2024, which resulted in fatalities. Tullow's thoughts are with all those affected by this event and the Group continues to offer its support to the operator.

- As a consequence of the incident, the Simba field remains shut in while the operator completes the incident investigation. Net production from the Simba field was expected to average c.1.3 kbopd in 2024 but there is scope to make up any shortfall from other fields in the portfolio. Therefore cash flow from the portfolio remains unchanged.

Source: Tullow Oil